(Mike Maharrey, Money Metals News Service) In one of the biggest economic stories of the year that nobody seems to care about, the Biden administration ran the third-largest budget deficit in history in fiscal 2024 and paid over $1 trillion just on interest payments on the debt.

This is the kind of borrowing and spending one would expect during an economic crisis. The only bigger annual budget deficits both occurred during the COVID lockdown era. Before that, the Obama administration ran the only trillion dollar-plus deficits during the Great Recession. (The Trump administration was on pace for a trillion-dollar-plus deficit in fiscal 2020 before the pandemic.)

And yet here we are, in what is supposed to be a “robust” economy, with a crisis-like budget deficit.

Perhaps the “robust” economy is an illusion created by the government deficit spending.

The Numbers

According to the final Monthly Treasury Statement of fiscal 2024, the federal government spent $1.83 trillion more than it took in.

The budget deficit was 8 percent higher than the 2023 shortfall.

The budget gap represents 6.4 percent of GDP, up from 6.2 percent in fiscal 2023.

Democrats love to blame the deficit on “tax cuts for the rich,” but the rhetoric doesn’t match reality.

Federal tax receipts came in at a record of $4.92 trillion, an 11 percent increase over fiscal 2023.

The real problem is on the spending side of the ledger.

Remember how the Biden administration promised that the [pretend] spending cuts would save “hundreds of billions” with the debt ceiling deal (aka the [misnamed] Fiscal Responsibility Act)?

That never happened.

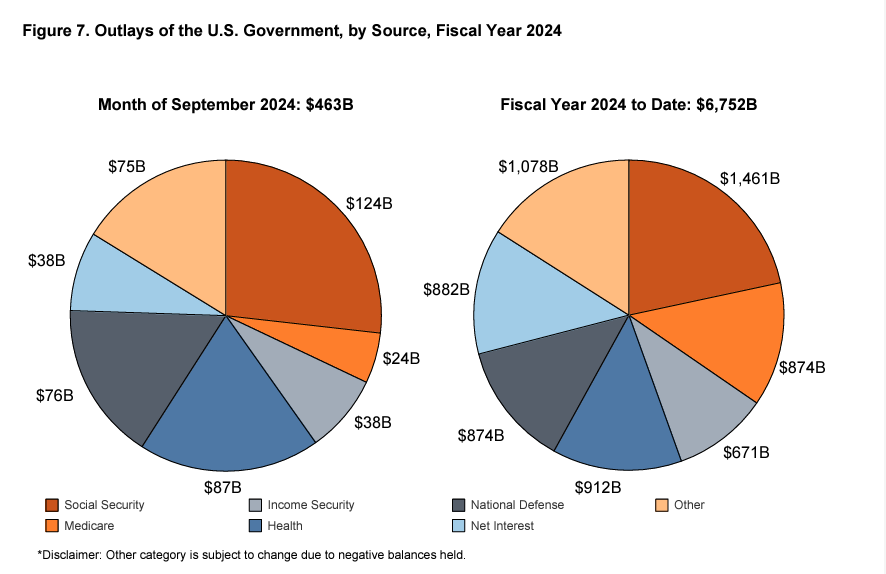

The Biden administration blew through $6.75 trillion in fiscal 2024, a 10 percent increase over 2023 spending.

Here are just a few examples of spending increases:

- Social Security spending was up 7 percent

- Medicare spending was up 4 percent

- Military program outlays increased by 6 percent

This tells you everything you need to know about government promises of spending cuts. Government people always find new reasons to spend money even as they pontificate about fiscal responsibility. Whether it’s a domestic crisis or a war, government spends more and more. This is why the deficits continue to expand – not because of some imagined lack of sufficient revenue.

And it’s not just Democrats spending like drunken sailors (with apologies to all the drunken sailors out there).

Prior to the pandemic, the U.S. government ran budget deficits of over $1 trillion just four times — all by the Obama administration in the aftermath of the 2008 financial crisis.

But the Trump administration almost hit the $1 trillion mark in 2019 and was on pace to run a trillion-dollar deficit in fiscal 2020 before the pandemic, even as the U.S. supposedly enjoyed the “best economy” ever. The economic catastrophe caused by the government’s response to COVID-19 gave policymakers an excuse to spend with no questions asked, and we saw record deficits in fiscal 2020 and 2021.

This reveals the ugly truth: borrowing and spending is a bipartisan sport.

The Interest Problem

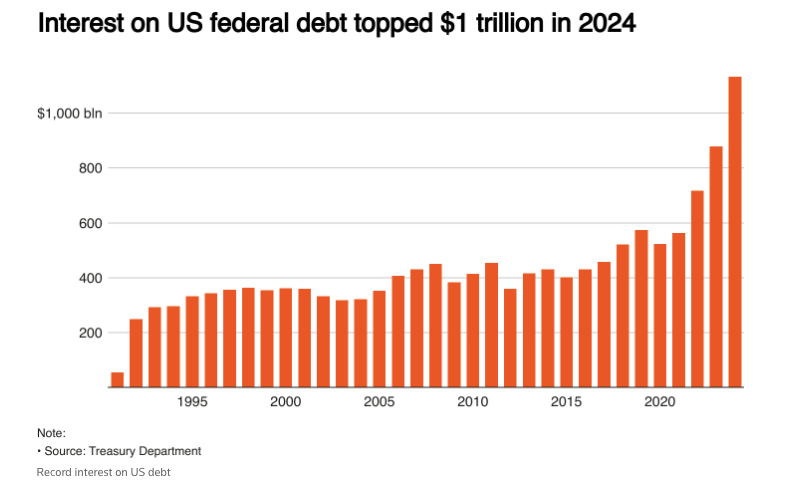

Uncle Sam paid $1.13 trillion in interest expense in fiscal 2023. It was the first time interest expense has ever eclipsed $1 trillion.

Interest payments were up 28.6 percent over fiscal 2023 levels.

Graph courtesy of Reuters

The U.S. government paid more in interest than it did for national defense ($882 billion) or Medicare ($874 billion). The only spending category larger than interest on the debt was Social Security ($1.46 trillion.)

Net interest expense factoring interest earned by the Treasury was $882 billion, sill more than national defense.

And interest expenses will only continue to climb.

Much of the debt currently on the books was financed at very low rates before the Federal Reserve started its hiking cycle. Every month, some of that super-low-yielding paper matures and has to be replaced by bonds yielding much higher rates.

Even with the recent Federal Reserve rate cut, interest rates remain elevated.

The National Debt Matters

Anybody who says “deficits don’t matter” is deluded.

As the Bipartisan Policy Center points out, the growing national debt and the mounting fiscal irresponsibility undermine the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

This could lead to lower economic growth, higher unemployment, and less investment wealth.

Lack of confidence in the U.S. fiscal situation could also lower demand for U.S. debt. This would force interest rates on U.S. Treasuries even higher to attract investors, exacerbating the interest payment problem.

The national debt continues to spiral upward at a dizzying pace. It currently stands at over $35.7 trillion. According to the national debt clock, that represents 122.28 percent of GDP. Studies have shown a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

And yet, virtually nobody in Washington D.C. has a plan to address the budget shortfalls or the growing national debt. Sure, federal officials will pay lip service to trim spending, but substantive spending cuts never materialize. Meanwhile, Democrats promise to raise taxes on the rich, a policy that plays well to its base but wouldn’t make a substantive debt in the budget shortfall.

Ultimately, the borrowing and spending issue is nothing more than a political hot potato that makes headlines every time Congress runs up against the debt ceiling.

The Bipartisan Policy Center warns, “Regular brinkmanship over addressing the federal debt limit—a symptom of broader fiscal dysfunction and mismanagement—could have a catastrophic impact on the U.S. credit rating, the dollar’s role, and U.S. global leadership.”

It’s almost certain that neither Congress nor the next occupant of the Oval Office will do anything substantive to address this fiscal train wreck. Instead, they will continue to kick the can down the road.

It’s a great political strategy because nobody wants spending cuts or tax hikes. The problem is, eventually, they will run out of road.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.