(Mike Maharrey, Money Metals News Service) Argentines are married to the dollar, but they’re having a love affair with gold.

As a Bloomberg article framed it, Argentines were once “almost irrationally devoted to the dollar.” In fact, the country ranks among the top holders of U.S. dollars.

According to Bloomberg, the devotion to the dollar “is now being challenged by a growing appetite for gold.”

“From bullion and small bars to exchange-traded funds, Argentines are increasingly turning to the precious metal as an alternative store of value.”

The reason is simple – the dollar has lost its luster. In the minds of many Argentines, the greenback no longer provides the inflation hedge it once did.

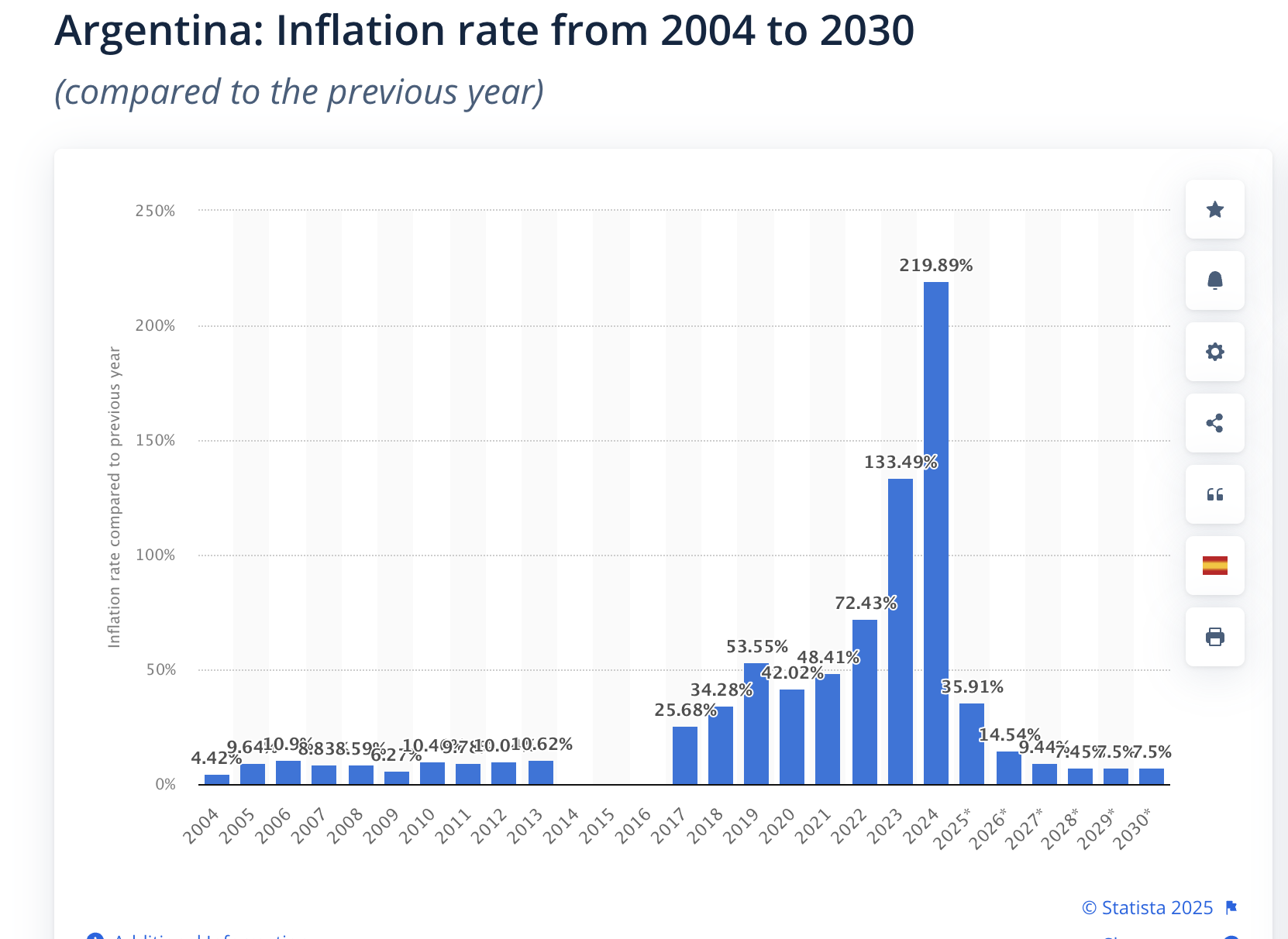

Argentines have struggled with inflation for decades. The country’s price index increased by 25 percent in 2017, and it got worse from there.

However, the peso has strengthened with the economic reforms introduced by President Javier Milei. Meanwhile, the U.S. continues to inflate the dollar. A population wary of the government abusing its currency has taken notice.

New government policies have also boosted gold’s appeal.

The Argentine government recently removed foreign exchange controls for individual investors, allowing them to purchase gold directly in pesos. This eliminated the need for dollars to buy gold. As Bloomberg put it, “That opened the door for small savers in search of a more stable store of value.”

Argentines can buy up to $7,200 in gold each month without disclosing the source of the purchasing funds. A recently proposed bill would raise the threshold to $12,000.

Banco Piano is one of the few Argentine banks that sells .999 pure physical gold with a certificate of origin. The bank has already quadrupled its gold imports from Switzerland this year.

Banco Piano director Leonardo Echegoyen told Bloomberg that investing in gold has become “very trendy.”

“People want to earn a return on their dollars, and they’re looking for that return in this commodity.”

He noted that even seasoned investors who have never considered gold have hopped on the bandwagon.

Brokers say there is also growing interest in gold ETFs. Win Securities partner Fabio Saraniti told Bloomberg, “There’s more demand for gold this year.”

“That happens because when financial assets rise, people want to buy. And when they fall, they want to sell.”

Jewelers are getting a boost from Argentina’s burgeoning love affair with gold. A spokesperson for one of the country’s most established jewelers said daily gold inquiries have tripled this year, and sales have already doubled over 2024.

“People want to preserve their capital amid economic uncertainty. They know time deposits offer low returns.”

Dollar weakness is driving Argentines to gold. The dollar index is down 7.5 percent since the beginning of the year, and many Argentines worry the dollar’s devaluation will accelerate. The U.S. government is buried under $36 trillion in debt and continues to borrow and spend with reckless abandon.

Argentines have an innate distrust of their banking system. During the country’s 2001 financial crisis, the government forcibly converted dollar deposits into pesos. As a result, Argentines pulled nearly $200 billion out of the financial system, storing money in safe deposit boxes, sheltering in real estate, or hiding it under their mattresses.

Juan Piantoni is the CEO of a safe deposit box manufacturer. He said that gold is now replacing dollars in those safe deposit boxes.

“Storing dollars in a safe deposit box isn’t common practice in most countries. It’s a uniquely Argentine habit,” he said, adding that Argentines view safe deposit boxes as a place meant for valuables.

However, dollars are becoming less valuable, as reflected in the surging price of gold.

Argentines spurning the dollar is more evidence of the trend toward de-dollarization. If it continues, it will be bad news for the U.S. economy.

Simply put, the U.S. needs the world to need dollars.

The U.S. depends on this global demand for dollars supported by its reserve status to underpin its massive government. The only reason Uncle Sam can borrow, spend, and run massive budget deficits to the extent that it does is the dollar’s role as the world’s reserve currency. It creates a built-in global demand for dollars and dollar-denominated assets. This absorbs the Federal Reserve’s money creation and helps maintain dollar strength despite the Federal Reserve’s inflationary policies.

Even a modest de-dollarization of the world economy would cause a dollar glut. The value of the U.S. currency would further depreciate. That translates to more price inflation at home. In the worst-case scenario, the dollar could collapse completely, leading to hyperinflation.

There is a way to shield yourself from the impacts of de-dollarization — minimize your exposure to the dollar. Instead of holding U.S. government fiat currency, buy gold and silver.

That’s exactly what Argentines are doing.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.