(Mike Maharrey, Money Metals News Service) Policies such as tariffs have consequences – both good and bad. It’s easy to focus on a policy decision’s perceived benefits, but it’s crucial to consider potential negative ramifications.

So, how could a prolonged trade war impact the precious metals markets?

The Movement of Gold

We’ve reported on the significant movement of gold from London to the U.S. The threat of tariffs pushed the futures price of gold (and silver) higher in New York, creating price discrepancies that traders sought to exploit.

(It’s important to note that there could also be a more fundamental issue at play: the fact that there is a lot more paper gold than physical metal.)

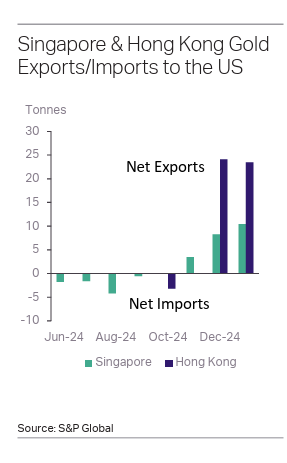

According to Metals Focus, about 600 tonnes of gold flowed into COMEX vaults in New York from December to February. Much of this gold came from London, but Singapore and Hong Kong also reported net outflows of about 70 tonnes.

As Metals Focus notes, the outflows of metal from Asia have tightened precious metals supplies driving wholesale premiums higher. We’ve also seen gold shortages in South Korea where the state-run mint paused gold bar sales.

This could be just the tip of the iceberg when it comes to the impact of tariffs on the precious metals market.

The Electronics Sector

Silver, and to a lesser extent gold, are both important inputs in the electronics sector. Industrial offtake accounts for over 50 percent of the annual silver demand. Much of this silver is used in electronics and solar energy applications.

Industrial demand is expected to rise by 7 percent this year and surpass 700 million ounces for the first time. Industrial demand set a record of 654.4 million ounces in 2023. As was the case last year, silver offtake for green energy applications is driving the increase in industrial demand.

Trump trade war 1.0 already altered the structure of electronics and semiconductor supply chains.

In 2018, the U.S. levied over $400 billion in tariffs on Chinese imports. In response, many companies sought to “de-risk” their supply chains by expanding their networks into other regions, including South-East Asia, India, Mexico, and Central and Eastern Europe.

It’s interesting to note that gold surged during this period, eclipsing $1,500 an ounce for the first time in six years by mid 2019.

The pandemic further disrupted supply chains. China’s draconian lockdowns led to a virtual halt in global electronics production. Once again responding to incentives, many companies sought to insulate themselves from future disruptions by adopting a “China+1” strategy to decentralize their supply chains.

Metals Focus said these factors have driven significant shifts in the industry.

“Vietnam has now emerged as a vital global hub for electronics manufacturing, particularly in mobile phones, laptops, and other electronic devices. Thailand has also become the largest producer of printed circuit boards (PCBs) in South-East Asia. While Malaysia, with a 13 percent share of the global packaging and testing market, is positioning itself as a key center for semiconductors. Finally, India has risen to become the world’s second-largest producer of mobile phones.”

While this decentralization has undoubtedly made supply chains more robust, electronic exports to the U.S. remain susceptible to U.S. tariff policies.

The recent announcement of large-scale reciprocal tariffs by the Trump administration has thrown the electronics industry into chaos. Metals Focus pointed out that multinational electronics manufacturers relied on “free trade” agreements as they built their supply chain networks.

“These companies have benefited from low-cost production in third countries, supplying products to the U.S. market through such agreements. However, this U.S. policy has created a dilemma for supply chains, necessitating major adjustments to their global operations.”

President Trump has said his goal is to bring manufacturing back to the U.S. While this may be a worthy endeavor, it won’t happen quickly or without a lot of pain.

Metals Focus noted that there are significant challenges in shifting manufacturing back to the U.S., particularly when it comes to semiconductors, photovoltaics, and auto production.

“This endeavor will be a long, drawn-out process, that requires significant human and capital investment from other countries to rebuild supply chain infrastructure.”

Analysts and Metals Focus said this may create opportunities for “local raw material suppliers to leverage their advantages and increase market share.”

Solar Energy

The solar energy sector is using increasingly large amounts of silver. Silver is the best conductor of electricity of all metals at room temperature, making it a vital input in the production of solar panels.

According to a research paper by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual silver supply by 2027. By 2050, solar panel production will use approximately 85–98 percent of the current global silver reserves.

China dominates the photovoltaic sector due to its capacity, price, and technological advantages. According to Metals Focus, assembly capacity has grown in South-East Asia, but much of this growth was fueled by Chinese investment.

In an attempt to return solar manufacturing to the U.S., the Biden administration upped tariffs on silicon-based solar products and critical metals imported from China to 50 percent on Jan. 1. The tariffs have since been expanded to include modules produced in Southeast Asia.

But according to Metals Focus, the U.S. faces significant challenges, “including insufficient production capacity for upstream raw materials, such as wafers and polysilicon, and key materials like silver paste and EVA film, which are primarily sourced from Chinese companies.”

“Additionally, many essential components for module assembly still require imports, impacting the industry’s autonomy. It is estimated that production costs in the US remain approximately 20-30% higher than in China, and even with tariff protection, competitiveness is constrained. China’s advantages in photovoltaic (PV) technology are expected to remain unchallenged in the short-term, allowing it to continue dominating the global solar market in the coming years.”

This underscores the fact that realigning global manufacturing isn’t as simple as slapping tariffs on things.

The Automotive Sector

The automotive industry will also feel the effects of tariffs.

Platinum and palladium are key components of catalytic converters. There is already significant tightness in platinum supplies.

The U.S. auto sector must compete against foreign imports. It seems like tariffing vehicles coming into the country would boost U.S. manufacturing, but it’s not that simple. The U.S. auto industry leans heavily on imported parts. Mexico supplies about 40 percent and Canada an additional 20 percent.

Metals Focus analyst project that a 25 percent tariff will increase vehicle prices, putting a drag on the entire sector.

“This will also impact PGMs [platinum group metals] used in emission systems. According to estimates by Metals Focus, if the US auto market loses 1m units in sales due to tariffs, PGM demand could fall by 160koz. This issue not only affects car manufacturers, but also has broader implications for the global precious metals market, influencing investment and production planning in related industries.”

According to Metals Focus, the bottom line is tariff policy is driving “significant” changes in global supply chains, including the movement of precious metals.

“Policies being enacted and proposed in the US and other regions are expected to further reshape the global production and trade landscape. Many companies are contemplating relocating some production bases to mitigate the effects of tariffs, but trade disputes may lead to retaliatory tariffs between nations, introducing further uncertainty into the redistribution of global industrial chains. Additionally, while tariffs may not significantly boost industrial demand in the US — due to increased production costs that could diminish their competitiveness — the competition for key raw materials and advanced technologies is likely to intensify.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.