(Mike Maharrey, Money Metals News Service) The Bureau of Labor Statistics finally managed to get the September CPI data together. The mainstream broadly characterized it as a good report.

It wasn’t.

But it was better than forecast, and in our world of politicized government data, that was good enough. As CNBC put it, the better-than-expected report “keeps the door wide open for another interest rate cut next week.”

In a sane world, a 3 percent inflation print would put the brakes on monetary easing. However, when you have a giant debt black hole, the economy can’t function in even a modestly high-interest-rate environment. That means the powers that be will spin data however they must to justify rate cuts.

They have a choice between propping up the debt-riddled, bubble economy and inflation.

They picked inflation.

CPI Data By the Numbers

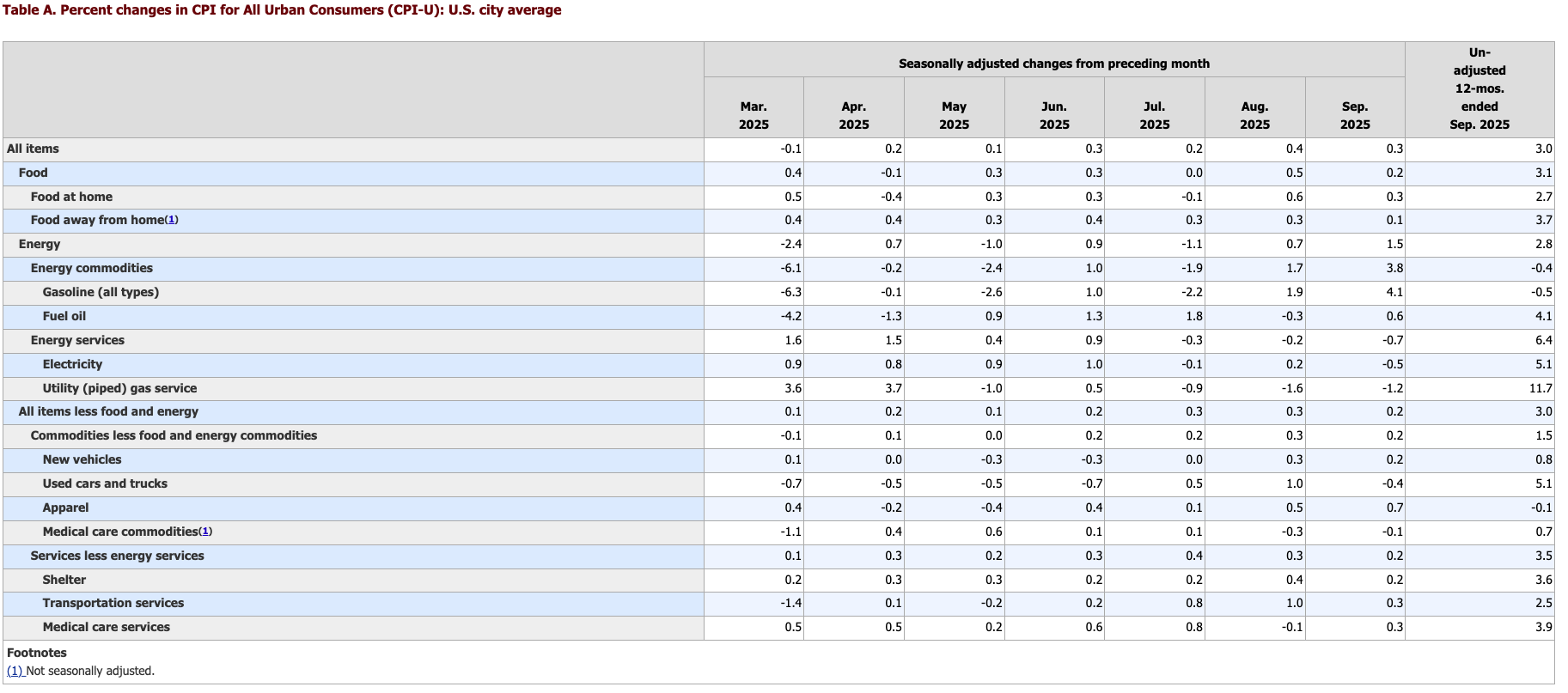

The headline annual CPI came in at 3 percent, according to BLS data. That was up from 2.9 percent in August and 2.7 percent in July. It was the highest print since January, and up from a low of 2.4 percent in March.

However, the forecast was for 3.1 percent. So, yay?

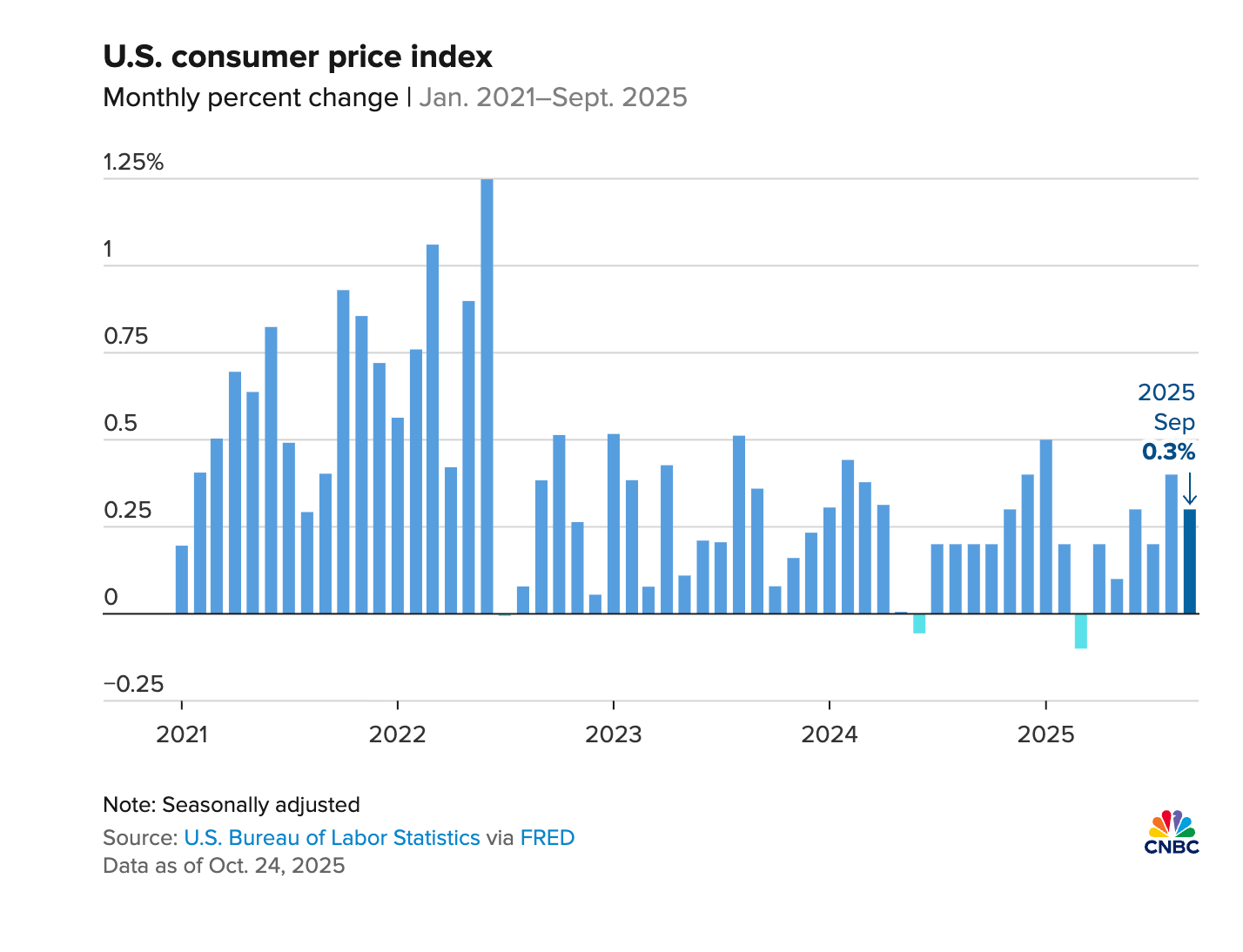

On a monthly basis, prices rose 0.3 percent. That was slightly cooler than the 0.4 percent surge in August, but still annualizes to 3.6 percent. And if you annualize the monthly CPI increases from the last three months, it comes to 3.6 percent.

However, the forecast was for 0.4 percent. So, yay?

Stripping out the more volatile food and energy prices (if only we could do that in real life), core CPI rose 3.0 percent on an annual basis. That was down a tick from 3.1 percent in August. Month-on-month, core CPI was up 0.2 percent, down from 0.3 percent in July.

However, over the last four months, core CPI has increased by 0.2, 0.3, 0.3, and 0.2 percent, annualizing to 3 percent. Core CPI has been mired in this range for months.

When you look at the CPI in graphical form, it’s clear that inflation has been bouncing in the same range since around mid-2022.

But hey, the numbers this month were better than forecast, so yay!

Of course, we should probably note that none of these numbers is anywhere near the Fed’s mythical 2 percent target.

As you parse the data, keep in mind that the CPI doesn’t tell the entire story of inflation.

The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS used the old formula, we’d be looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

The recent massive revisions to the BLS employment data have also cast some doubt on the veracity of government number-crunching.

However, this is the formula the government uses, and it drives decision-making.

When we look at the data, it’s clear that prices are still rising rapidly in most categories. The price for food at home rose 0.3 percent, pushing the broader food index up 0.2 percent.

Service prices were up another 0.2 percent month-on-month and 3.5 percent annually. This is significant because you can’t blame tariffs for rising service prices.

Zombie Inflation

As I wrote after the August CPI data came out, we have zombie inflation. It just won’t die.

The fact of the matter is that inflation has been increasing for more than a year.

And the Fed is about to crank up the inflation machine even faster.

As I mentioned earlier, with the September CPI data coming in cooler than projected, it’s almost certain that the Fed will cut again during the October meeting. Perhaps more significantly, Federal Reserve Chairman Jerome Powell recently hinted that balance sheet reduction is about to come to an end.

Why would the central bank ease monetary policy when there is clearly significant inflationary pressure in the economy?

I’ve already mentioned the debt black hole. The U.S. national debt just topped $38 trillion, with no end to the borrowing and spending in sight.

There is significant softness in the labor market. Based on the BLS data, the economy only created 22,000 jobs in August. Meanwhile, the BLS has erased nearly 1 million jobs from the data through revisions.

We don’t have any employment data for September, thanks to the government shutdown; however, private payroll growth was sluggish.

The sagging employment picture signals economic contraction.

And what do we call low economic growth and high price inflation?

Stagflation.

This puts the Fed between a rock and a hard place. In fact, it has faced this Catch-22 for months. As already noted, the Fed needs to cut to support the debt-riddled bubble economy. But it also needs higher rates to keep price inflation under control.

Obviously, it can’t do both.

It looks like the central bank chose inflation.

No matter how you choose to parse the CPI data, inflation is already increasing, and another rate cut, coupled with an end to quantitative tightening, will accelerate that trend.

As of the end of June, the money supply had expanded by more than $600 billion since its low point in mid-2023.

As of August, the M2 money supply stood at $22.2 trillion and is above the peak reached during the pandemic.

We can’t overstate this fact: this IS inflation.

During the Fed’s inflation fight, the M2 money supply contracted. This is exactly what needs to happen to wring out inflation from the economy. The money supply bottomed a little over a year ago at $20.60 trillion.

That sounds like an impressive inflation fight, until you realize that the money supply would need to fall by at least another $3 trillion to get back to the trend of 2019. Clearly, that’s not the trajectory.

And now the Fed is going to push up the throttle on inflation.

This isn’t a situation you can vote away. All you can do is try to shield yourself from this relentless destruction of your purchasing power.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.