(Mike Maharrey, Money Metals News Service) Chinese wholesale gold demand rebounded in September.

This was partly due to a seasonal uptick in gold buying, along with continued support from investors as the yellow metal scaled new record highs.

China ranks as the world’s largest gold market.

In September, the London Bullion Market Association (LBMA) gold price recorded its largest monthly increase since January 2012, driving Q3 prices to the biggest quarterly gains since 2016. The LBMA gold price increased by 43 percent through the first three quarters of ’25, the best year-to-date performance since 1979.

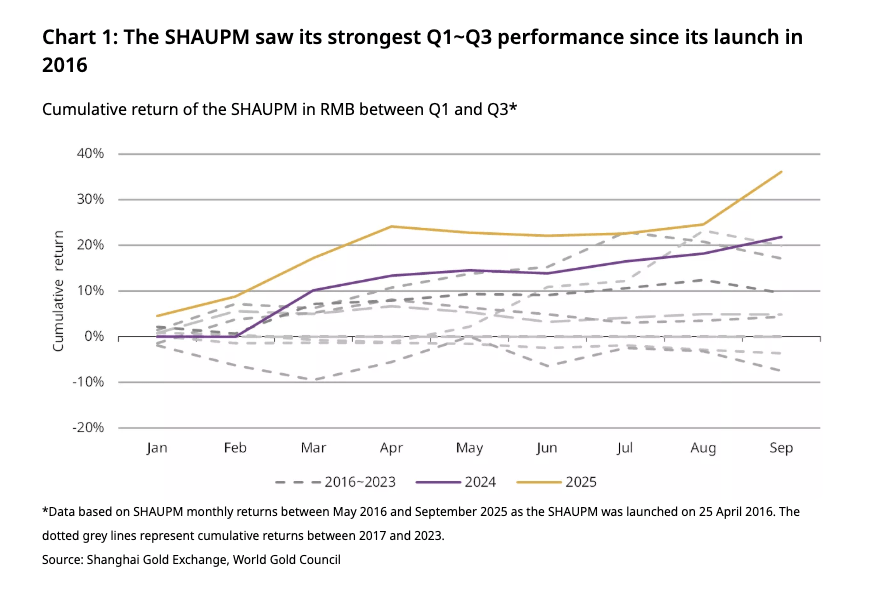

Local Chinese gold prices followed suit. The Shanghai Gold Benchmark Price PM (SHAUPM) gained 36 percent through the first nine months of 2025, charting the best year on record to date. The SHAUPM set new records 36 times through the first three quarters of the year, and the Shanghai price charted its best month on record in September.

Q3 was the second-strongest quarter on record, with the SHAUPM gaining 14 percent. The only stronger quarter came in Q1 of this year with an 18 percent surge.

The smaller SHAUPM gain compared to London was primarily due to a 4 percent appreciation in the RMB against the dollar during the period.

Chinese Gold Demand Data

Higher prices continued to create headwinds for Chinese gold jewelry sales, but investors took up some of the slack.

Wholesale gold demand came in at 118 tonnes in September, a 33-tonne month-on-month gain. Demand was 4 tonnes higher year-on-year last month.

Through the first three quarters, Chinese wholesale gold demand was 297 tonnes. That was down about 3 percent year-on-year.

The impact of higher prices is obvious as wholesale demand remains around 33 percent lower than the long-term average, largely due to sluggish jewelry sales. According to the World Gold Council, weakness in the gold jewelry sector has outpaced investment strength.

That’s not expected to improve in the coming months. According to the World Gold Council, after re-stocking in September, retailers will likely dial back their replenishment in October, following seasonal trends.

Investment demand also sagged during July and August. According to the World Gold Council, economic factors contributed to the cooling of the Chinese gold investment market in the first two months of Q3.

“Chinese investor risk appetite improved as the need for safe-haven assets declined: July and August saw better growth expectations on the back of strong Q2 economic data and a reducing U.S.-China tariff risk. This sentiment was reflected in the strong CSI300 Stock Index rally, which surged 18 percent during Q3, the strongest quarter since Q1 2019. Meanwhile, rising government bond yields – as the market priced in fewer rate cuts by the PBoC – increased opportunity costs of holding gold.”

However, Chinese gold bar and coin sales rebounded in September, even as some investors sold gold to book profits.

Chinese physical gold demand was a primary driver during the early stages of this gold bull market.

Chinese bar and coin demand grew by 44 percent year-on-year in H1. Chinese investors snapped up 115 tonnes of gold bars and coins in the second quarter alone. It was the strongest H1 for physical gold buying since 2013.

Given the rapidly increasing price, it was inevitable that demand would slow.

However, the anticipation of further price gains seems to have reignited investor interest.

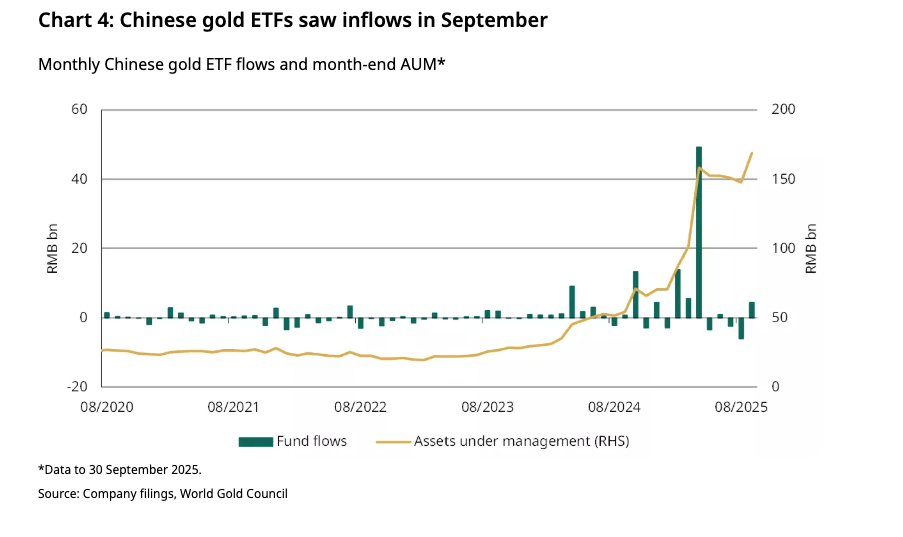

After two consecutive months of outflows, gold once again flowed into Chinese ETFs last month.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Chinese gold-backed funds added 4.9 tonnes of gold totaling ¥4.5 billion ($622 million).

With positive September’s inflows of gold coupled with the surging price, assets under management (AUM) by Chinese gold ETF grew to another month-end peak of ¥169 billion ($22 billion).

With positive September’s inflows of gold coupled with the surging price, assets under management (AUM) by Chinese gold ETF grew to another month-end peak of ¥169 billion ($22 billion).

Gold futures investor activity also improved last month. The average trading volumes on the Shanghai Futures Exchange jumped 70 percent month-on-month to 394 tonnes per day. That was 82 percent higher than the five-year average.

Gold imports were steady in September. Based on World Gold Council data, imports fell modestly by 2 tonnes month-on-month, coming in at 87 tonnes.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.