(Mike Maharrey, Money Metals News Service) Indian gold imports rebounded significantly in July as retailers built inventories for the festival and wedding season.

Meanwhile, gold investment demand remained robust.

India ranks as the second-largest gold market in the world behind China.

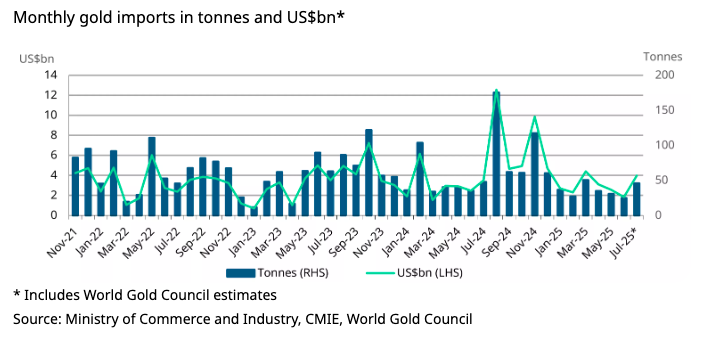

After declining for three straight months, gold imports surged in July, totaling nearly $4 billion, according to Indian customs data. The World Gold Council estimates that translates to between 42 and 48 tonnes.

July gold imports were up 14 percent year-on-year and doubled June totals, exceeding the monthly average through the first half of the year.

Jewelry makers are building inventory in anticipation of the fall wedding and festival season, when Indians traditionally buy gold.

The Indian jewelry market has faced headwinds due to higher prices, with many consumers opting for smaller pieces or sitting out altogether. But World Gold Council analyst Kavita Chacko said there are signs of revival and anecdotal reports indicate “a positive outlook.”

Chacko said that during the recent India International Jewelry Show, “many manufacturers reported stronger-than-expected buying interest and a noticeable pickup in orders from both large chain stores and independent retailers.”

Meanwhile, retailers who had been cautious about inventories are reportedly actively restocking in anticipation of improved festival sales.

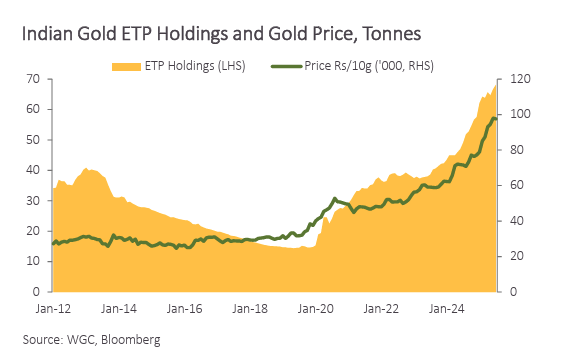

Even as gold jewelry demand withered under price pressure, gold bar and coin sales have remained robust. Chacko said physical investment demand “remains healthy.”

Investor bullishness is also reflected in continued inflows of gold into Indian ETFs. Indian funds added ₹12.6 billion ($146 million) of gold in July, approximately 1.2 tonnes. It was the third straight month of gold inflows.

Analysts say the momentum continued through the first two weeks of August.

As of the end of July, Indian gold ETFs reported assets under management (AUM) of ₹676 billion ($7.85 billion), a 96 percent year-on-year increase.

There were 215,000 new Indian ETF accounts set up in July. So far this year, ETF accounts have grown by 42 percent.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item. Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.