(Mike Maharrey, Money Metals News Service) The official numbers are in, and industrial demand for silver set a fourth consecutive record in 2024.

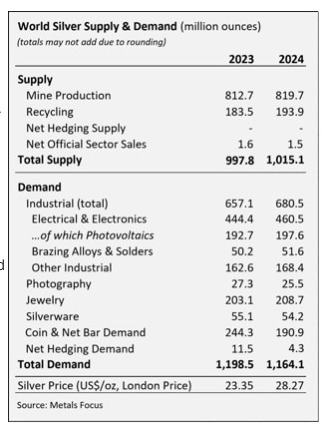

Despite record industrial offtake, total silver demand declined by 3 percent to 1.16 billion ounces last year, primarily due to weak investment demand, according to the World Silver Survey 2025 published by the Silver Institute.

Even with the slight decline, demand outstripped the silver supply for the fourth consecutive year. The structural market deficit came in at 148.9 million ounces. That drove the four-year market shortfall to 678 million ounces, the equivalent of 10 months of mining supply in 2024.

The silver price remained well below its all-time high throughout 2024, creating the impression that it underperformed. However, it had a pretty solid year.

The White Metal kicked off 2024 at $23.99 per ounce and closed out the year at $28.91, a 20.5 percent gain.

Industrial Silver Demand Drives Higher

Industrial demand for silver hit 680.5 million ounces last year. According to the Silver Institute, record electronics and electrical demand underpinned the growth.

“This reflected structural gains in the green economy flowing through from the PV and automotive sectors and grid infrastructure development. Demand also received a boost from AI-related applications.”

China accounted for the largest share of industrial gains with a 7 percent increase. There was also strong industrial demand in India, with offtake increasing by 4 percent.

Demand in the West was more tepid. U.S. industrial silver demand dropped by 6 percent last year, and most European countries also reported modest declines.

Demand for silver in solar panels accounted for nearly half of the total silver demand in the electronics sector.

Silver is the best conductor of electricity of all metals at room temperature. That makes it a vital input in the production of solar panels. With demand for solar power increasing along with the amount of silver used in each panel, analysts believe that solar panel production will consume increasingly large amounts of silver in the future.

According to a research paper by scientists at the University of New South Wales, solar manufacturers will likely require over 20 percent of the current annual silver supply by 2027.

By 2050, solar panel production will use approximately 85–98 percent of the current global silver reserves.

The green energy sector is also essentially recession-proof because it is being driven, incentivized, and in some cases directly funded by governments around the world.

Silver Jewelry Demand Grows as Investment Remains Tepid

Silver jewelry demand grew by 3 percent to 208.7 ounces in 2024.

According to the Silver Institute, India accounted for the bulk of these gains, driven by an import duty cut, a healthy rural economy, and the ongoing rise in purities.

The Silver Institute reported that improving exports to key Western countries also lifted silver jewelry demand. For instance, fabrication in Thailand grew by 13 percent.

“Western consumption was broadly steady, as positives, such as branded silver’s gains, balanced negatives, including cost-of-living issues.”

By contrast, China reported a third consecutive year of losses due to its challenging economic backdrop.

Silverware demand fell by 2 percent to a 3-year low of 54.2 million ounces. This was primarily due to soft demand in India, where rising prices put a strain on the gifting segment.

The biggest drag on silver demand was in the investment sector. Coin and net bar demand plunged by 22 percent to a 5-year low of 190.9 million ounces.

Western markets reported the biggest sag in demand, with double-digit declines across the board. The steepest drop was in the U.S., where silver investment demand crashed by 46 percent. According to the Silver Institute, profit-taking at higher prices, market saturation, and optimism about a Trump presidency created headwinds for silver in the U.S.

India was the bright spot for silver investment, with demand growing by 21 percent. Bullish price expectations and the import duty cut buoyed the market.

Silver Supply

Silver mine output was steady, rising by 0.9 percent to 819.7 ounces.

Lead and zinc mines continued to produce the most silver globally, however, output was flat year on year. In contrast, silver production from gold mines recorded the strongest growth, up 12 percent to 13.9 million ounces, a three-year high.

Mexico ranked as the top silver-producing country, followed by China, Peru, Bolivia, and Chile.

With the silver price rising, recycling rose 6 percent, hitting a 12-year high of 193.9 million ounces.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.