(Mike Maharrey, Money Metals News Service) Nothing is forever. Not even Forever.

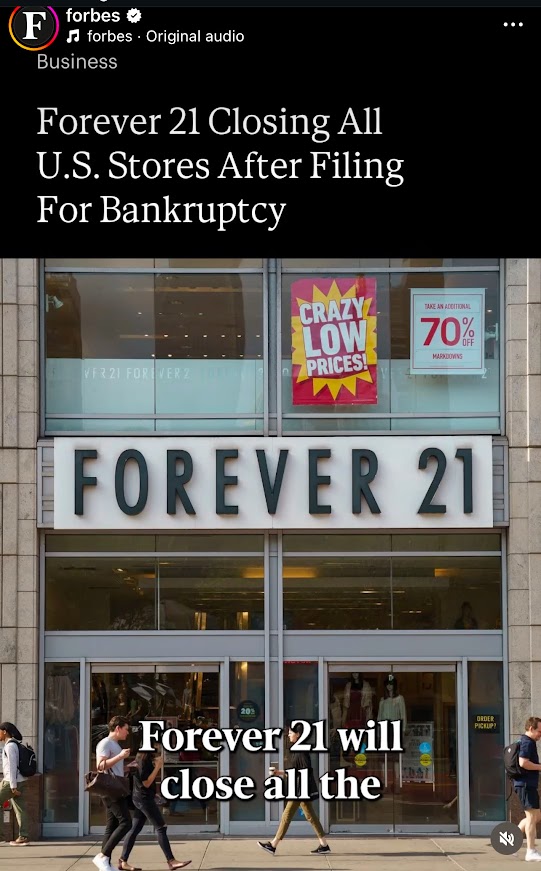

Forever 21 recently filed for bankruptcy – again. The clothier reorganized back in 2019. Now it is shutting down for good. According to recent reporting, the company plans to close all 354 stores in what the company calls “an orderly wind down” of its operations.

This is yet another hiccup revealing that the undercarriage of the U.S. economy is rickety.

Forever 21 isn’t drowning alone. Corporate bankruptcies reached a 14-year high last year. Party City, Kohl’s, JCPenney, and Joann Fabrics are among the retailers filing bankruptcies in recent months.

Goldman Sachs survey found that 91 percent of small business owners are struggling with the current economic impact on their industries. More than half (56 percent) reported that the situation has worsened since the beginning of the year.

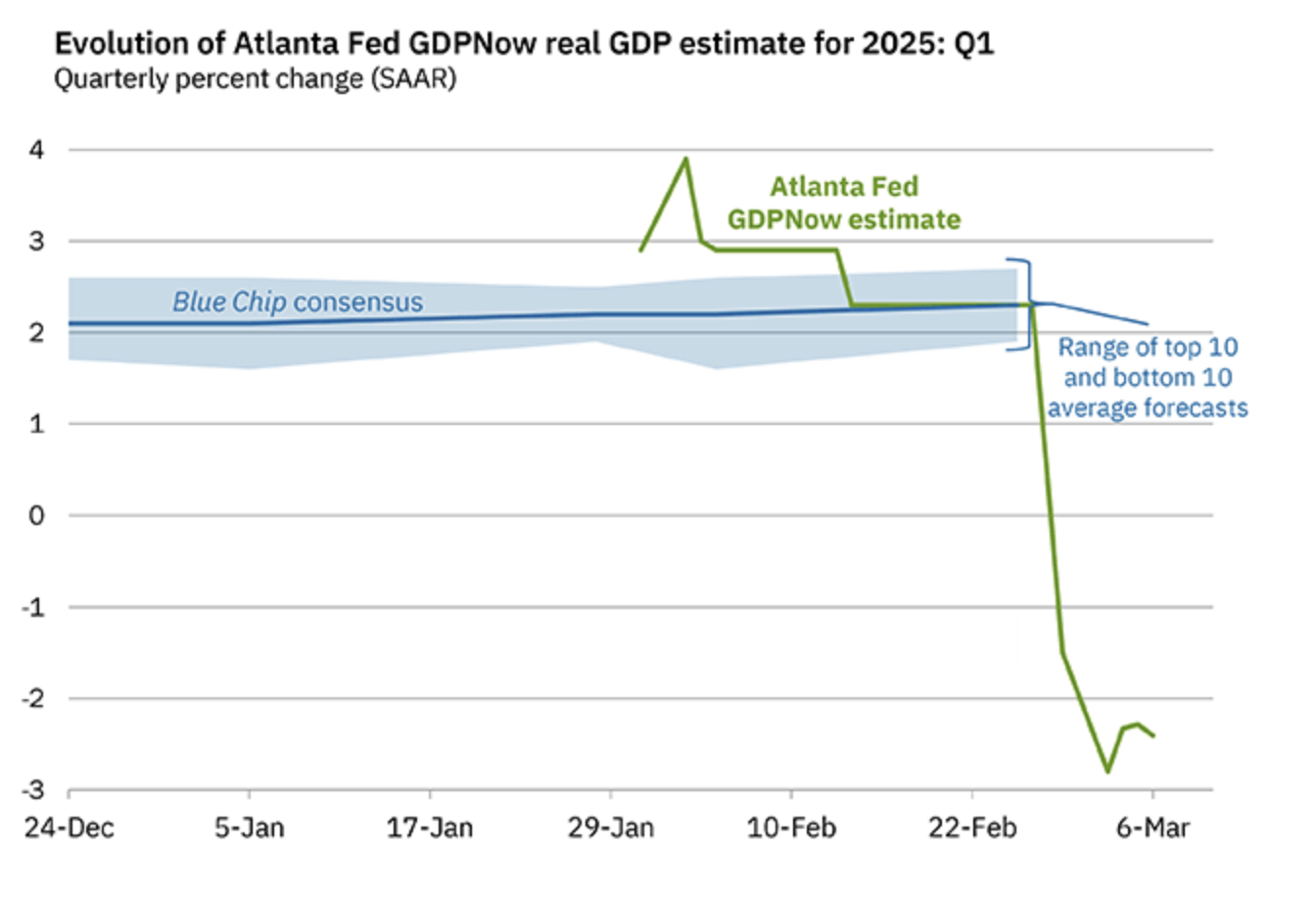

The problems are getting hard to ignore. After insisting the economy is booming for months, the mainstream suddenly developed a case of the yips, and we’re hearing chatter about a potential recession. The Atlanta Fed’s GDPNow forecast plunged from a 2.3 percent growth rate in late February to -2.8 percent within a matter of weeks.

Mainstream analysts tend to blame the trade war for the sudden recession worries, but the economy has been poised for a downturn for well over a year. Decades of easy money in the wake of the 2008 financial crisis created significant distortions and malinvestments in the economy, along with a massive debt bubble. The central bank was forced to take the easy money drug away due to price inflation. However, this economy is not built to operate in a normal interest-rate environment. This is why the markets are desperate for rate cuts.

A Sign of the Times

In an article published by the Mises Wire, economist Mark Thornton called the surge in business closures “a sign of the times,” emphasizing this is the inevitable consequence of central bank monetary malfeasance.

“It was not long ago when signs for ‘Help Wanted’ seemed to be in every store window. That is starting to be replaced in 2024 and 2025 with ‘Store Closing’ signs. This switcheroo tells us volumes about how people and the economy are adjusting to the Fed’s money-printing business. While the government and the wealthy elite benefit from the money printing, consumers and workers only seem to suffer.”

Thornton argues that the shifts we see in the economy are reflecting the response of entrepreneurs and business people as they adjust to monetary moves.

“According to the [Austrian Business Cycle Theory], firings, mass layoffs and closures are late-stage events that are predictable from the previous stages starting with the Fed’s money printing. It is not the result of some random or mysterious psychological process. Sure, managers make plenty of what appear to be bonehead decisions, but I don’t envy them for the tough decisions they have to make every day.

“We know it’s a Fed-caused business cycle because the trends happen in stages along with spikes in the data, rather than in a normal fashion, with no spikes and correlation—so large numbers of ‘Help Wanted’ signs followed later by large numbers of ‘Store Closure’ signs. The time of adjustment with business cycles is uncertain. We don’t know exactly how much time will be involved or exactly how events will unfold. We do know that Trump’s tariffs will make things worse, but not by how much.

“The ways in which people have been adapting are particularly illuminating to the cause of the cycle—the Fed’s money supply expansion, but also to the fact that it causes, not just higher prices, but that it does cause a cyclical disturbance and that it creates winners and losers, and that, above all else, paper money is not neutral!”

Thronton points out that store closures are visible signs of the times, however, entrepreneurs and managers have been working tirelessly trying to keep the economy afloat despite the monetary malfeasance.

“Business closures and startups are visible, but entrepreneurs and managers have been working at a frantic pace to keep companies operational and profitable enough to stay in business and expand. Staffing and shift changes, input mixes, technological fixes, product lines, and operating hours are just some of the noteworthy aspects or ‘margins’ of the business that have been changing at revolutionary speed compared to normal conditions. Of course, customers don’t like price hikes, surcharges, and automated tipping, but—under the circumstances—it is completely understandable.”

The reality is the malinvestments and debt bubbles incentivized by decades of easy money have to unwind eventually. While we have dealt with a surge of price inflation due to the rapid infusion of money into the economy during the pandemic, we still haven’t reckoned with the economic rot caused by well over a decade of easy money.

As Thornton summed it up, “The main source of our frustrations as consumers is the Federal Reserve.”

The markets are clamoring for deeper rate cuts hoping that it will save us from a recession. While more of the easy money drug might kick the can down the road for a while, it will also mean more inflation. And eventually, they will run out of road. We enjoyed a long easy money boom. Booms always come with a bust. And the bust is generally commensurate with the boom.

It’s likely too late for rate cuts to bail out the economy. The damage has been done, and it’s only a matter of time before we have to pay the price for those decades of monetary malfeasance. The economy is like a dry grassland during a drought. All it needs is a spark to catch fire. The trade war could be that spark.

This puts the Federal Reserve in a Catch-22. Given the escalating inflationary pressure, it needs to push hold rates steady or even push them higher. After all, it never did do enough to slay the inflation monster. The bottom line is that the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

This is bullish for gold.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. Given the levels of debt and the amount of malinvestment, the economy can’t function in this higher interest rate environment. It needs its easy money drug.

This is also bullish for gold.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.