(Mike Maharrey, Money Metals News Service) On Friday, the spot price of gold topped $3,000 an ounce for the first time.

This is yet another milestone in a bull run that started last year.

Since the end of 2023, gold has climbed to $3,000 from $2,064, a 45.3 percent increase. The yellow metal is up 14.3 percent in 2025 alone.

Gold was not able to hold the $3,000 level. By the close on Friday, it was hovering around $2,996 an ounce. However, it pushed above $3,000 again Monday morning.

Given the significance of the $3,000 resistance level, it may take several runs to clear that hurdle. However, given the factors driving this bull run, there is every reason to believe it will continue beyond this milestone.

So, what is driving gold higher? And is it sustainable?

Factors Driving Gold Higher

Trade War

The blossoming trade war is the dynamic most often cited as the catalyst for this gold rally by mainstream media. Many analysts worry that increasing tariffs will drive consumer prices higher and drag down economic growth. The fact that President Trump is prone to quickly shift policy has also created a significant level of uncertainty. As Hargreaves Lansdown’s head of research, Victoria Hasler pointed out, “Markets hate uncertainty. This dynamic has helped to drive the gold price to new highs.”

The tariff threat has also contributed to significant structural shifts in the gold market, with tonnes of metal moving from London and Asia to New York.

While the trade war is in the spotlight, it is not the only factor driving gold higher.

“Though it feels like a psychological threshold, gold at $3,000 might just be a stepping-stone if trade wars deepen,” Cosmos Currency Exchange founder Tony Redondo told Yahoo Finance. “That said, it’s not all about Trump. Central banks, interest rate bets, geopolitical tensions, and inflation concerns are all stoking the flames.”

Recession Worries

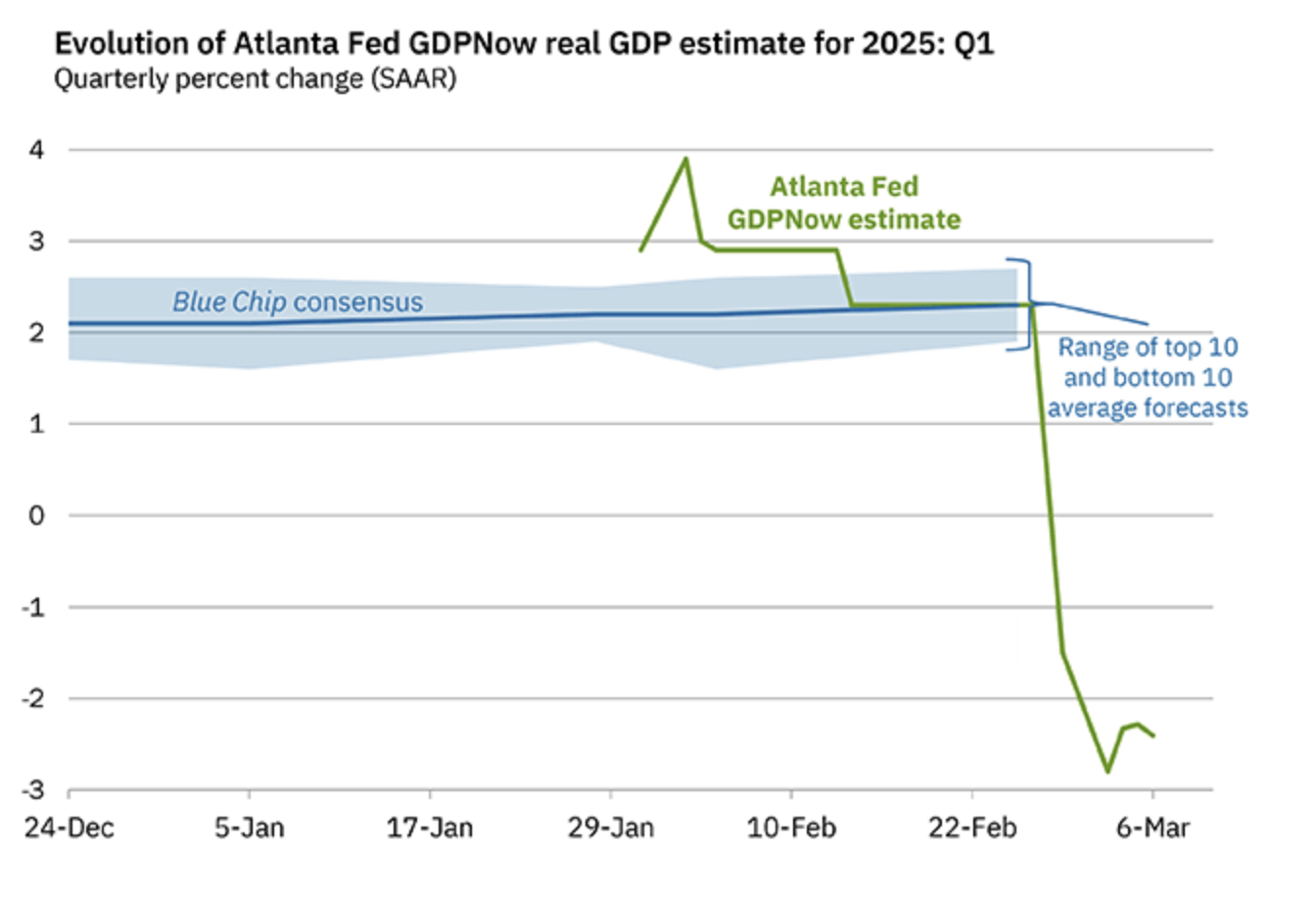

After insisting the economy was great for months, the mainstream has suddenly gotten jittery about a potential recession. The Atlanta Fed’s GDPNow forecast plunged from a 2.3 percent growth rate in late February to -2.8 percent within a matter of weeks.

Mainstream analysts tend to blame the trade war for the sudden recession worries, but the economy has been poised for a downturn for well over a year. Decades of easy money in the wake of the 2008 financial crisis created significant distortions and malinvestments in the economy, along with a massive debt bubble. The central bank was forced to take the easy money drug away due to price inflation. However, this economy is not built to operate in a normal interest-rate environment. This is why the markets are desperate for rate cuts.

It’s likely too late for rate cuts to bail out the economy. The damage has been done, and it’s only a matter of time before we have to pay the price for those decades of monetary malfeasance. The economy is like a dry grassland during a drought. All it needs is a spark to catch fire. The trade war could be that spark.

This puts the Federal Reserve in a Catch-22. Given the escalating inflationary pressure, it needs to push hold rates steady or even push them higher. After all, it never did do enough to slay the inflation monster. The bottom line is that the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

This is bullish for gold.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. Given the levels of debt and the amount of malinvestment, the economy can’t function in this higher interest rate environment. It needs its easy money drug.

This is also bullish for gold.

Inflation Fears

The February CPI data gave markets a glimmer of hope, but price inflation remains well above the Fed’s 2 percent target. It’s also important to note that any “victory” over price inflation sets the stage for the central bank to create more inflation.

Rate cuts encourage borrowing. In turn, this boosts the money supply. This is, by definition, inflation. One of the symptoms of this monetary inflation is price inflation. In other words, any victory over price inflation opens the door for the Fed to resume the very policy that gave us higher price inflation to begin with.

There doesn’t seem to be a lot of mainstream worry about a resurgence of price inflation, but savvy gold investors recognize the fundamentals and are behaving accordingly.

A spokesperson for the World Gold Council summed it up:

“With rising inflation expectations, lower rates, and continued uncertainty, we continue to see support for gold looking ahead.”

Central Bank Gold Buying

Central banks have increased gold reserves by over 1,000 tonnes for three straight years. This constant demand has underpinned this entire gold rally.

To put it into perspective, central bank gold reserves increased by an average of just 473 tonnes annually between 2010 and 2021.

Analyst Adrian Day said there is no reason to think $3,000 gold will slow this institutional demand.

“Strong central bank buying continues, and gold will move above $3,000. That round number is not a barrier for foreign central banks, or indeed foreign buyers who price gold in their own currencies.”

Conclusion

While a significant milestone, $3,000 gold is likely just one more touchstone in a long-term bull market for gold.

Barchart Dot Com senior analyst Darin Newsom said gold is currently moving up on its own momentum.

“Neither fundamental nor technical analysis matters at this point. Gold is the safe-haven market at a time when global economics and politics are in a state of intentional upheaval. That’s the safest way I can describe the situation at this time.”

Walsh Trading co-director Sean Lusk told Kitco News that everything seems to be pointing in gold’s favor.

“You’ve got the central banks supporting it on any kind of sizable dips, increasing their holdings all across the world. On top of the fact that you have the geopolitical concerns that were real, now you have a trade war. It’s inspiring no confidence in equities for the near term here.”

We may see some profit-taking in the near term. Forex.com James Stanley told Kitco News that he thinks $3,000 will bring some sellers into the market, but he emphasized, “I’m only looking for pullbacks at this point rather than full-fledged reversals.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.