(Money Metals News Service) On November 21, 2024, the Bryan Hyde Show featured Stefan Gleason, President and CEO of Money Metals Exchange. The discussion explored sound money, the role of precious metals, and current economic challenges.

Listen to the interview with Bryan Hyde and Stefan Gleason here:

Stefan Gleason’s Background and Money Metals Exchange

Gleason shared his journey from a 15-year career in public policy with the National Right to Work organization to his focus on monetary policy. His concerns about the Federal Reserve’s intervention in markets and the erosion of purchasing power led him to precious metals over 20 years ago.

In 2010, he launched Money Metals Exchange, alongside his brother Mike Geason and brother-in-law Clint Siegner, to popularize precious metals ownership.

Today, the company ranks among the top three U.S. precious metals dealers and operates the nation’s largest private depository.

What Is Sound Money?

Gleason defined sound money as stable, market-based money that retains its value over time. Unlike “political money” managed by central planners, sound money—historically gold and silver—is durable, divisible, and universally recognized. He emphasized that the U.S. monetary system, particularly since leaving the gold standard in 1971, has caused a 98% decline in the dollar’s value, contributing to inflation and economic instability.

Central Bank Digital Currencies (CBDCs): A Concern

Gleason expressed alarm over central bank digital currencies (CBDCs), calling them a potential tool for totalitarian control. Unlike private digital currencies like Bitcoin, CBDCs would allow governments to monitor and restrict financial transactions. He criticized this shift as a response to declining dollar credibility caused by fiscal mismanagement and devaluation.

The Importance of Tangible Assets

Gleason highlighted the advantages of owning tangible assets like gold and silver, which serve as hedges against inflation and currency devaluation. Despite gold prices reaching $2,700 per ounce this year (a 30% rise), precious metals remain under-owned in the U.S., with only 1-2% of people holding them. Gleason encouraged Americans to diversify their savings into gold and silver, noting their global liquidity, lack of counterparty risk, and historical role as money.

The Undervaluation of Silver

Silver’s current value, Gleason argued, is historically undervalued. The gold-to-silver ratio, typically around 40:1, now exceeds 80:1. He predicted silver’s revaluation, driven by its monetary and industrial applications. While silver’s volatility has disappointed investors, its potential remains significant, especially as global interest in tangible assets grows.

Challenges in Precious Metals Adoption

Gleason pointed to misinformation, financial industry bias, and unethical practices in parts of the precious metals market as barriers to wider adoption. He condemned predatory tactics by companies charging excessive premiums on collectible coins and emphasized Money Metals’ mission to provide fair, transparent pricing.

The Money Metals Depository

Located in Idaho, the Money Metals Depository is the largest private storage facility for precious metals in the U.S., with 40,000 square feet, including 9,000 square feet of Class 3 vaults. Gleason noted that while most clients prefer personal possession of their metals, the depository offers secure storage and quick liquidation options.

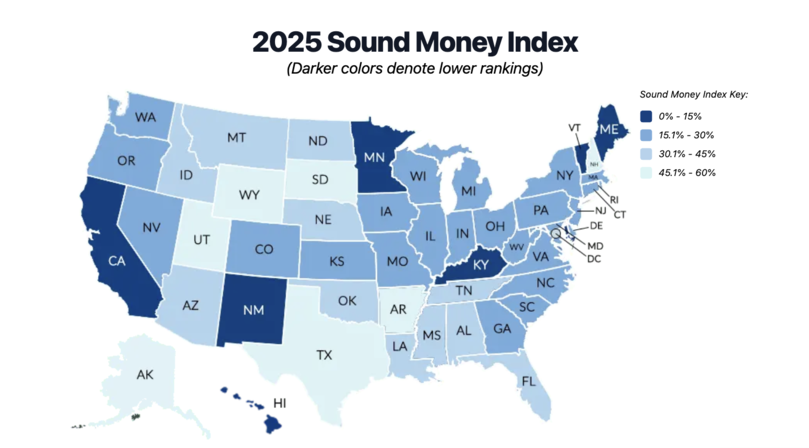

The Sound Money Index

Money Metals Exchange annually ranks all 50 states on policies affecting sound money. The Sound Money Index evaluates 14 criteria, including tax treatment of precious metals and state reserves. Wyoming ranks at the top, while states like California and Vermont lag behind. Gleason encouraged listeners to visit the index at MoneyMetals.com and get involved in advancing sound money legislation.

Conclusion

Gleason’s insights underscored the importance of returning to sound money principles. He invited listeners to explore Money Metals’ resources, including the Sound Money Index and educational tools, to better understand and protect their financial future.

For more information, visit MoneyMetals.com or check the November 21, 2024, show notes at The Bryan Hyde Show.

Key Questions & Answers

In the November 21, 2024, episode of The Bryan Hyde Show, host Bryan Hyde interviewed Stefan Gleason, President and CEO of Money Metals Exchange, discussing topics related to sound money and precious metals. Key questions and Gleason’s responses included:

What is your background, and how did you become involved with Money Metals Exchange?

Stefan Gleason detailed his 15-year tenure in public policy with the National Right to Work organization, where he developed an interest in monetary policy and the Federal Reserve’s influence on markets. This led him to invest personally in precious metals over two decades ago. In 2010, he founded Money Metals Exchange with his brother and brother-in-law to promote precious metals ownership. The company has since become one of the top three precious metals dealers in the U.S. and operates the nation’s largest private depository.

How do you define ‘sound money’?

Gleason described sound money as stable, market-based currency that maintains its value over time, such as gold and silver. He contrasted this with “political money,” managed by central planners, which often leads to inflation and economic instability. He noted that since the U.S. departed from the gold standard in 1971, the dollar has lost approximately 98% of its value.

What are your thoughts on Central Bank Digital Currencies (CBDCs)?

Expressing concern, Gleason argued that CBDCs could enable governments to monitor and control individual financial transactions, potentially leading to totalitarian oversight. He advocated for free-market money and the ability for individuals to choose their preferred currency, including gold, silver, and private digital currencies like Bitcoin.

Why should individuals consider owning tangible assets like gold and silver?

Gleason emphasized that tangible assets, particularly gold and silver, serve as hedges against inflation and currency devaluation. He highlighted their global liquidity, absence of counterparty risk, and historical role as money. Despite gold prices reaching $2,700 per ounce in 2024—a 30% increase—he noted that only 1-2% of Americans own precious metals, indicating significant room for increased adoption.

Why is silver currently undervalued, and what is its potential?

Gleason pointed out that the gold-to-silver ratio, typically around 40:1, had exceeded 80:1, suggesting that silver is historically undervalued. He predicted that silver’s value would rise, driven by its monetary and industrial applications, including technology and healthcare uses. While acknowledging silver’s past volatility, he expressed optimism about its future performance.

What challenges exist in promoting precious metals ownership?

Gleason identified several obstacles: misinformation, a lack of recommendations from financial advisors, and unethical practices within parts of the precious metals market. He criticized companies that charge excessive premiums on collectible coins and emphasized Money Metals Exchange’s commitment to fair, transparent pricing.

Can you tell us about the Money Metals Depository?

Gleason described the Idaho-based facility as the largest private depository for precious metals in the U.S., encompassing 40,000 square feet, including 9,000 square feet of Class 3 vaults. He noted that while many clients prefer personal possession of their metals, the depository offers secure storage and facilitates quick liquidation when needed.

What is the Sound Money Index?

Gleason explained that the Sound Money Index is an annual ranking of all 50 U.S. states based on their policies affecting sound money. The index evaluates 14 criteria, such as tax treatment of precious metals and state reserves. He mentioned that Wyoming ranks at the top, while states like California and Vermont are at the bottom. He encouraged listeners to visit MoneyMetals.com to see their state’s ranking and to participate in efforts to promote sound money legislation.