(Brien Lundin, Money Metals News Service) Forget Halloween — what’s happening in the markets right now is what should really frighten you.

There’s been red all over the screen as the global bond sell-off continues…

If you’ve been listening to the major financial media this week, you’ve noticed the concern in the voices of the talking heads. Treasury yields, and indeed yields across the globe, have been surging despite central banks’ efforts to send rates lower.

I sensed something was up last week, and it prompted me to post this on X:

I got a lot of responses from that tweet, running the gamut from giant meteors to any number of conspiracy theories.

But none of that was what I was sensing. Which is, a growing skepticism that global debts will be paid back in currencies worth anything close to today’s values…that sovereign yields are currently commensurate with the risks…and that the rickety house of cards that is the global financial system is teetering.

Most market pundits view falling Treasury yields as a sign of “safe haven” investing. But, as I’ve said, sometimes rising yields are a sign that investors are rushing for safety…because they’re viewing Treasurys as the source of the risk.

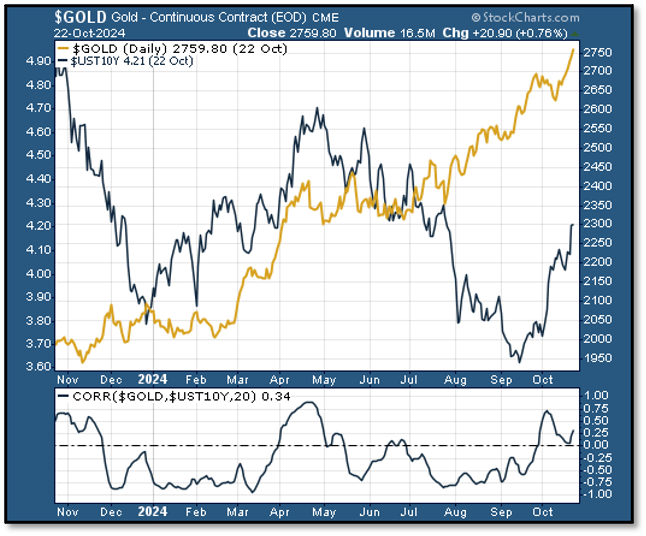

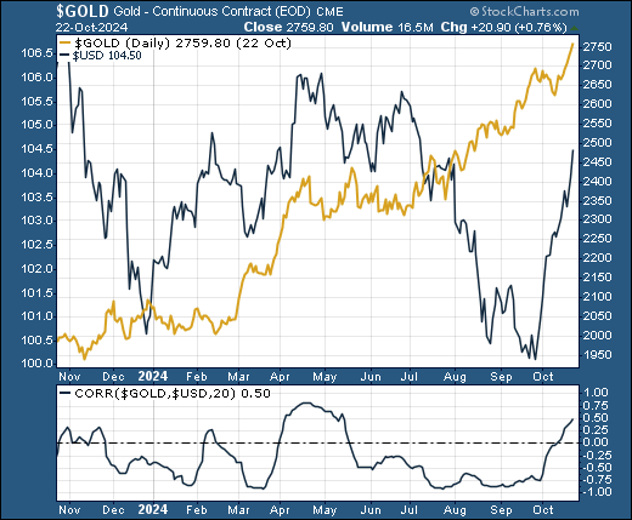

Consider two charts I’ve been featuring in my presentations…

The first chart shows the gold price plotted alongside 10-year Treasury yields, while the second plots gold against the Dollar Index.

The bottom panels in each show the rolling 20-day correlations. When the correlation line is below zero, there is an inverse relationship; when the line is above zero, there is a positive correlation wherein the two assets are moving together.

Gold should have an inverse correlation with Treasury yields and the dollar. But, as you can see, that correlation has been positive a number of times over the past year.

I first commented on this in my presentation at last year’s New Orleans Conference, when I noted that the phenomenon was a sign of emerging skepticism over the U.S. federal debt.

Now that’s become one of the dominant themes in mainstream financial media, as the markets are trembling in response to a future of high deficits and unmanageable interest expense.

As I said, Halloween isn’t for a few days… but things are already getting scary.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.