(Deroy Murdock, Headline USA) President Joe Biden, 78, has a 7-year-old’s grasp of basic math.

“My Build Back Better Agenda costs zero dollars,” Biden claimed via Twitter on September 25. Regarding this multi-trillion-dollar budget, he continued: “And it adds zero dollars to the national debt.”

One can imagine a second-grader named Joey Biden showing off his new train set and telling his playmates, “My daddy bought it for me at Woolworth’s. So, it didn’t cost anything.”

That’s cute enough to make a coal miner cry.

But in a commander-in-chief who turns 79 on November 20, such “thinking” should bring America to tears.

Biden’s Build Back Better Act originally cost $3.5 trillion, or an average $24,424 for each of America’s 143.3 million taxpayers.

The House Budget Committee’s version of this socialist extravaganza weighs in at $4.3 trillion. That’s 23% more expensive and even farther Left.

Somehow, Biden argues that all of this costs “zero.”

Perhaps Biden believes that if he and his fellow Democrats can shake down taxpayers for either $3.5 trillion or $4.3 trillion, then this massive dump of jumped-up welfare spending and shiny new entitlements will total “zero.”

Never mind the thousands of billions of dollars vacuumed into the U.S. Treasury via the Internal Revenue Service.

But even this absurd “zero” is meaningless. As massive as these tax hikes are, they thankfully are not massive enough to cover this staggeringly high new spending.

The Budget Committee’s 2,465-page text proposes a mere $2.3 trillion in tax increases to underwrite this Democrat cornucopia. Of course, this falls short of even the original price tag.

Only in Biden’s mind would $3.5 trillion minus $2.3 trillion equal $0.

Biden also must reckon that $50,000 = $400,000.

At least 42 times, Americans for Tax Reform reports, Biden publicly pledged these or similar words: “I promise you, you have my word, if you make less than $400,000 a year, you won’t pay a penny more in taxes.”

Since multiplication and division escape most 7-year-olds, Biden might be forgiven for confusing $400,000 for the far lower income levels on which he itches to hike taxes.

The Congressional Joint Committee on Taxation (JCT) announced that Biden’s blueprint would raise taxes on:

- 8.8% of those who earn between $50,000 and $75,000

- 17.9% between $75,000 and $100,000

- 34.8% between $100,000 and $200,000

Economists understand that the working class will pay much of Biden’s $858 billion corporate-tax-rate increase—from 21% to 28% of profits.

Companies will finance these higher taxes by raising prices (inflation!), firing workers and slashing or slowing compensation on the survivors.

“Literature suggests that 25% of the burden of the corporate tax may be borne by labor in terms of diminished wage growth,” JCT Chief of Staff Thomas A. Barthold told the House Ways & Means Committee on Sept. 14.

Who would get this potential $214.5 billion bill? Barthold said: “Labor. Laborers.”

Biden also has a tot’s grip on what constitutes a “fair share” of income taxes. Like a second grader, he sees wealthy people and screams insults.

As Biden said on Sept. 16, if his plan is enacted, “the super-wealthy … can finally begin to pay their fair share of what they owe.”

But even a Cub Scout could use the IRS’s statistics to refute Biden’s remarks.

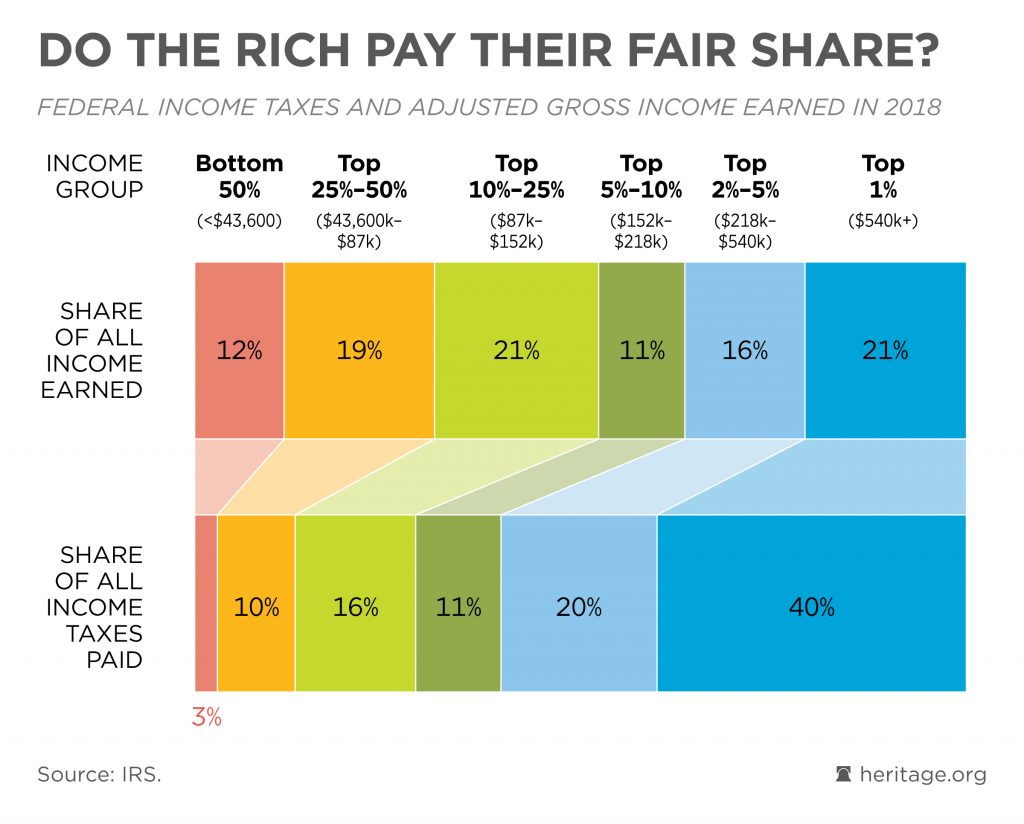

The latest data show that in 2018, the top 1% of taxpayers earned at least $540,000 each. This group scored 21% of all national income and paid 40 percent of all federal income taxes.

And the bottom 50%? They earned less than $43,600 each, made 12% of national income, and paid a measly 3% of income taxes.

As childlike as is Joe Biden’s mathematical prowess, he is a veritable calculus professor beside House Speaker Nancy Pelosi, D-Calif. Evidently, she never learned to count.

Concerning Joe’s budget, Nancy told ABC’s This Week: “Let’s not talk about numbers and dollars. Let’s talk about values.”

Deroy Murdock is a Manhattan-based Fox News Contributor, a contributing editor with National Review Online, and a senior fellow with the London Center for Policy Research.