(Brien Lundin, Money Metals News Service) Gold is closing out an extraordinary year, one which marked the start of a new bull market.

More importantly, this bull market seems likely to go on much longer and much higher, thanks to a few fundamental forces and irreversible trends.

It’s been a helluva year for gold.

In the early days of this bull market…way, way back in March…I reported in these pages how fortunate we were to have an unprecedented mix of buyers for gold.

The mix included central banks, with furious buying from the People’s Bank of China in particular, along with strong demand from Chinese citizens as their equity and real estate markets tanked.

It was something we’d never seen before in the history of gold as an investible asset. Not only were these buyers acquiring gold aggressively, they also didn’t seem to care much about the price. If anything, they were buying more as the price rose.

The one thing we didn’t have in the market were the Western investors.

“Be Careful What You Wish For…”

The saying “Be careful what you ask for — you might just get it, good and hard!” is often attributed to legendary journalist and curmudgeon H.L. Mencken, but the underlying sentiment actually predates the pundit by a couple of millennia, having originated with Aesop’s fables circa 250 BC.

No matter where it came from, it rings true — as gold bugs learned this year.

As the gold price rose relentlessly in March and well into April, I was among those predicting that Western buyers would turbocharge the gold rally once they got onboard.

I also warned, however, that we had become spoiled by the price-insensitive central banks and that the trading-oriented Western investors would bring a lot more volatility to the uptrend when they arrived.

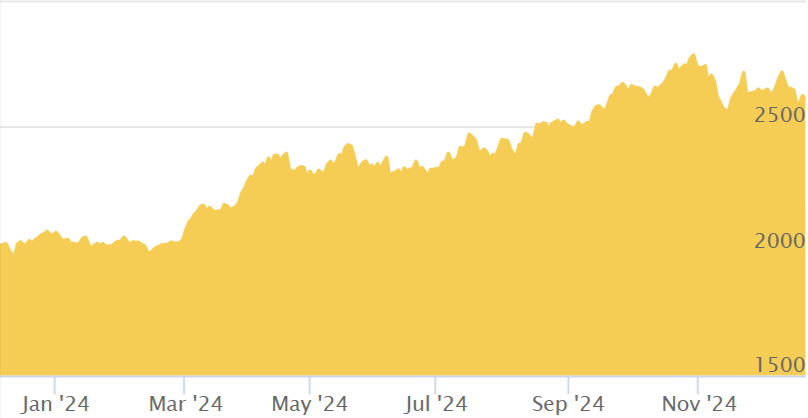

Well, as you can see from the accompanying one-year chart of the gold price, we got the turbocharged gold market we wished for… and then got all the volatility we feared, good and hard.

Much of this year was spent in anticipation of the Fed’s pivot to rate cuts. In fact, last December the market was expecting as many as seven rate cuts in 2024, with the first coming early in the year.

As the year progressed, though, those hopes were repeatedly dashed as Powell & Co. kept postponing the pivot. It wasn’t until mid-summer that they began signaling that the long-awaited rate cuts were near, and not until their September meeting that they actually pulled the trigger.

As part of their pricing of markets in anticipation, those infamous Western traders started buying gold in earnest in July, as evidenced by the year’s first inflows into the GLD gold ETF in that month.

That gold-price surge from July to October that you can see above reflects the impact of the Western traders as they eagerly built long gold positions and started dipping their collective toes into mining equities.

We enjoyed that run higher, but then came the volatility.

It actually started in late October, as traders played with the market as the month-end options expiry approached. It accelerated, however, immediately after Trump’s election victory, with the manipulators using the Bitcoin-bullish result as a perceived threat against gold.

That strange bit of logic was used as a fulcrum for leveraged short positions, forcing the gold price lower and taking out sell-stop after sell-stop.

The result: Instead of bursting through the $2,800 level, gold was shoved down to the $2,600s.

As you can also see from the chart above, the metal has been recovering from that take down in halting fashion.

Even as the price rebounded, the attacks continued, with the paper gold speculators sometimes using signs of peace breaking out in the Middle East as flimsy rationales for selling gold.

I thought we might have finally broken out for good in the last bounce to the $2,750 range, even telling my Alert readers that this had all the earmarks of the typical year-end to new year rally…although also warning that we’d been bitten before over the years by early-December surges that quickly faded away.

It looks like this was one of those false moves, with a couple of bear attacks late last week — including the market-wide sell-off predicted in our year-end issue of Gold Newsletter — providing yet another setback.

So where does this leave us?

Frankly, I still expect an imminent rebound and rally in gold, whether that begins in the few remaining days of this year or in the early days of the next.

My optimism is based partly on seasonality patterns as well as the return of central banks to the gold market…but primarily upon the intractable debt trap that the Fed is now in.

I explained a bit about this in our issue last week, and have been covering it in detail for years. The bottom line is that the Federal Reserve is facing increasing pressure to cut rates because neither Uncle Sam nor corporate America can afford to service their massive debt loads at current interest levels.

Yet this growing financing risk is being sensed by investors, who are driving rates higher in response. And this in turn makes the Fed even more desperate to lower rates.

The end result will be the Fed losing control…or a recession that forces them to impose emergency cuts…or both. And gold will be the big winner.

Obviously, there’s a lot more to this than I can relate here. The good news, as I told you last week, is that my full insights, as well as those of many of the world’s top experts, are available to you now:

The Single Best Value in Investing

Last Tuesday, we delivered the single best value in investment publishing to our readers of Gold Newsletter.

It was our blockbuster year-end issue packed with 87-pages of invaluable investing intelligence. It presented not only my latest market outlook, but also coverage of dozens of today’s top junior resource stocks (including three red-hot new recommendations) and comprehensive highlights from our recent New Orleans Investment Conference.

My comments above were taken from my opening article in that year-end Gold Newsletter. But I went much deeper into the issues, risks and opportunities now facing us.

For example, consider what I wrote in my opening article on Tuesday — notably, the day before the big sell off in the markets on Wednesday:

“…that valuations of equities and other assets are getting stretched to the point where a very significant correction, if not a full-blown crash, seems both inevitable and imminent. When that happens, we need to understand that gold will get hit hard along with everything else…but gold is also positioned as no other asset to benefit from the inevitable flood of liquidity from central banks.”

Bottom line, between my market comments and the insights of dozens of today’s top experts featured in this issue, our year-end edition of Gold Newsletter is the single best guide for the uncertain days ahead.

Once again, you have a special opportunity to purchase this single issue — jam packed with value — at the special low price of just $29.95.

Just click on the link here and get this special single issue right now.

And if you wish to subscribe for a year — or access our special alert service — just click here.

The Best of the Season to You and Yours!

Finally, as we close out this remarkable year, please accept my sincerest wishes for the best of the season.

It’s been a good start for gold, and while we’re hopeful that the mining sector will finally respond in the months ahead, we most importantly wish that the new year brings you and your loved ones happiness and health.

All the best,

Brien Lundin

Publisher, Gold Newsletter

CEO, the New Orleans Investment Conference

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.