(Mike Maharrey, Money Metals News Service) The Federal Reserve kicked off its October meeting today (Tuesday, Oct. 28). The central bank is expected to cut interest rates another quarter percent and could announce a timetable to end balance sheet reduction.

But why?

A lot of the people clamoring for looser monetary policy claim the economy is booming. That isn’t generally a signal for rate cuts. So, why ease when price inflation remains well above the Fed’s purported 2 percent target and is rising?

In a sane world, the central bank would be holding rates higher to strangle inflation once and for all. It might even be hiking rates.

But we don’t live in a sane world.

We live in a world with a debt black hole. The debt-riddled bubble economy can’t function even with modestly higher interest rates. It needs its easy money drug. The Fed seems intent on supplying it to keep the party going, inflation be damned.

Simply put, the Fed is in a Catch-22. It must choose between fighting inflation and keeping the air in the bubbles. It can’t do both.

It picked inflation.

Based on the October CNBC Fed Survey, economists, strategists, and fund managers, the Fed will not only cut rates at the meeting, but it will also trim rates at the next two.

I’m not the only one questioning this pivot to easy money.

While 92 percent of the survey respondents said the Fed would cut at the October meeting, only 66 percent thought it should, with 38 percent indicating they opposed the cut.

Richard Bernstein Advisors CEO said he thinks politics are influencing the decision more than economic data.

“Financial conditions are near historically easy, GDP is tracking 3.5-4 percent, financial assets are ripping, and inflation remains well above the Fed’s target. In more normal times, there is no way the Fed would be cutting rates.”

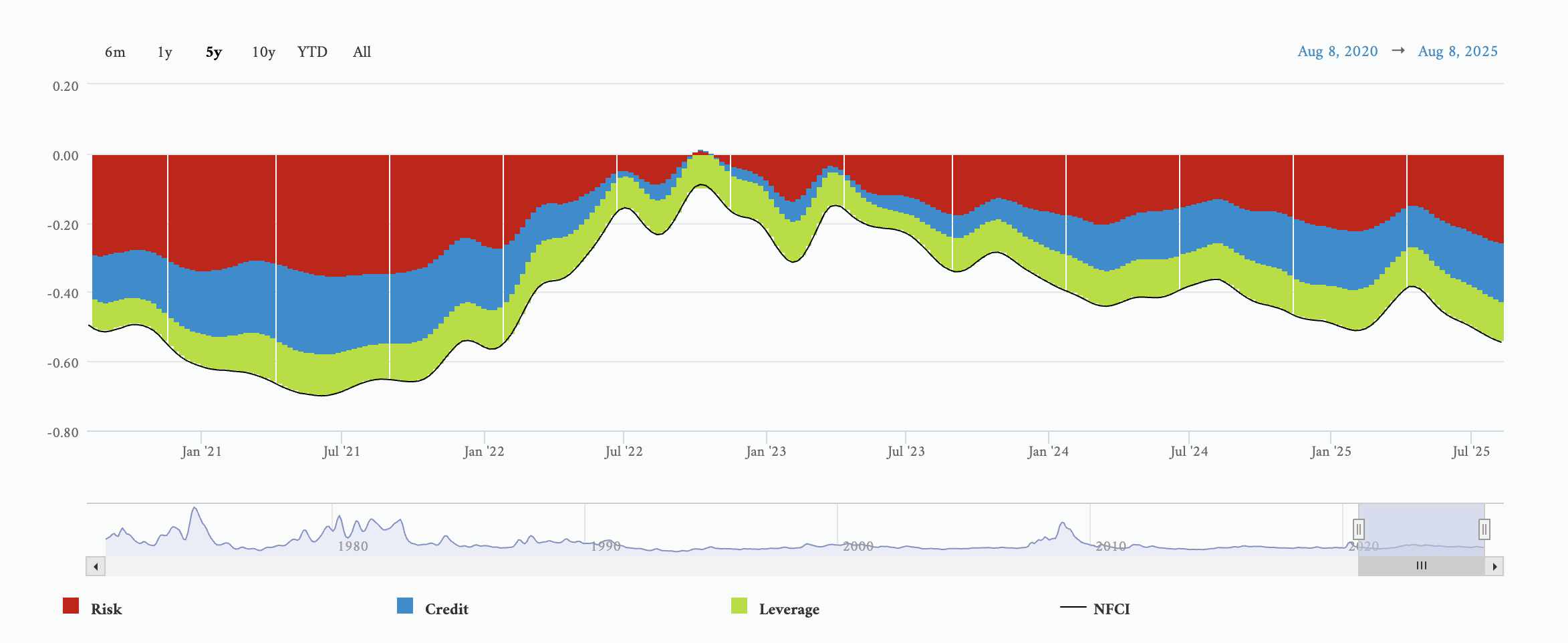

He’s right. The Chicago Fed’s own National Financial Conditions Index indicates that monetary policy is currently loose from a historical standpoint. In fact, it never got tight, even at the height of the hiking cycle.

Stifel chief economist Lindsey Piegza said there is also concern that the lack of data due to the government shutdown is obscuring the full picture.

“Fed officials are unable to draw much of a conclusion about anything and therefore should arguably remain on hold, waiting for additional information before potentially further compounding a policy error with a second-round rate cut if unwarranted by the evolution of inflation and hiring conditions.″

Janney Montgomery Scott chief fixed income strategist Guy Lebas likened it to “flying in a blizzard with a blindfold on and no backup instrumentation.”

“It’s even worse when there are mountains in the area.”

The lack of good data is a fair concern, but the reality is that even with perfect data, central planning will still fail. No brain-trust can ever possess all the knowledge necessary to run a complex economy. They will also run aground on the rocks of unforeseen consequences.

But what people lack in knowledge, they make up for in hubris. They’ll keep trying.

And they’ll keep failing.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.