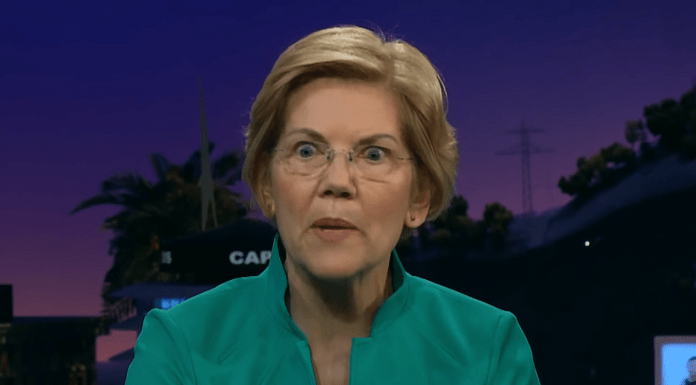

Sen. Elizabeth Warren, D-Mass., unveiled the Ultra-Millionaire Tax Act this week, which would levy a 2% annual tax on the net worth of households and trusts of $50 million or more, as well as a 1% annual surtax on assets above $1 billion.

The proposal—which is co-sponsored by Sen. Bernie Sanders, I-Vt.; and Reps. Pramila Jayapal, D-Wash., and Brendan Boyle, D-Pa.—would serve as a means for Democrats to pay for their expensive leftist policies, such as universal health care coverage, child care and the Green New Deal.

“As Congress develops additional plans to help our economy, the wealth tax should be at the top of the list to help pay for these plans because of the huge amounts of revenue it would generate,” Warren said in a statement.

“This is money that should be invested in child care and early education, K-12, infrastructure, all of which are priorities of President Biden and Democrats in Congress,” she said.

More than 100,000 American families would be subject to the tax. The top 100 richest Americans would end up paying more than $78 billion in taxes annually, according to an analysis by Bloomberg News.

Jeff Bezos, for example, would face an additional $5.4 billion in taxes if the bill is signed into law; Tesla CEO Elon Musk would have to pay an additional $5.2 billion; and Microsoft founder Bill Gates would have to pay another $4 billion.

Wealthy Americans who seek to renounce their U.S. citizenship to avoid paying the tax would be subject to a 40% exit tax, according to the bill.

Biden has gone back and forth on whether he would support a wealth tax. Early on the campaign trail, he said he would oppose it, but then he announced he would “right the tax code” and increase taxes on the wealthy.

“You got billionaires in this country making $700 billion during this [coronavirus] crisis. $700 billion,” Biden said in October.

When asked if raising taxes in the middle of the coronavirus pandemic would be a good idea, Biden said: “Depending who you’re raising them on. Look, if you’re raising ’em on somebody who’s making $1 billion a year, it’s not a problem that they pay 39.6%, which everybody should pay, raise another $90 billion.”