(Mike Maharrey, Money Metals News Service) It’s no wonder people don’t understand inflation. High school students are only being taught half the story.

A friend ran across this lesson for International Baccalaureate (IB) high school students. The IB program is “a rigorous, two-year high school curriculum (Grades 11 and 12) that emphasizes intercultural understanding and global awareness.”

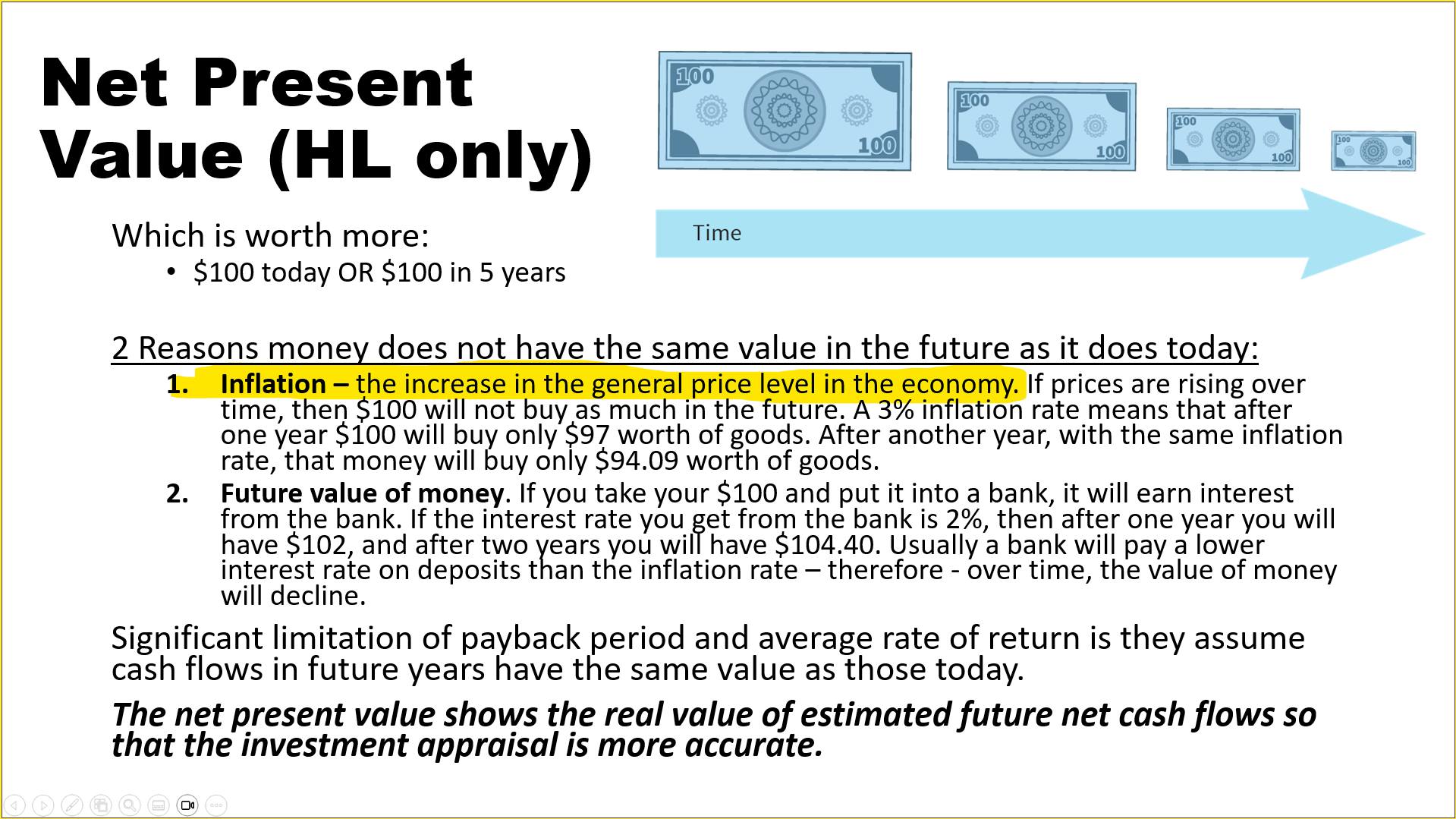

Note the definition of ‘inflation’: the increase in the general price level in the economy.

That’s a perfectly good definition of price inflation, but it leaves an important question unanswered: what causes a rise in the general price level? Why do we have “inflation” to begin with?

That seems like an important part of the lesson, doesn’t it?

A student taking this class will be left to assume that it’s magic.

Prices just rise.

Too bad, too sad.

What Causes Price Inflation?

All kinds of things drive prices up—increased demand, shortages, natural disasters, wars, government policy, etc. Sometimes, price increases can ripple through the economy, causing other prices to follow suit. For instance, oil prices spiked after Russia invaded Ukraine. But this wasn’t technically “inflation.” It would be better described as a price shock. Price shocks do, in fact, raise prices. And those price increases can cascade through the economy, causing other prices to rise with them.

But again, this isn’t “inflation” in the historical and technical sense of the word. There is only one thing that causes price inflation (defined as a general rise in the level of prices) – monetary inflation, or more precisely, an increase in the supply of money and credit.

As economist Milton Friedman put it, “[Inflation] is always and everywhere a monetary phenomenon. It’s always and everywhere a result of too much money.”

You don’t get that part of the story from the IB lesson plan, do you?

I think that’s by design.

After all, who causes the money supply to increase?

Governments and central banks.

And the political class would rather you not realize they are causing the pain you’re feeling at the grocery store and gas station.

Words Mean Things

There was a time in the not-too-distant past when inflation was more precisely defined.

A 1970s dictionary described it this way:

“A sharp increase in the amount of money and credit, causing advances in the price level.”

Economist Ludwig von Mises defined it this way in his essay “Inflation: An Unworkable Fiscal Policy“:

“Inflation, as this term was always used everywhere and especially in this country, means increasing the quantity of money and bank notes in circulation and the quantity of bank deposits subject to check.”

Price inflation (or “inflation” as the IB lesson plan calls it) is one symptom of this government-created monetary inflation. In other words, a rise in the general price level isn’t inflation. It is caused by inflation.

Henry Hazlitt is best known for his brilliant book Economics in One Lesson. In another essay titled “Inflation in One Page,” he explained why using a more precise definition of inflation is crucial.

“Inflation is an increase in the quantity of money and credit. Its chief consequence is soaring prices.

“Therefore inflation—if we misuse the term to mean the rising prices themselves—is caused solely by printing more money. For this the government’s monetary policies are entirely responsible.” (Emphasis added)

Mises expounded on this.

“People today use the term `inflation’ to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise.

“The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation… As you cannot talk about something that has no name, you cannot fight it.

“Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of the evil. They try to keep prices low while firmly committed to a policy of increasing the quantity of money that must necessarily make them soar.

“As long as this terminological confusion is not entirely wiped out, there cannot be any question of stopping inflation.” [Emphasis added]

Over the years, the political class, along with their apologists in the mainstream financial media and academia, intentionally muddied the definition of inflation to suit government purposes. The standard definition of inflation you hear during White House press conferences, at a CNBC roundtable, or during an IB high school class is nothing more than government propaganda.

By obscuring the fact that price inflation (a general rise in all prices) is the result of monetary inflation, government and central bank officials can blame “inflation” on all kinds of things. After all, there are a lot of reasons certain prices go up and certain prices go down.

This is precisely why so many people believe “inflation” is caused by greedy corporations, Putin’s price hikes, or voodoo.

The real culprit is government.

Sadly, your highly educated IB graduate will probably never realize this.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.