(Jesse Colombo, Money Metals News Service) Silver is making a strong comeback at the start of 2025, following a challenging year-end performance in 2024.

There is good reason to suspect that bullion banks have deliberately driven gold and silver prices lower at the close of 2024 to “paint the charts” and influence the yearly closing prices.

This tactic seems plausible, given the solid gains gold and silver posted throughout the year—26% and 21%, respectively. With the new year underway, the stage is set for the gold and silver bull market to regain momentum and potentially exceed last year’s performance.

Although silver broke below its uptrend line on December 18th, it appears to have formed a double bottom and rebounded off the downtrend line that began in May.

To confirm that the sell-off is truly over and silver’s rally is ready to resume, I would like to see it close back above the uptrend line, effectively negating the December 18th breakdown. Following that, a convincing close above the $32–$33 resistance zone—an area that has posed a significant challenge for the past seven months—would strengthen the bullish case.

If silver can sustain a close above this key level, it should pave the way for a rally to $35, $40, and ultimately higher.

While silver has remained stagnant since late October, there’s reason to believe this is merely another consolidation phase, similar to those seen a year ago and during the past summer.

If history repeats itself, and a breakout occurs, silver could be poised for another strong rally, just as it did following the previous consolidation periods.

I closely monitor gold, as it, along with copper, plays a significant role in influencing silver prices.

Currently, COMEX gold futures are trading within a range of $2,550 to $2,800. To confirm that gold’s bull market has resumed, a decisive, high-volume close above both the triangle pattern and the $2,800 resistance level is necessary.

Such a breakout would likely propel gold to $3,000 and beyond in short order, which would prove very beneficial for silver as well.

In addition to gold, I closely monitor the price of copper, as it significantly influences silver’s performance.

For silver to gain meaningful bullish momentum, a strong rally in copper is likely necessary. Currently, copper is hovering near its key $4 support level, and a rebound from this point would be a positive signal. If copper can successfully rally, the next critical test will be the $5–$5.20 resistance zone.

A decisive close above this range should ignite a powerful copper bull market, which would likely have a favorable impact on silver prices.

I’ve developed an indicator to help confirm price movements in silver, called the Synthetic Silver Price Index (SSPI).

This index combines the average prices of copper and gold, with copper adjusted by a factor of 540 to prevent gold from disproportionately influencing the index. The SSPI closely mirrors silver’s price movement, even though silver itself is not an input.

The encouraging news is that the SSPI has just bounced off its uptrend line, signaling underlying strength. The next key step is for the index to achieve a decisive close above the 2,600–2,640 resistance zone, which would provide a strong bullish signal for silver.

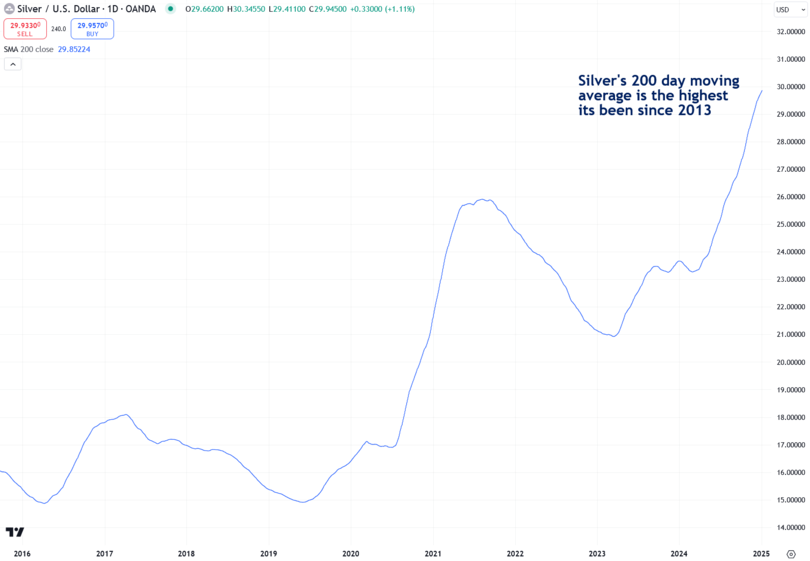

Though silver investor sentiment is currently quite negative, it’s important to step back and focus on the bigger picture, which remains very positive.

The 200-day moving average of silver prices, which smooths out short-term volatility, is at its highest level since 2013.

Trends in motion tend to persist, suggesting that this underlying strength is likely to carry into 2025 and beyond.

Silver is still on track to break out of its multi-decade cup-and-handle pattern, paving the way for it to reach several hundred dollars per ounce:

As silver gains momentum, I anticipate silver miners will thrive, despite their recent struggles. This lag is likely due to silver’s long-term bull market still being in its early stages.

It will take some time for investors to recognize how undervalued silver mining stocks truly are—but when they do, these stocks are poised to soar.

Although silver stagnated at the end of 2024, the new year brings plenty of reasons for optimism. Most investors are currently underestimating silver, overlooking its strong overall performance over the past year and dismissing the fact that its bull market is just beginning, with significant potential ahead.

Now is the time to remain confident and focus on the opportunity that lies ahead.

Personally, I am highly optimistic about silver’s prospects, and the widespread negativity surrounding it only strengthens my conviction from a contrarian perspective—after all, the crowd is typically wrong.

Jesse Colombo is a financial analyst and investor writing on macro-economics and precious metals markets. Recognized by The Times of London, he has built a reputation for warning about economic bubbles and future financial crises. An advocate for free markets and sound money, Colombo was also named one of LinkedIn’s Top Voices in Economy & Finance. His Substack can be accessed here.