One key reading of the misery index for U.S. consumers is continuing to rise, according to data released by the Bureau of Labor Statistics.

The “misery index” is calculated by adding unemployment to inflation.

Wholesale prices (PPI), driven by rising food costs, increased 0.8% in May and by a unprecedented amount over the past year as the U.S. economy emerges from pandemic lockdowns and pushes inflation higher.

Retail Sales fall short -1.3% vs -0.8% estimated

Bigger News – Empire State falls short 17.4 vs 22.3

First regional manufacturing survey missed.

PPI CORE HOTTER THAN EXPECTED

More stagflation flagged.

— Danielle DiMartino Booth (@DiMartinoBooth) June 15, 2021

The PPI report follows a 0.6% increase in April and a 1% jump in March, and signals rising prices for consumers.

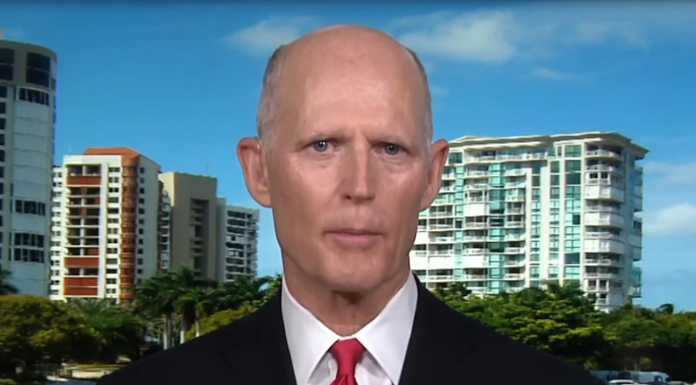

“Today’s PPI report is clear,” said Sen. Rick Scott, R-Fla., “Joe Biden’s reckless spending has created an inflation crisis in America not seen since the 1970s, and it’s devastating for our families and small businesses.”

Key Federal Reserve officials, including Chairman Jerome Powell, have maintained that the currently skyrocketing inflation levels will abate.

But Powell’s apparent reassurance does not indicate when it will happen—and there is no reason to believe prices will go back down for consumers when all is said and done.

The latest report shows that if inflation abates, it won’t be any time soon.

Producer prices rose at the fastest rate in over a decade, even as retail sales slumped 1.3% raising fears of stagflation, which is a combination of a slowing economy and higher prices.

Producer prices are prices that producers pay before good reach consumers. Producers either pass those costs on to consumers or they reduce their profits.

Last week, the U.S. reported that consumer prices rose 0.6% in May with prices over the past year surging by 5%, the biggest 12-month gain in more than a decade.

“As prices keep climbing, it’s small businesses and our poorest families—like mine growing up—that are hurt the most,” said Scott, a self-made multimillionaire, currently believed to be the wealthiest member of Congress.

“The wasteful spending must end,” Scott continued.

Scott recently introduced the Federal Debt Emergency Control Act to hold Congress accountable for its awful spending habits and start paying down the debt.

Among the bills proposals:

- Require the Office of Management and Budget to declare a “Federal Debt Emergency” in any fiscal year where the federal debt exceeds 100% of that year’s Gross Domestic Product.

- Terminate any unobligated funding from the American Rescue Plan Act, and any previous stimulus bills, sending it back to the Treasury General Fund immediately for deficit reduction.

- Require all legislation that increases the federal deficit, as determined by the Congressional Budget Office, to carry its own offsets. If it does not, the legislation shall be considered out of order and will require at least two-thirds of all Senators to vote to increase federal debt before even being able to consider the bill.

- Fast-track any legislation that would reduce the federal deficit by at least 5% over 10 years.

Meanwhile, CNBC reported Monday that several notable Wall Street names—including Bank of America CEO Brian Moynihan and hedge-fund billionaire Paul Tudor Jones—were calling on Powell and the Fed to slam the breaks on the central bank’s unfettered creation of new money and debt.

“[I]t’s time for the Fed to pull back on the easy-money policy it instituted during the pandemic,” said CNBC.

The Fed notably kept the economy on life support for much of the Obama presidency by taking interest rates to near-zero levels, ostensibly to recover from the Great Recession.

When it attempted to raise rates on then-President Donald Trump during the economic boom of his early presidency, Trump cried foul, accusing Powell of essentially playing politics.

A reluctance to raise rates now, with clear warning signs of an impending crisis amid Biden’s $6 trillion spending plan and low projected growth, could validate Trump’s suspicions further.

“With a national debt surpassing 28 trillion dollars, our country’s fiscal health is in dire straits,” said Adam Brandon, president of the conservative think-tank FreedomWorks, in support of Scott’s legislation.

“Decades of reckless spending have created a true emergency laid at the feet of Americans now and for generations to come,” Brandon added. “More than ever, we need real conversations and workable solutions to address the national debt.”

Headline USA’s Ben Sellers contributed to this report.