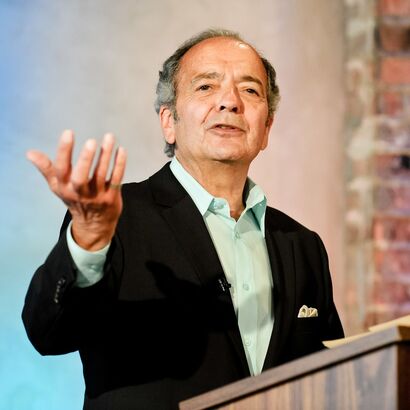

(Money Metals News Service) In a recent interview with Money Metals Podcast host Mike Maharrey, Gerald Celente, Founder of the Trends Research Institute and Publisher of the Trends Journal, discussed the significant global issues that he believes are shaping the future.

With over 43 years of experience in trend forecasting, Celente’s insights on geopolitics, the economy, and gold’s growing importance are compelling.

(Interview Begins Around 6:49 Mark)

Who is Gerald Celente?

Gerald Celente is a renowned trend forecaster, author, and founder of the Trends Research Institute. He publishes the weekly Trends Journal magazine and is known for his bold predictions about global financial markets, geopolitics, and societal trends. (Coupon code at end of article)

With over 43 years of experience, Celente has accurately forecasted significant events, such as the 1987 stock market crash, the Dot-com bust, the 2008 financial crisis (“Panic of ’08”), and the rise of gold prices.

Celente developed a forecasting method known as Globalnomic methodology, which he uses to track and predict future trends. He describes himself as a “political atheist,” meaning he operates free from political ideology or conventional wisdom, and his motto is “Think for Yourself.” Celente is also the founder of the Occupy Peace & Freedom movement, advocating for constitutional rights and non-interventionist foreign policy.

He has authored best-selling books such as Trend Tracking and Trends 2000 and is widely seen and heard across major media outlets like The Today Show, CNN, Fox News, and BBC. Celente is recognized for his critical perspective on U.S. government policies, the global economy, and the declining state of the U.S. dollar.

A World on the Brink of Nuclear War

Gerald Celente opened the conversation by highlighting his deep concern for the escalating global conflict, stating, “I’ve never been more concerned about World War III and nuclear annihilation in my life.”

Citing Russian President Vladimir Putin’s recent warnings regarding U.S. involvement in Ukraine, Celente emphasized that if the U.S. provides long-range missiles, nuclear retaliation may be inevitable.

His perspective on the Ukraine conflict dates back to 2014 when the Trends Journal published an article by Dr. Paul Craig Roberts, detailing the U.S.-backed overthrow of Ukraine’s democratically elected government.

Gold’s Meteoric Rise in 2024

Shifting focus to the economy, Celente reflected on his forecast made on January 2nd, predicting that 2024 would be a “golden year for gold.”

He noted how his prediction materialized with the Fed’s 50-basis-point rate cut, which triggered gold’s price increase. He highlighted that lower interest rates weaken the dollar, driving up the price of gold.

According to Celente, gold’s future trajectory remains upward as geopolitical tensions continue to rise and central banks stockpile gold reserves in record amounts.

He emphasized the importance of understanding these dynamics, saying, “The deeper the interest rates go, the deeper the dollar falls, and the higher gold prices go.” This trend, coupled with the ongoing economic and geopolitical crises, has solidified gold as the top safe-haven asset.

Office Building Bust and Looming Banking Crisis

Celente also underscored the looming “office building bust,” a direct consequence of the COVID-19 lockdowns. He cited startling data, such as the 35% office vacancy rate in San Francisco, with properties like a once $320 million building selling for just $8.5 million.

Celente forecasts this crisis will drive hundreds of banks into failure, reminiscent of the 2023 collapse of institutions like Signature Bank and First Republic.

He predicts that gold could surge to $3,000 an ounce when this crisis intensifies, noting, “The sky’s the limit when the banks start going bust.”

The Weaponization of the Dollar

Celente and Maharrey also delved into the U.S. weaponization of the dollar through mechanisms like the SWIFT payment system. Celente pointed to the BRICS nations’ growing resistance to U.S. hegemony and their interest in de-dollarizing global trade.

With countries like Turkey signaling their desire to join BRICS, Celente foresees the continued erosion of the dollar’s status as the world’s reserve currency.

“The U.S. became the country our Founding Fathers fought against,” Celente remarked, adding that ongoing wars and economic mismanagement are accelerating the dollar’s decline. He warned that the combination of lower interest rates and mounting geopolitical conflicts will eventually lead to the dollar’s demise.

A Call for a Renaissance

Despite the grim outlook, Celente ended the interview with a message of hope, calling for a new cultural renaissance. Drawing parallels to the Renaissance that followed the Black Plague in Europe, Celente expressed his belief that a revival of arts, culture, and intellectualism could steer humanity away from its current destructive path.

He called for unity among those who care about peace, saying, “It does not take a majority to prevail, but rather an irate, tireless minority.”

Final Thoughts

Gerald Celente’s interview offers a sobering view of the global landscape, with insights into the rising dangers of war, economic instability, and the decline of the U.S. dollar. His longstanding expertise in trend forecasting, combined with his candid and unfiltered analysis, underscores the need for individuals to prepare for the future by investing in safe-haven assets like gold and promoting peace.

For those interested in following Celente’s work, the Trends Journal provides in-depth analysis on geopolitics, economics, and social trends. As Celente emphasized, “Think for yourself” is the guiding principle that drives his forecasting, and his publications aim to equip readers with the knowledge to navigate the turbulent times ahead.

Key Questions & Answers

How is Gerald Celente doing?

“I’m doing fine, but my heart’s broken seeing what’s going on around the world. We’re having a Peace and Freedom rally up in Kingston, New York, with Judge Napolitano, Scott Ritter, Max Blumenthal, and others, but the reality of the global situation is heartbreaking.”

What are Gerald Celente’s concerns about World War III?

“I’ve never been more concerned about World War III and nuclear annihilation. Putin recently said if the U.S. sends long-range missiles into Ukraine, they’ll go nuclear. He’s serious, and people don’t realize how close we are to that. People are distracted by irrelevant news, like whether Taylor Swift had sex last night, but the reality is we’re on the brink of a catastrophic war.”

What did Celente forecast for gold in 2024, and how accurate was that prediction?

“On January 2nd, I forecasted that 2024 would be a golden year for gold, and I was spot on. When the Fed cut rates by 50 basis points, gold prices soared just as we predicted in the Trends Journal. This isn’t rocket science—lower interest rates mean a weaker dollar, and that drives gold up. We called it.”

What impact will the ongoing interest rate cuts have on the U.S. dollar?

“The deeper the interest rate cuts, the weaker the dollar gets. As the dollar falls, gold prices rise. It’s the beginning of the death of the dollar. The only reason the dollar’s been strong is because of high interest rates, and now we’re seeing the end of that.”

What is the significance of the “office building bust”?

“We’re on the verge of a massive office building bust. Take Manhattan—office vacancy rates are at 24%, and properties once worth hundreds of millions are selling for peanuts. Look at that building on 15th Street in New York—sold for $320 million in 2006, and it went for $8.5 million recently. Banks are going to start collapsing as a result of this, and when they do, gold could hit $3,000 an ounce.”

What are Celente’s thoughts on the weaponization of the dollar?

“The U.S. is using the dollar as a geopolitical weapon, locking Russia out of the SWIFT system. Countries like Turkey are looking to join BRICS because they’re tired of U.S. hegemony. Just like the British Empire fell after World War I, the U.S. is headed in the same direction—war after war is killing the dollar. It’s only a matter of time.”

How does Celente address those who don’t care about geopolitics?

“Most people don’t care, and it’s a waste of time trying to convince them. My father used to say, ‘People have little minds, don’t waste your time.’ Samuel Adams said it best: ‘It does not take a majority to prevail, but an irate, tireless minority keen on setting brush fires of freedom in the minds of men.’ Focus on the people who care—facts don’t matter to the masses.”

What is something that mainstream analysts are missing?

“The office building bust, without a doubt. The mainstream media is completely ignoring the fact that office vacancy rates are skyrocketing, and this is going to take down banks. Tech companies aren’t bringing their workers back, and these buildings are non-convertible into apartments. We’re looking at an impending economic crisis.”

Is there anything that gives Celente optimism?

“A renaissance. After the Black Plague, Europe had the Renaissance, and I believe we need something similar today. We need to bring back art, culture, and the true meaning of the human spirit. That’s the only thing that gives me optimism—people striving to reach their highest potential.”

Where can listeners find Celente’s work?

“You can follow my work at Trendsjournal.com. It’s $2.56 a week, with no ads, and we cover everything—geopolitics, economics, high-tech, health, and more. We give you the facts from all over the world, and we don’t push any agenda. It’s about thinking for yourself and being prepared for what’s coming.”

The coupon code is MONEY METALS.

To subscribe, go to www.trendsjournal.com/