(Mike Maharrey, Money Metals News Service) With American consumers using credit cards to make ends meet month after month, and interest rates well over 20 percent, it’s only a matter of time before the spending spree comes to an end. After all, credit cards have this inconvenient thing called a limit.

And there are increasing signs that the American consumer may be near the end of that proverbial rope.

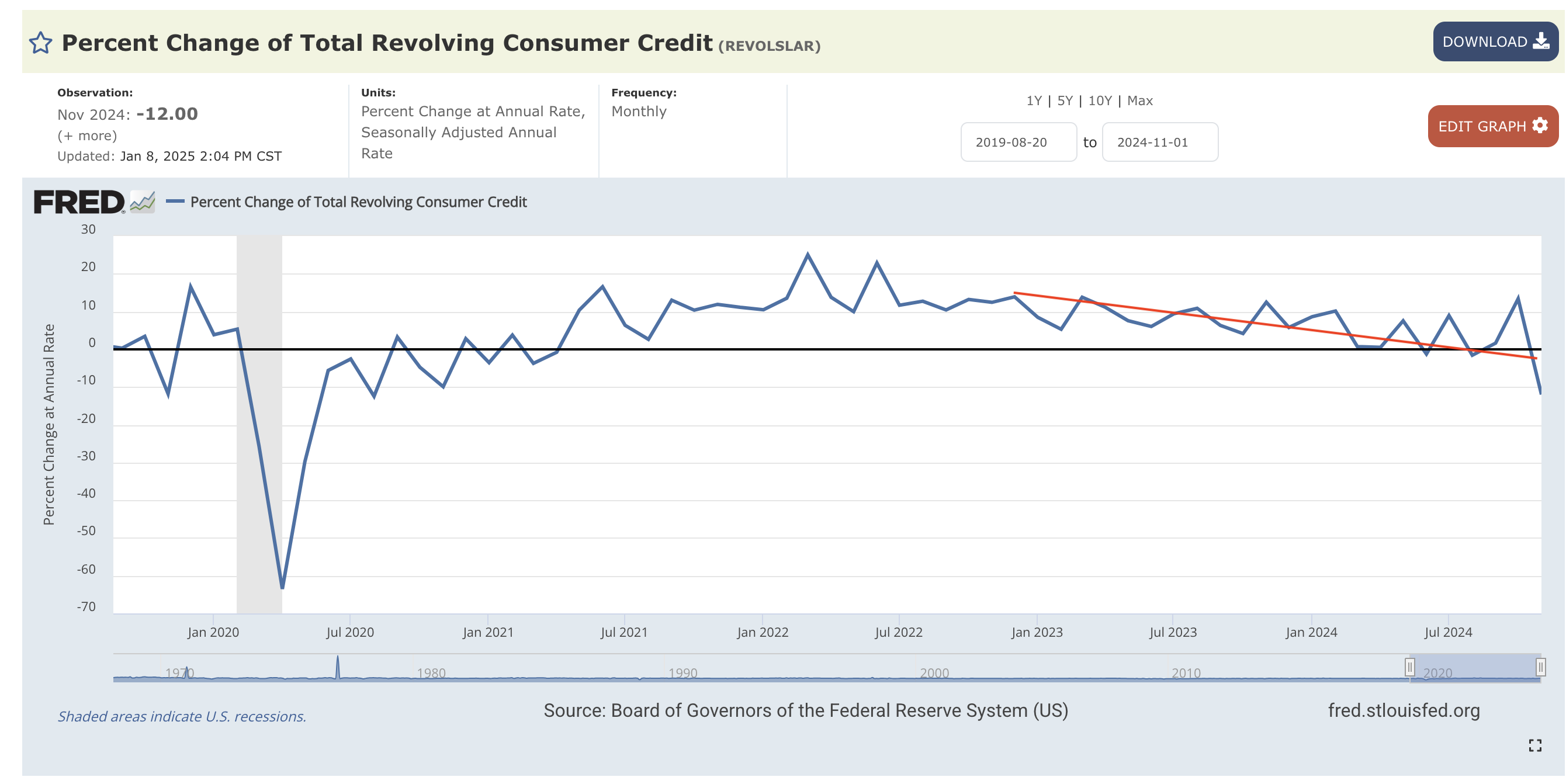

Credit card spending has generally declined for several months, and it fell off a cliff in November, according to the latest data from the Federal Reserve.

Consumer debt plunged by $7.5 billion in November, driven by a 12 percent drop in revolving credit – primarily made up of credit card balances.

Big drops in consumer debt often signal the early stages of a recession.

Despite the decline, Americans are still buried under over $5.1 trillion in consumer debt.

The Federal Reserve consumer debt figures include credit card debt, student loans, and auto loans but do not factor in mortgage debt. When you include mortgages, U.S. households are buried under a record level of debt. As of the end of the third quarter, total household debt stood at $17.94 trillion.

A Worrisome Trend

The sustained increase in credit card borrowing that began in May 2021, suddenly slowed in March of last year. Since then, we’ve seen revolving credit moving erratically up and down. Borrowing tanked in April, June, and August, and it was tepid again in September. There was a surge in borrowing in October, but it appears that was an outlier. The trend is a contraction in borrowing.

This is really bad news for an economy that depends on people buying stuff to keep limping along.

Revolving credit dropped by $13.7 billion in November. It was the biggest decline since early in the pandemic. This underscores the fact that credit card spending tends to plunge during a recession.

Americans currently owe $1.36 trillion in revolving debt.

The double whammy of rising debt and interest rates exacerbates the debt problem. The average annual percentage rate (APR) currently stands at 20.15 percent, with some companies charging rates as high as 28 percent. That’s only slightly down from the record high of 20.79 percent set in August.

Rates aren’t coming down much even with Federal Reserve rate cuts. According to an ABC News report, despite a full percentage point in rate cuts, credit card companies are charging a higher margin “to weather default risk, cover overhead costs and recoup profits, experts added.”

“Credit card rates are high, and they’re staying high,” Bankrate analyst Ted Rossman told ABC News.

And as Bloomberg noted, the central bank has indicated a slower pace of cuts in 2025.

“That means Americans will find only modest relief from high rates on credit-card accounts and other forms of borrowing.”

High credit card balances coupled with high interest rates are beginning to squeeze consumers, particularly those in lower income brackets.

According to New York Fed Q3 data, “Aggregate delinquency rates edged up from the previous quarter, with 3.5 percent of outstanding debt in some stage of delinquency.” It characterized delinquency rates as “elevated.”

Subprime credit card borrowers are struggling the most, with delinquency rates nudging upward by about 5.6 percent since the Federal Reserve began raising rates to battle price inflation.

Non-revolving debt, primarily reflecting outstanding auto loans, student loans, and loans for other big-ticket durable goods, increased by 2 percent in November. Non-revolving debt rose at a relatively tepid pace of under 2 percent for most of the year as consumers cut back on big-ticket spending to cover the increasing costs of day-to-day necessities.

Recession Warning Sign?

Historically, significant declines in revolving credit have indicated the U.S. economy is either on the brink of a recession or is already in the early stages of one.

Credit card spending is known as “forward consumption.” In other words, people use credit to buy things they can’t afford today, expecting that they will be able to pay it off over time in the future.

When consumers are concerned about their future economic prospects, they tend to roll back “forward consumption.” In effect, they hunker down to weather the coming economic storm.

The surge in credit card spending right after the pandemic was likely driven by optimism as the economy came out of lockdown. Americans spent the pandemic months saving and paying down debt. This was facilitated by multiple rounds of stimulus money.

But the picture was muddied by inflation. As prices began to rise, consumers were forced to turn to credit cards in order to make ends meet. Citigroup noted a shift in spending patterns as more consumers used credit cards to pay for “basic needs.” Analysts also noted a significant slowdown in “non-vital” purchases.

This slowdown was reflected in the ebbing growth of non-revolving credit.

In other words, credit card spending in recent months wasn’t so much about economic optimism and “forward consumption. People were using credit cards with 28 percent interest rates to pay for groceries.

But as already mentioned, credit cards have a limit and it appears that Americans might be getting close to being tapped out. Credit card spending is trending downward. This could be a sign that the “soft landing” narrative is a myth.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.