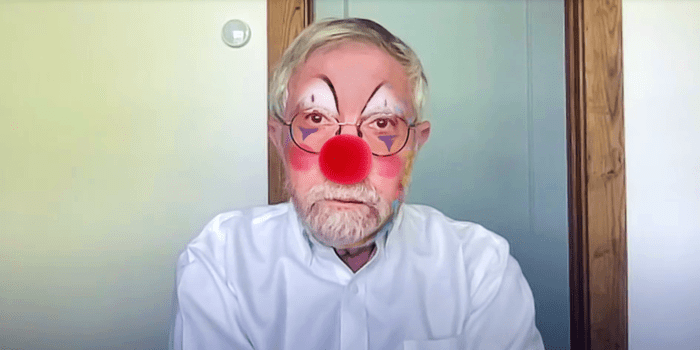

) Using heavily cherrypicked data on Thursday, Nobel Prize-winning economist and New York Times columnist Paul Krugman once again proved why neither the Nobel Prize nor the New York Times caries any sort of intellectial heft among people who actually know things.

“The war on inflation is over,” Krugman declared. “We won at very little cost.”

The war on inflation is over. We won, at very little cost pic.twitter.com/opumf3nEvL

— Paul Krugman (@paulkrugman) October 12, 2023

However, keen observers noted that the accompanying chart showing steady declines in the Consumer Price Index since May 2022 excluded food, energy, shelter and used cars.

It was not immediately clear what the data actually included.

This is fantastic news for all Americans who don’t need food, a place to live, or fuel & electricity.

(Note the subtitle on Krugman’s chart) https://t.co/Dor4BvAxjo

— Tim Murtaugh (@TimMurtaugh) October 12, 2023

Krugman, who won the Nobel Prize in 2008, stood to be proven doubly wrong as actual government data released Thursday in fact showed that consumer prices rose significantly in September, further undoing a trend of slowing inflation that had begun earlier this year.

The U.S. Bureau of Labor Statistics on Thursday released the latest CPI data, a key marker of inflation that tracks the cost of a range of consumer goods and services. That index rose 0.4% in September alone, a notable increase that is higher than months earlier this year.

“The index for shelter was the largest contributor to the monthly all items increase, accounting for over half of the increase,” BLS said. “An increase in the gasoline index was also a major contributor to the all items monthly rise. While the major energy component indexes were mixed in September, the energy index rose 1.5 percent over the month.”

Food prices rose as well.

“The food index increased 0.2 percent in September, as it did in the previous two months,” BLS said. “The index for food at home increased 0.1 percent over the month while the index for food away from home rose 0.4 percent.”

The rate of CPI had begun to slow until August, when it rose 0.6% in August, more than expected and the highest increase so far in 2023. Those figures flew in the face of hopes that inflation was on a steady trajectory to continue slowing, thus ending the recent years of high inflationary increase.

This increase comes after a series of interest rate hikes from the Federal Reserve, which have put interest rates on mortgages well over 7%. Those hikes, which have been paused at least for now, are meant to rein in inflation.

The price increases varied across different goods and services.

“The medical care index rose 0.2 percent in September, as it did in August,” BLS said. “The index for hospital services increased 1.5 percent over the month, and the index for physicians’ services was unchanged. The prescription drugs index fell 0.7 percent in September. The index for used cars and trucks fell 2.5 percent in September, after decreasing 1.2 percent in August. The apparel index declined 0.8 percent over the month, and the communication index was unchanged.”

The federal pricing data comes one day after the BLS released its Producer Price Index, another inflation marker that rose 0.5% last month. That increase was driven in large part because of gas prices, according to BLS.

Leaders in Washington, D.C. have taken fire for the increased inflation since federal debt spending, which has soared in recent years, is offset in part by printing money.

Experts now say that gas prices could rise because of the conflict between Israel and the terrorist group Hamas, especially if other world powers get involved in the fight.

“Historically, any tensions in the Middle East cause market volatility, and I don’t see this being any different especially if Israel takes direct action against Iran,” Daniel Turner, executive director of the energy workers advocacy group, Power the Future, told the Center Square.

Headline USA’s Ben Sellers contributed to this report.