(John Ransom, Headline USA) Billionaire Elon Musk has been dropping hints on Twitter that he’s going to issue a tender offer to the board for the shares of the company.

Elon Musk raised the prospect of launching a tender offer to acquire Twitter in a cryptic tweet following his $43 billion offer last week to acquire the social-media platform https://t.co/9l9ZrjFUTL

— The Wall Street Journal (@WSJ) April 20, 2022

A tender offer is made directly to the board of directors to buy the stock at a specified price over a period of time, likely raising the price from the $43 billion offer he currently has on the table, said the Wall Street Journal.

For Musk, it comes down to two variables:

The first is how much does Musk think the company is actually worth.

The other is whether Musk can secure the funding that he needs in order to make an offer.

His investment banker, Morgan Stanley, is reportedly reaching out to other banks to see if they can put together a financing package for the world’s richest man, reported the New York Times.

As of Thursday, Musk reported in documents filed with the Securities Exchange Commission that he had raised $46.5 billion in financing, according to The Hill.

To tease a potential tender offer, Musk offered a fill in the blank on Twitter to let people know what was on his mind.

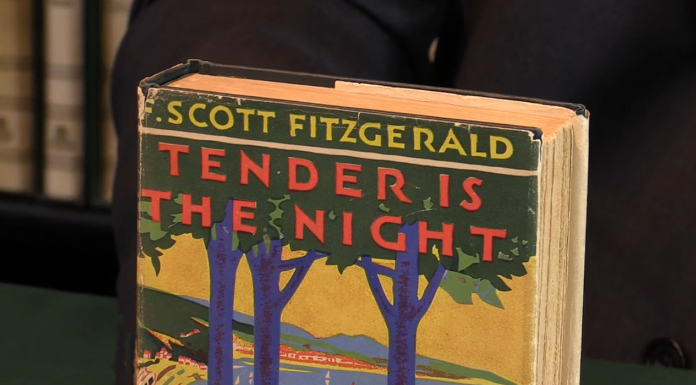

“_______ is the Night,” wrote Musk on Twitter, with “tender” being the missing word. The phrase, from John Keats’s poem “Ode on a Nightingale,” also is the title of a 1936 F. Scott Fitzgerald novel and a 1983 Jackson Browne song.

_______ is the Night

— Elon Musk (@elonmusk) April 20, 2022

At the same time, not content to just harass the Twitter board, Musk blasted the financial performance of Netflix, accusing the company of having a “woke mind virus,” which puts its liberal social agenda above the profitability of the company.

He called the subscription channel unwatchable.

The taunt led Yahoo Finance news anchor Dave Briggs, to call Musk “the Donald Trump of Twitter today.”

“Let’s just be frank, Trump is gone and Elon now, everything he tweets makes news,” aid Briggs on Yahoo Finance Live. “And now he’s also going after Netflix, kicking them when they’re down.”

Netflix stock has fallen out of bed the last few months, another victim of the belief that progressive votes can be turned into cash if companies are just progressive enough.

In November, the company reached a 52 week high of $700.99. Since then it’s lost 56% of its value closing at $226.19 on Wednesday, and continuing its plunge on Thursday.

The company announced in its first-quarter report for the fiscal year that it had lost 200,000 subscribers—the first time it had lost subscribers in a decade—and warned more losses were coming, said CNBC.

The single day losses wiped $50 billion off Netflix’s market capitalization.

As for Musk, the ubiquitous Tesla CEO also made headlines for warning at an investors’ meeting that the inflation caused by the Biden administration was significantly higher than what was reported.

And he even made a cameo appearance in the witness list of a high-profile lawsuit between actor Johnny Depp and his ex-wife, Amber Heard, who had previously dated Musk.