(Mike Maharrey, Money Metals News Service) Even with gold scaling record highs, Indian demand was robust in September as the festival season kicked off.

India ranks as the world’s second-largest gold market behind China.

Gold has hit record highs 48 times this year in dollar terms. The yellow metal was up by 11.6 percent in September and added another 7.9 percent through the first two weeks of October before correcting later in the month.

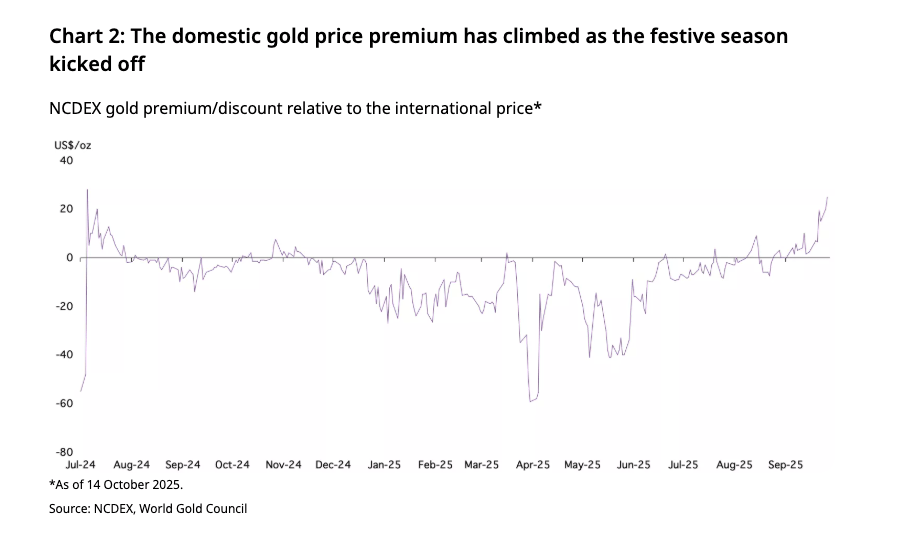

Prices rose even faster in rupee terms. By mid-October, the local price in India was at a $25 premium over international prices, signaling strong demand. This is the widest spread since July 2024, when the Indian government lowered the customs duty on gold and silver.

The higher gold price has created headwinds for Indian jewelers. However, investors have taken up the slack. Furthermore, consumers were in a buying mood as the fall festival season cranked up despite the higher prices.

According to the World Gold Council, the festival season started on a “positive note” with anecdotal evidence indicating healthy demand for both physical investment products and jewelry.

“Despite the pressure on gold jewelry consumption due to high prices and affordability, there has been a recent sales uptick, predominantly concentrated around wedding-related purchases and aligning with the wedding season.”

However, consumers are opting for lighter pieces and lower-karat jewelry. This means we will probably see lower retail volumes.

According to the World Gold Council, “Retailers’ revenues may benefit from a boost in jewelry sales, overall volume demand is bound to decline due to affordability constraints from high gold prices.”

While jewelry sales continue to feel pressure from the surging gold price, investment demand remains robust, with dealers reporting strong gold coin and bar sales.

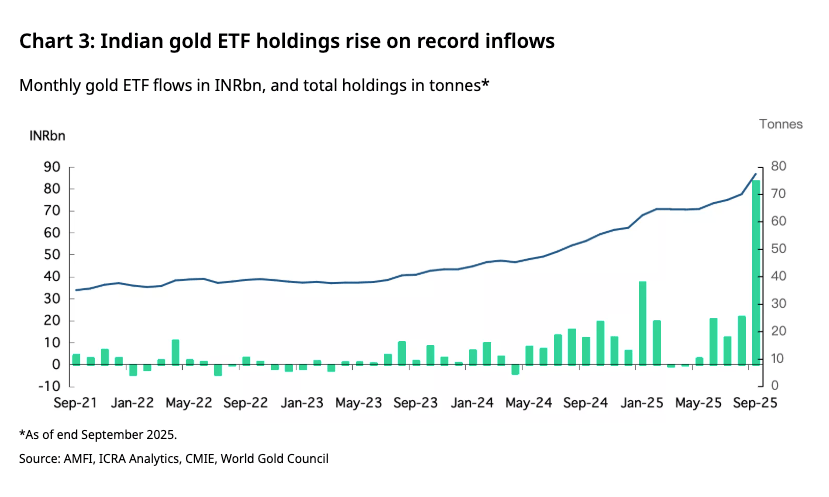

Meanwhile, India-based gold ETFs recorded the largest net inflows on record in September. Indian funds added 7.4 tonnes of gold totaling ₹83.6 billion.

According to the World Gold Council, “The sustained and unprecedented gold price rally has captured investor interest, likely fueling the surge in inflows; persistent safe-haven demand has also contributed.”

There was also a surge in new ETF clients, with 629,000 new accounts added in September. This pushed the total number of active folios to 8.7 million, a 33 percent increase since the start of the year.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself. ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

Traditionally, Indian investors have preferred physical metal, but there is growing interest in ETFs due to the convenience.

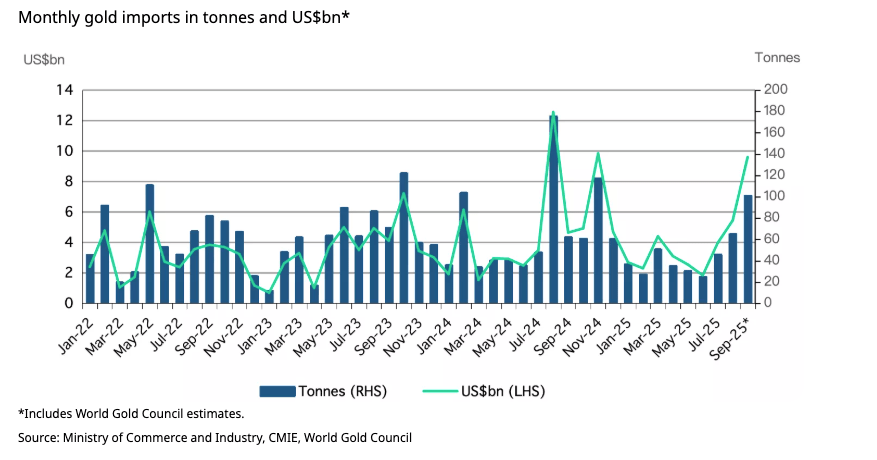

A sharp rise in gold imports reflected strong retail and investor demand. After hitting a nine-month high in August, September imports came in at $19.2 billion, a 77 percent month-on-month increase. The World Gold Council estimates the imports ranged between 100 and 104 tonnes, up from 65 tonnes in August.

According to the World Gold Council, “The surge reflects seasonal buying ahead of the festival season, supported by robust investment demand.”

Indians have a longstanding love affair with gold.

The yellow metal is deeply interwoven into the country’s marriage ceremonies, along with its religious and cultural rituals. Festival seasons typically boost gold demand.

Indians have long valued the yellow metal as a store of wealth, especially in poorer rural regions. Around two-thirds of India’s gold demand comes from beyond the urban centers, where large numbers of people operate outside the tax system. Many Indians use gold jewelry not only as an adornment but as a way to preserve wealth.

In the West, gold is generally viewed as a luxury item.

Not in India. Even poor Indians buy gold.

According to a 2018 ICE360 survey, one in every two households in India had purchased gold within the last five years. Overall, 87 percent of Indian households own some gold. Even households at the lowest income levels in India hold some of the yellow metal. According to the survey, more than 75 percent of families in the bottom 10 percent of income managed to buy some gold.

The yellow metal was a lifeline for Indians buffeted by the economic storm caused by the government’s response to COVID-19. After the Indian government locked down the country, banks tightened credit to mitigate the default risk. Unable to secure traditional loans, Indians used gold to secure financing. As Indians endured a second wave of lockdowns, many Indians resorted to selling gold outright to make ends meet.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.