(Molly Bruns, Headline USA) Sen. Josh Hawley, R-Mo., introduced a bill that, if passed, would forbid members of Congress from trading individual stocks.

The Preventing Elected Leaders from Owning Securities and Investments Act, otherwise known as the PELOSI Act, would necessitate that members move their private stocks into blind-trust accounts.

NEW: @HawleyMO announces the PELOSI Act 👀 pic.twitter.com/E9eXH5CXNd

— Abigail Marone 🇺🇸 (@abigailmarone) January 24, 2023

According to the Daily Caller, it would also forbid the immediate family members of congressional representatives from trading.

Upon failure to forfeit control of the stocks, representatives would relinquish their stocks to the U.S. Treasury.

“For too long, politicians in Washington have taken advantage of the economic system they write the rules for, turning profits for themselves at the expense of the American people,” Hawley said in a statement posted to Twitter.

“As members of Congress, both Senators and Representatives are tasked with providing oversight of the same companies they invest in, yet they continually buy and sell stocks, outperforming the market time and again,” he added.

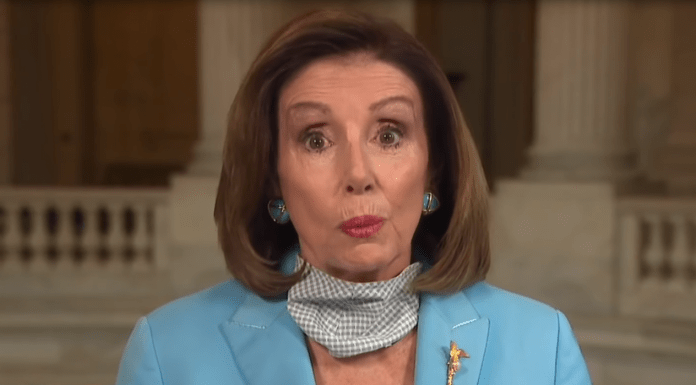

Former House Speaker Nancy Pelosi, D-Calif., opposed a similar bipartisan bill in the 117th Congress.

She also claimed that trading stocks allows members to “participate” in the “free market economy.”

Democrats delayed the vote and did not pass the legislation. However, Rep. Kevin McCarthy, R-Calif., who was House minority leader at the time, vowed that the issue would return in the 118th Congressional session, should he assume the speakership.

Pelosi is offender No. 1 for Congressional insider trading. Many of the stocks she and her husband, Paul, have a hand in are related to goings on in Congress.

For example, in 2022, the Pelosis invested in chip stocks days before Congress passed a bill providing subsidies to the manufacturers of semiconductors, giving a boost to the market.

There is even a Twitter account dedicated to tracking all of the stocks the Pelosis stock trading.

BREAKING🚨:

The DOJ has officially opened up a lawsuit against Google to break up its Ad Technology Monopoly

Pelosi sold $3 Million dollars worth of Google just four weeks ago

Wild.

— Nancy Pelosi Stock Tracker ♟ (@PelosiTracker_) January 25, 2023

Several members of Congress own outperforming stock portfolios, according to analysis site Unusual Whales.

Pelosi’s stock ended the 2022 fiscal year 19.8% down, partially because she was forced to divest in her chips stocks at a $340,000 loss after public outrage over the scandal.

🚨BREAKING🚨

I have just released the full trading report on politicians in 2022.

Despite 2022 being the worst market since 2008, both Democrats & Republicans beat the market.

Many politicians individually beat the market.

And many made unusual trades resulting in huge gains. pic.twitter.com/qDWIJB2spk

— unusual_whales (@unusual_whales) January 3, 2023