Nearly two dozen Republican attorneys general are fighting back against the recently passed COVID-19 stimulus bill, saying it violates the Constitution and takes power away from the states.

At issue is a stealthy addendum to the $1.9 trillion American Rescue Plan that prevents states from lowering taxes if they accept the federal funds.

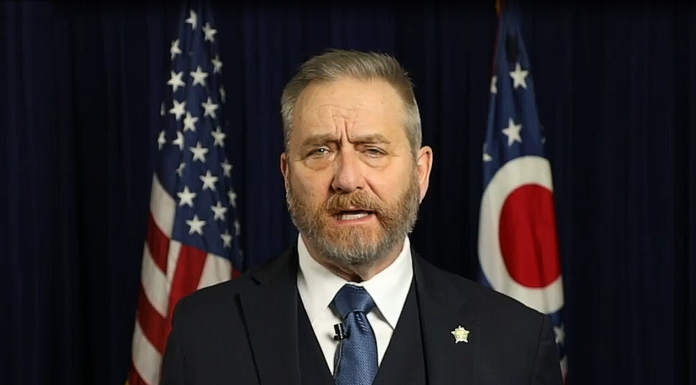

“It basically mandates that the states maintain their existing tax structure during the pendency of this spending bill,” Ohio Attorney General Dave Yost told the Columbus Dispatch.

“There’s nowhere in which the federal government has the right to dictate tax policy to a state,” he said.

Yost, a Republican, filed a suit Wednesday that asks for a preliminary injunction against this provision in the law.

While the relief package rewards profligate Democrat states for their fiscal insolvency with billions in bonus cash, the tax mandate appears to target fiscally conservative states with an unwelcome dilemma, said the filing.

“[T]hey can have either the badly needed federal funds or their sovereign authority to set state tax policy. But they cannot have both,” it said. “In our current economic crisis, that is no choice at all. It is a metaphorical ‘gun to the head.'”

The recently passed stimulus bill also includes language that could allow the federal government to take back funds if states violate the tax rules, even if the money is already spent.

“It’s a blatant violation of federalism,” Yost told NBC News. “Congress is without authority to enact this kind of law.”

On Tuesday, 21 other red-state attorneys general sent a letter to Treasury Secretary Janet Yellen calling the tax provision “the greatest attempted invasion of state sovereignty by Congress in the history of our Republic.”

The letter asked Yellen to confirm that certain provisions of the law “do not attempt to strip States of their core sovereign authority to enact and implement basic tax policy.”

The Treasury Department defended the bill’s language in a statement to The Hill, but the state governments will likely want more precise and official language before moving forward.

“The law does not say that states cannot cut taxes at all, and it does not say that if a state cut taxes, it must pay back all of the federal funding it received,” said the statement. “It simply instructed them not to use that money to offset net revenues lost if the state chooses to cut taxes.”