(Lau Vegys, Money Metals News Service) 102% – That’s how much silver has rallied since it bottomed during the pandemic crash in March 2020.

If you haven’t been following silver, this may come as a surprise. After all, gold’s been getting most of the attention after it hit new all-time highs, surging past $2,400 an ounce earlier this year.

But the poor man’s gold still has a significant upside from its current levels. And I’m not the only one saying that.

Just yesterday, I read an article featuring Jim Rogers. As you may know, Rogers is a legendary investor, billionaire, and bona fide international man who has successfully completed two round-the-world trips and visited 116 countries. A longtime friend of Doug Casey’s, he is someone worth paying attention to.

In said article, Jim Rogers said something that I found quite interesting. Here’s the quote:

I have some gold, I want to buy some more gold, too. If I were buying one today, I would buy silver. Because you know silver is cheaper. I think silver is down 40% from its all-time high. Gold is near its all-time high. So, I would prefer to buy silver now. I bought some silver yesterday. I hope I buy some more if they go down.

Jim Rogers is, of course, absolutely correct that gold has not yet hit its all-time high when adjusted for inflation.

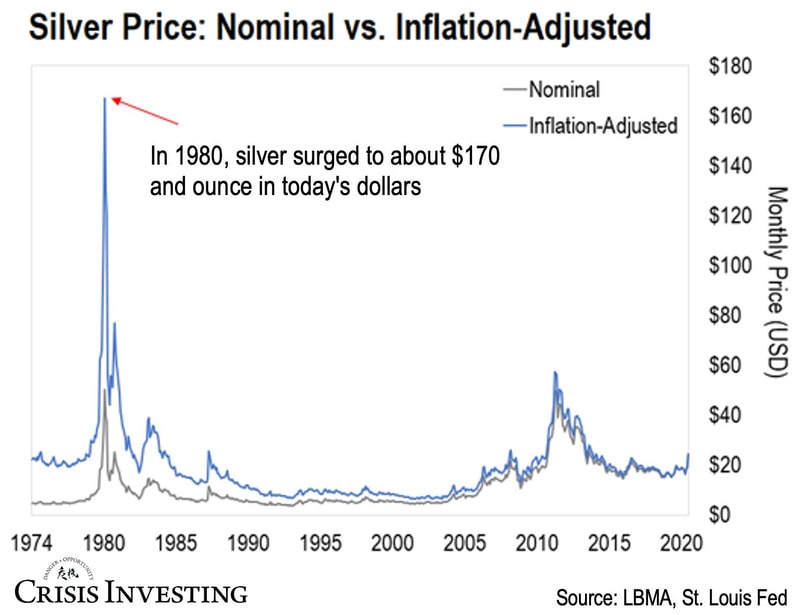

At any rate, silver’s discount relative to gold becomes even more obvious when you look at its price in real terms. In fact, its current price of $30 per ounce is 48% below its 2011 high of $57.11, adjusted for inflation. But that’s not even the highest price silver has ever reached. Just take a look at the next chart.

Back in 1980, silver shot up to $50.36, which would be about $170 in today’s dollars.

Put another way, silver would need to rise 5.8 times from its current price to match its inflation-adjusted peak.

This makes it easy to see why Jim Rogers is so bullish on silver right now. But let’s look deeper to understand why his silver versus gold investment thesis holds even more weight than it appears at first glance.

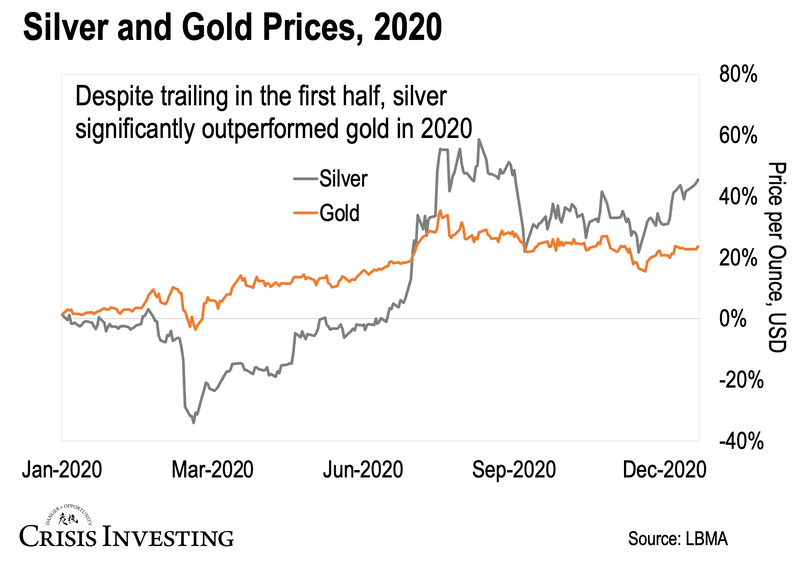

Many people don’t know, but silver tends to trail behind gold in performance. That’s why it didn’t perform as well as gold in both 2022 and 2023 but surpassed it in 2024. And historically, when silver catches up to gold, it tends to blow it out of the water. Just take a look at the chart below, showing silver and gold performance during the pandemic year of 2020.

As you can see, silver trailed behind gold for much of the year, only to decisively overtake it in July/August. By year-end, silver had significantly outperformed gold, gaining 45% compared to gold’s 24%.

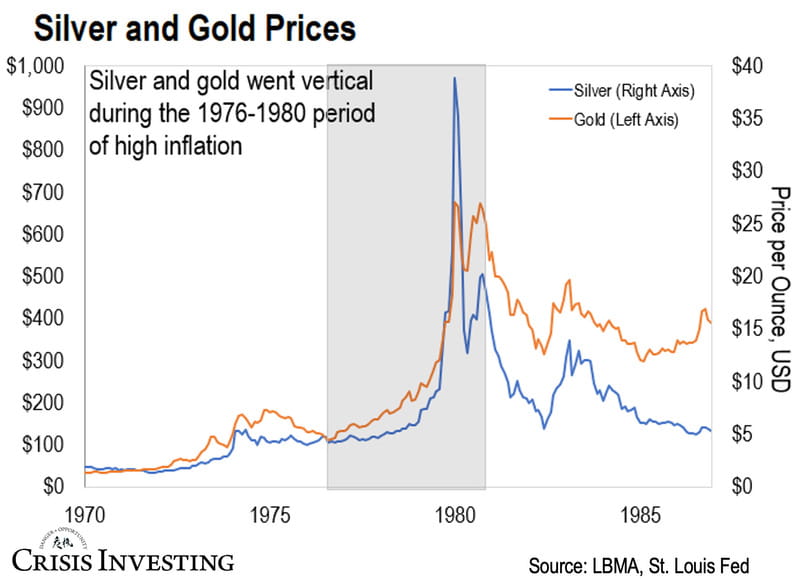

But let’s rewind further back in time so you don’t think I’m cherry-picking… to the late 1970s and early 1980s when both gold and silver reached their all-time highs in real terms.

During those years, we had high inflation, geopolitical tensions, and economic uncertainty – much like today. So, investors flocked to gold and silver as safe-haven assets. In the next chart, you can see how both metals shot up during that period.

Gold gained 415%… with silver returning more than double that – 857%. And it all followed the same pattern: starting off behind gold, silver gradually caught up and surged ahead as the world entered the final year of the 1970s.

Now, there are several reasons why silver tends to start slower but ends up outperforming gold historically… and why I think it’ll happen again this time around.

First, like gold, silver is a precious metal. The word literally means “money” in dozens of languages, and that’s no coincidence. But unlike gold, about 80% of silver is actually mined as a byproduct of industrial metal mining or gold itself. So, the silver supply doesn’t react as directly – or as quickly – to higher prices, like gold usually does.

Then there’s the size of the silver market.

Doug Casey: The market dynamics of silver are very different from those of gold in a number of ways. One important consideration for an investor is that silver is a much smaller market, partly because an ounce of gold is worth about 80 times more than an ounce of silver. When people get interested in it, it tends to move explosively.

Doug is right on the money. The next chart illustrates just how small silver is compared to other metals. Take a look.

You can see that the silver market is only one-tenth the size of the global gold market. It’s even smaller than the zinc and nickel markets.

With a market this small, it only takes a small amount of money to push the price around. And large amounts of money can dramatically impact prices. This makes gold’s more volatile cousin prone to sharper upside explosions.

Now, If you’re looking to invest in silver, it’s crucial to know that not all bets on the silver price are created equal.

Doug Casey always recommends holding precious metals in your long-term investment portfolio. But he also recommends investing in precious metal stocks for even more profits.

That’s because miners tend to do better than the physical commodities when prices rise, as their extraction costs become cheaper. This gives investors more leverage for higher profits… but it also means greater risk.

This article was originally published by the Silver Academy Substack.

Lau Vegys is a financial analyst whose work supports Rogue Economics’ publications. He previously wrote for Crisis Investing, The Casey Report, International Man, and Casey Daily Dispatch, among other newsletters. Lau has an extensive track record of investing in stocks, cryptocurrencies, and financial derivatives. He specializes in spotting megatrends in sectors like precious metals, mining, and tech.