(Peter C. Earle, Money Metals News Service) Gold has surged to a new all-time high, breaking through $2,911.72 per ounce on a thick mix of domestic and foreign uncertainty, inflation concerns, and a shifting macroeconomic landscape. While bullion has historically served as a safe-haven asset, the latest rally is not merely a reaction to market turbulence but instead to a confluence of economic and financial factors that reinforce its role in global portfolios.

Gold price per oz, USD (Jan 2015 – present)

One of the primary catalysts behind gold’s latest rally is the renewed threat of tariffs on steel and aluminum, announced by President Donald Trump over the weekend. Those tariffs, along with potential levies on the growing bloc of BRICS nations if they move away from the dollar usage, have heightened global economic uncertainty.

Additionally, US-China trade wrangling is continuing to push global capital toward gold. Since the February 2022 decision by the Biden administration to eject Russia from the international SWIFT payments system, many nations, including China, have been expanding their gold reserves in a strategic shift away from reliance on the US dollar.

In January alone, China’s central bank added to its gold holdings for the third consecutive month, and a newly approved pilot program will allow Chinese insurers to invest up to 200 billion yuan ($27.4 billion) directly in bullion. That development alone marks a significant demand-side development, possibly supporting sustained price appreciation.

Although higher interest rates traditionally weigh on non-yielding assets like gold, Federal Reserve policy has also played a role in supporting bullion prices.

Fed Chair Jerome Powell’s testimony this week is expected to reaffirm that although the US economy remains resilient, rate cuts are unlikely in the near term. This would typically be bearish for gold, as higher interest rates raise the opportunity cost of holding gold, but the prevalence of other factors in the economy suggests otherwise.

Indeed, a key factor keeping gold demand strong is uncertainty about the trajectory of inflation.

While the Federal Reserve is proceeding with its data-focused aims to bring inflation down to its 2 percent target, the University of Michigan consumer sentiment survey indicates that inflation expectations remain elevated. Investors are hedging against the risk that persistent inflation could continue to erode the purchasing power of fiat currencies, making gold a more attractive store of wealth.

There are technical factors boosting the gold price, as well. Exchange-traded funds (ETFs) backed by physical gold have seen significant inflows in recent weeks. The SPDR Gold Shares ETF (GLD) rose 1.7 percent on Monday alone, extending its six-week winning streak — the longest since the COVID terror in 2020.

Year-to-date, the ETF is up 10.8 percent, far outpacing the S&P 500’s 3.1 percent gain. Both institutional and retail investor interest in gold as a defensive asset is elevated.

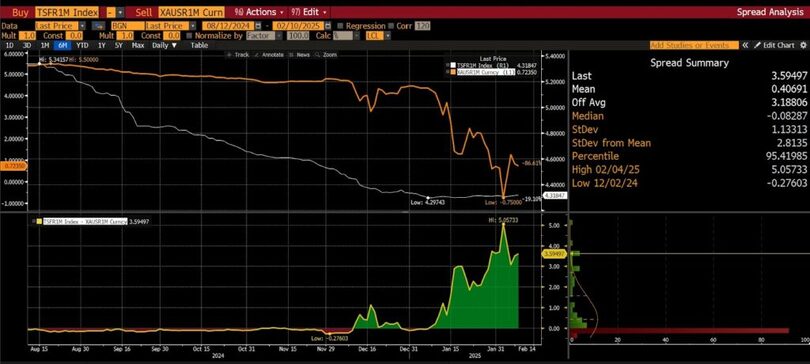

Gold lease rate (August 2025 – present)

Another important yet often overlooked factor in gold’s recent price action is the gold lease rate, which recently surged above 5 percent. Lease rates are the cost for borrowing gold in the London bullion market: as they rise, they reveal heightened demand for physical gold relative to available supply.

Although the rate has eased back to 3.5 percent, that level is still vastly higher than has been seen in many years. Furthermore, the premium for gold futures over spot prices is increasing as traders reposition holdings to evade US tariffs. There is a growing preference for securing gold in US markets, where trade policies are likely to have a more pronounced impact on supply chains.

Also, while gold has been rallying, US equities have experienced heightened volatility, although the S&P 500 remains range-bound between 6000 and 6100 with the VIX term structure flattening and VVIX (volatility of volatility) near 2025 lows hints at complacency. The likelihood that some news or announcement will drive equity indices out of their narrow range is an additional factor in gold’s record ascent.

On the topic of macroeconomic drivers, Wednesday, February 12th, will see the release of the January Consumer Price Index (CPI) report. If inflation data comes in hotter than expected, increased demand for gold as an inflation hedge may result. If, on the other hand, the CPI surprises to the downside, the Fed may reassess its policy stance, and substantial downward pressure on gold prices may ensue.

While trade policy remains the dominant theme in gold markets, investor sentiment toward inflation, interest rates, and equity volatility will continue to shape bullion’s trajectory. Given the combination of geopolitical risk, central bank buying, and strong ETF inflows, gold’s bullish momentum appears well-supported in the near term.

Whether the current rally is the beginning of an extended run or simply a fear-driven speculative surge depends upon how economic and policy developments unfold. In any case, gold’s many-millennia status as the ultimate safe-haven asset remains firmly intact.

Originally Published on AIER’s The Daily Economy.

Peter C. Earle is an economist who joined AIER in 2018. Prior to that he spent over 20 years as a trader and analyst at a number of securities firms and hedge funds in the New York metropolitan area. His research focuses on financial markets, monetary policy, and problems in economic measurement. He has been quoted by the Wall Street Journal, Bloomberg, Reuters, CNBC, Grant’s Interest Rate Observer, NPR, and in numerous other media outlets and publications. Pete holds an MA in Applied Economics from American University, an MBA (Finance), and a BS in Engineering from the United States Military Academy at West Point.