(Brien Lundin, Money Metals News Service) Gold lost its gains as today’s stock sell-off gained steam, leading to a liquidity crunch and margin calls. Still, the yellow metal is weathering the turmoil very well so far.

A couple of days ago I predicted that we had another week or two of sideways trading before gold was ready to take off again.

On Wednesday morning, I thought that the yellow metal wasn’t waiting any longer — the U.S. stock market was in the midst of a swan dive, Treasury yields and the Dollar Index were lower, but gold, silver, and mining stocks were trading nicely higher.

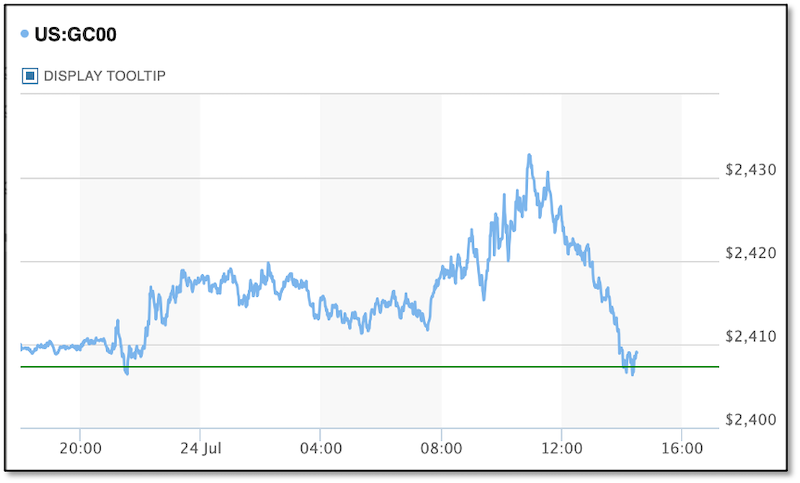

Since then, gold has given up most of its gains, and it’s not hard to see why. Here’s today’s gold chart, basis the active futures contract:

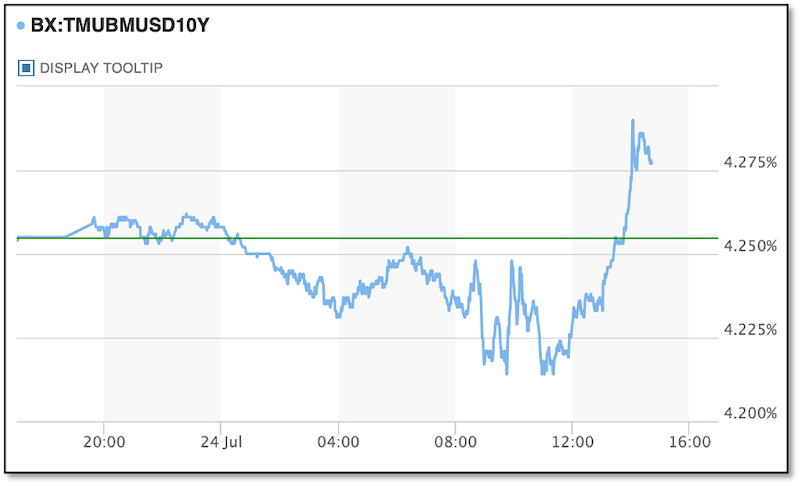

And here’s today’s chart of the 10-Year Treasury yield:

As you can see, gold was up as much as $25 before a spike in Treasury yields sent it lower.

As to what’s driving yields higher, it seems that as the U.S. equity sell-off gained steam today, margin calls spawned a liquidity crunch that forced investors to begin selling whatever they could…with Treasuries and gold topping the list.

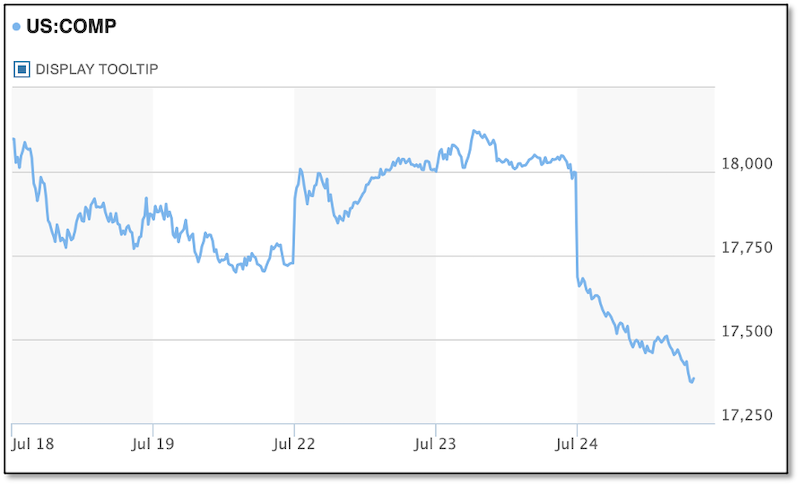

For some context on how the stock sell-off hit hard and gained momentum, look at this five-day chart of the Nasdaq:

With a drop of 3.4% as I write, this is the worst day for the Nasdaq since 2022.

Is this the beginning of a new stock-market crash — the latest financial crisis that will force the Fed to not only begin rate cuts but urgently drive rates lower?

We’ll see soon. And while it was encouraging to see gold rising as everything else was falling early on in today’s session, it’s important to note that everything will get hit, and hard, in a true liquidity vacuum.

Good luck trying to trade that phenomenon. My advice is, if metals and mining stocks go on the bargain rack, take advantage of it to buy as much as you can.

Because the inevitable rescue plan by the Fed and other central banks will quickly send these assets catapulting higher.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.