(Mike Maharrey, Money Metals News Service) The gold-silver ratio has surged to over 90-1. This indicates that silver is extremely underpriced from a historical perspective.

In other words, silver is on sale.

The last time we saw a gold-silver ratio over 90-1 was in the early days of the pandemic lockdowns.

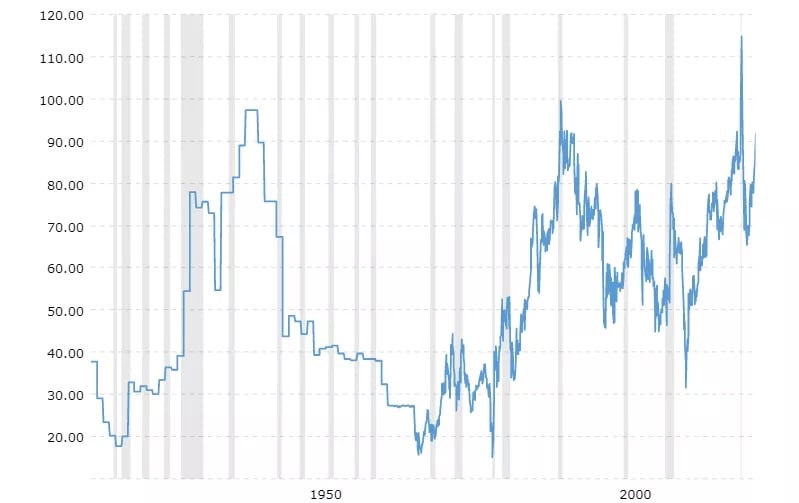

In the modern era, the gold-silver ratio has averaged between 40-1 and 60-1. When it rises far above that level, it tends to snap back quickly to that mean.

You can see the phenomenon in this cart. Although the ratio has run at a higher average since the U.S. government demonetized silver in 1964, we still see sharp returns to the mean when the gold-silver ratio gets out of whack.

This typically happens when the price of silver rallies to close the spread. For instance, the gold-silver ratio fell to 30-1 in 2011 after rising to over 80-1 during the money creation of the Great Recession in the wake of the 2008 financial crisis.

In a more recent example of this snap-back, the gold-silver ratio set a record of 123-1 as Covid hysteria gripped the world and then plunged to around 60-1 as central banks around the world cranked up the money creation machine to cope with governments shutting down economies.

From a historical perspective, when you see gold-silver ratios well above the historical average, it tells you that silver is underpriced compared to gold and there is a strong possibility that silver will go on a bull run to close that gap. Historically, this has often happened in the midst of a gold bull rally, with silver outperforming gold. (Of course, past performance does not guarantee future results.)

Some mainstream analysts are projecting silver will outperform gold in 2025 even as the gold bull market marches forward.

Saxo Bank head of commodity strategy Ole Hansen recently said silver’s dual role as a monetary and industrial metal creates the potential for a strong upside in the coming year with the gold-silver ratio falling into the 70s.

He notes that in 2024, “increased industrial demand helped create physical tightness in the silver market. Sectors such as electronics and renewable energy, particularly photovoltaic (solar) technologies, significantly contributed to this surge.”

Based on preliminary data from the Silver Institute, industrial demand set a record in 2024, topping 700 million ounces for the first time. With mine output declining, the market will likely see its fourth consecutive supply deficit.

“The expectation of sustained industrial demand is likely to keep silver in a supply deficit into 2025, potentially deepened by a pick-up in ‘paper’ demand through exchange-traded funds,” Hansen said.

If Hansen is correct, that would still leave room for further upside in 2026 based on the historical trajectory of the gold-silver ratio.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.