(Mike Maharrey, Money Metals News Service) Last week was a wild one for investors, with stocks whipsawing in a storm of volatility and uncertainty. When the dust settled, gold was the last safe haven standing.

Spot gold opened the week just below $3,040 an ounce. During Monday’s stock rout, the yellow metal plunged below $3,000 and tested $2,950.

That was as low as gold would go.

On Tuesday, gold stabilized and traded in a range between $2,980 and $3,017.

It’s not unusual for gold to fall sharply in the early stages of a stock market selloff. Because of its liquidity, traders often cash in gold to cover short positions in equities.

On Tuesday evening, gold started to rebound, climbing to $3,073 Wednesday morning before President Trump surprised everybody by announcing a 90-day reprieve on reciprocal tariffs.

Gold rebounded with other assets on the news. The rally ran out of steam in the stock market on Thursday, but gold kept climbing. By Friday, gold was at a new record, closing at $3,251.

Other safe-haven assets didn’t fare as well.

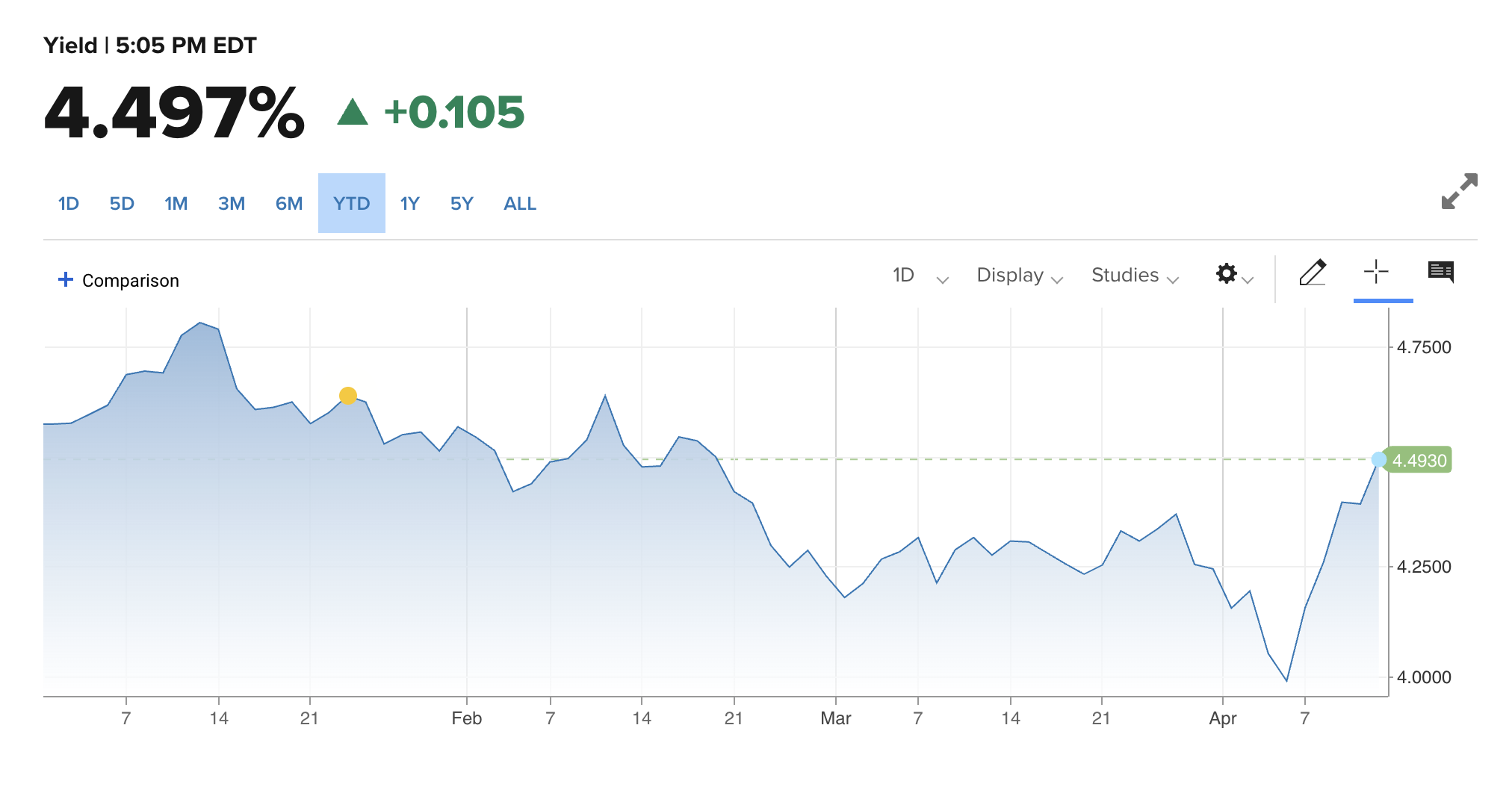

Bonds initially rallied early in the week, with yields on the 10-year Treasury dropping below 4 percent. However, bonds sold off later in the week even as stocks struggled after the brief Trump announcement rally. By Friday afternoon, the 10-year Treasury yield was at 4.49 percent. That was the highest level since February.

Rising yields signal a lack of demand for Treasuries. That’s bad news for a government depending on borrowing to maintain its high-spending ways.

Meanwhile, the dollar index plunged. The ICE Dollar Index closed at 99.78, the lowest level since April 2022.

This was not business as usual during a time of stock market weakness and general market instability. As CNBC noted, “Treasuries and the dollar typically benefit from flight-to-safety environments, a function of the U.S.′ historical financial strength.”

That happened early in the trade war, but it quickly unraveled.

It’s also very unusual for gold to rally when bond yields are rising. This underscores the fundamental strength of the yellow metal in the current market environment.

Bannockburn market strategist Marc Chandler called the bond selloff “severe” in an interview with Yahoo Finance, adding that we could be seeing a brewing “sell America” trade.

“People are concerned that maybe we’re seeing a capital strike against the U.S., where large pools of capital are selling U.S. assets and taking their money home.”

Deutsche Bank strategist George Saravelos also worried out loud about the trajectory of the dollar.

“The market is re-assessing the structural attractiveness of the dollar as the world’s global reserve currency and is undergoing a process of rapid de-dollarization. Nowhere is this more evident than the continued and combined collapse in the currency and U.S. bond market as this week comes to a close.”

Minneapolis Federal Reserve Bank President Neel Kashkari noted that a falling dollar in the midst of a trade war was not expected.

“Normally, when you see big tariff increases, I would have expected the dollar to go up. The fact that the dollar is going down at the same time I think lends some more credibility to the story of investor preferences changing.”

And what about gold?

“To the moon,” Chandler said.

“Many are talking about the capital strike against the U.S. and the demise of the greenback. Market turmoil and sharp drop in the dollar offsets the higher rates and drives the yellow metal to record levels. It is hard to talk about resistance, but the next target may be $3300, and $3500 in the slightly longer-term.”

Adrian Day Asset Management president Adrian Day agreed with the bullish sentiment, saying he thinks the trajectory of the yellow metal will continue upward.

“The latest pullback, like all the other recent pullbacks, was very short-lived. Gold clearly has momentum, with many buyers in the wings.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.