Gold prices closed Friday at a 7-week high above $1,950/oz.

The monetary metal also appeared to break out of a larger consolidation pattern that formed after all-time highs were hit in August.

But with news today of a vaccine breakthrough, gold has fallen back below its breakout point. It is now retesting support in the $1,865 range and could consolidate for a few more weeks, though in these volatile market conditions another plunge lower or a whipsaw breakout higher is possible at any time.

If it rallies back to $1,950 this week, however, traders expect it to break above $2,000/oz this month and make a run to new all-time highs by the end of the year.

That outcome would likely be associated with a falling U.S. dollar. The Dollar Index plunged 2% last week and is now on the verge of breaking down to new lows for the year.

Global investors apparently think a Biden administration would pursue weak dollar policies.

If it also ramps up regulations and threatens to impose taxes that scare investors, then safe-haven demand for gold and silver could accelerate dramatically.

For now, though, Donald Trump is still in office and hasn’t made any plans to move out. Uncertainty remains about the final election results and what kind of transition, if any, will take place.

One thing that will remain constant is the Federal Reserve.

Its printing press will keep running and its unelected Board of Governors will remain firmly in power.

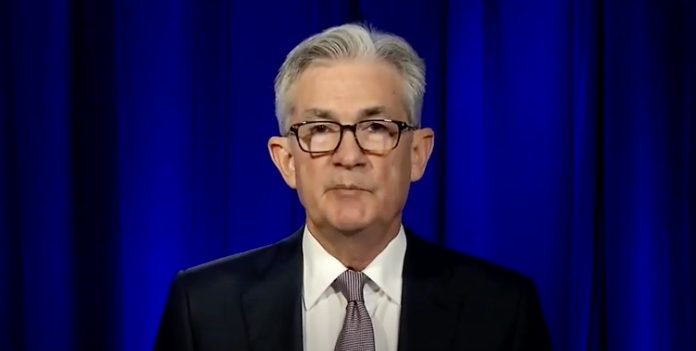

Powell to Continue Serving as Unelected ‘Stimulator in Chief’

President Donald Trump has not conceded defeat, and not a single state has certified election results – nor will any do so for a while.

In key battleground states, Biden has eked out a narrow lead – enough to put him over the top in the electoral college, according to the establishment media.

However, the Trump campaign insists there are legal votes still left to be counted and illegal votes still subject to being tossed out.

Control of the U.S. Senate remains up for grabs with two Georgia races headed for a runoff. Odds favor Republicans capturing at least one of them to retain a small majority in the Upper Chamber.

Divided government would mean more gridlock when it comes to passing major legislation.

Failure to come to an agreement on a new fiscal stimulus package passes the buck to the Federal Reserve.

Fed Chairman Jerome Powell stands ready to assume the role of stimulator in chief.

During remarks last Thursday, Powell said, “Further support is likely to be needed from fiscal and monetary policies.”

He added, “With inflation running persistently below 2%, we will aim to achieve inflation moderately above 2% for some time.”

With the unlimited ability to purchase assets by the trillions and no means or willingness for Congress to rein him in, Powell could single-handedly trigger an inflation outbreak or currency crisis during the next presidential administration…Original Source…

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.

Stefan Gleason is President of Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of the University of Florida, Gleason is a seasoned business leader, investor, political strategist, and grassroots activist. Gleason has frequently appeared on national television networks such as CNN, FoxNews, and CNBC and in hundreds of publications such as the Wall Street Journal, The Street, and Seeking Alpha.