(Peter St. Onge, Money Metals News Service) In case you thought anybody in Washington was driving this thing, they are not.

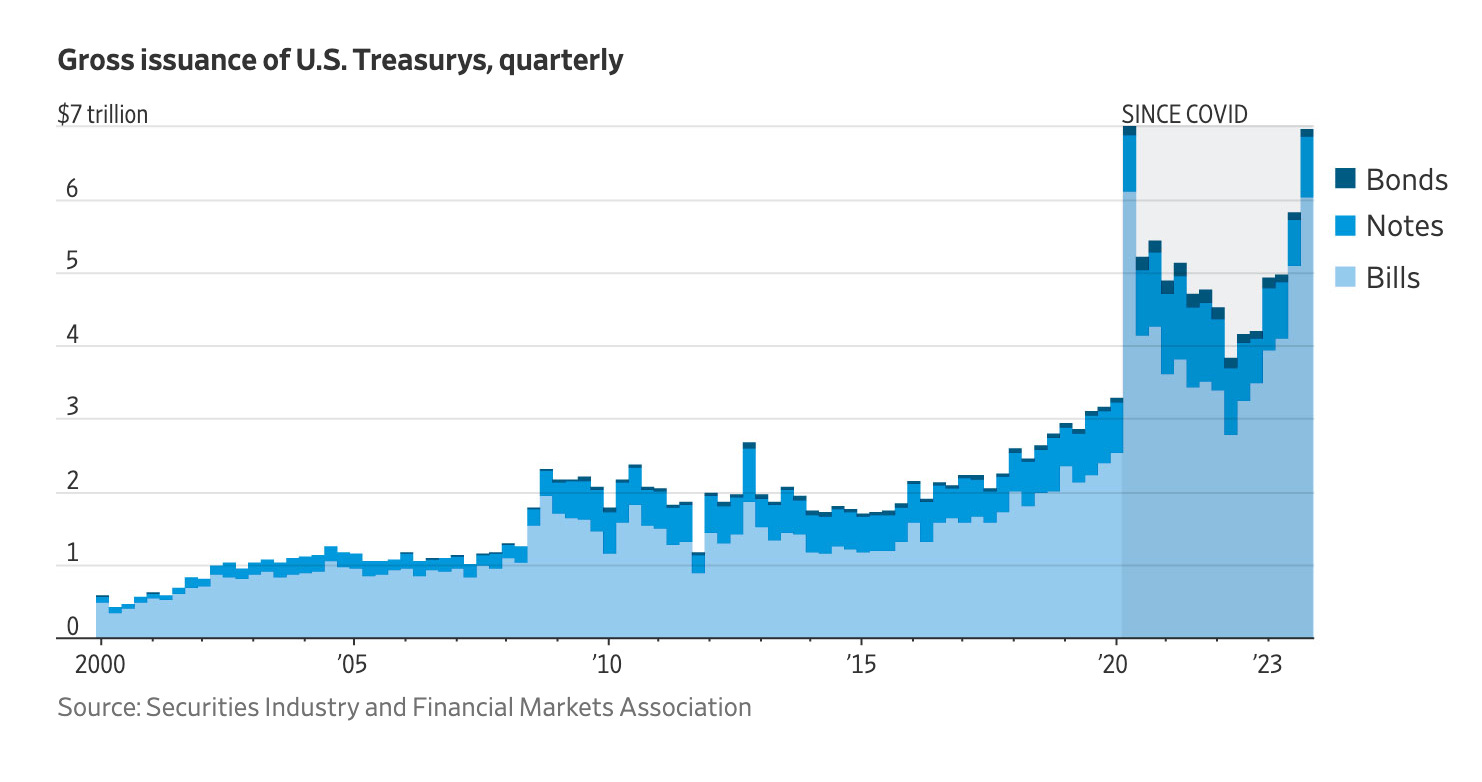

It’s official: the Department of Treasury is now issuing debt at pandemic levels. It’s worth noting the pandemic record was double the previous record, which had stood for 231 years.

In raw numbers, the latest numbers for Q4 2023 show Treasury issued $7 trillion in new debt. For the entire year, it came to $23 trillion.

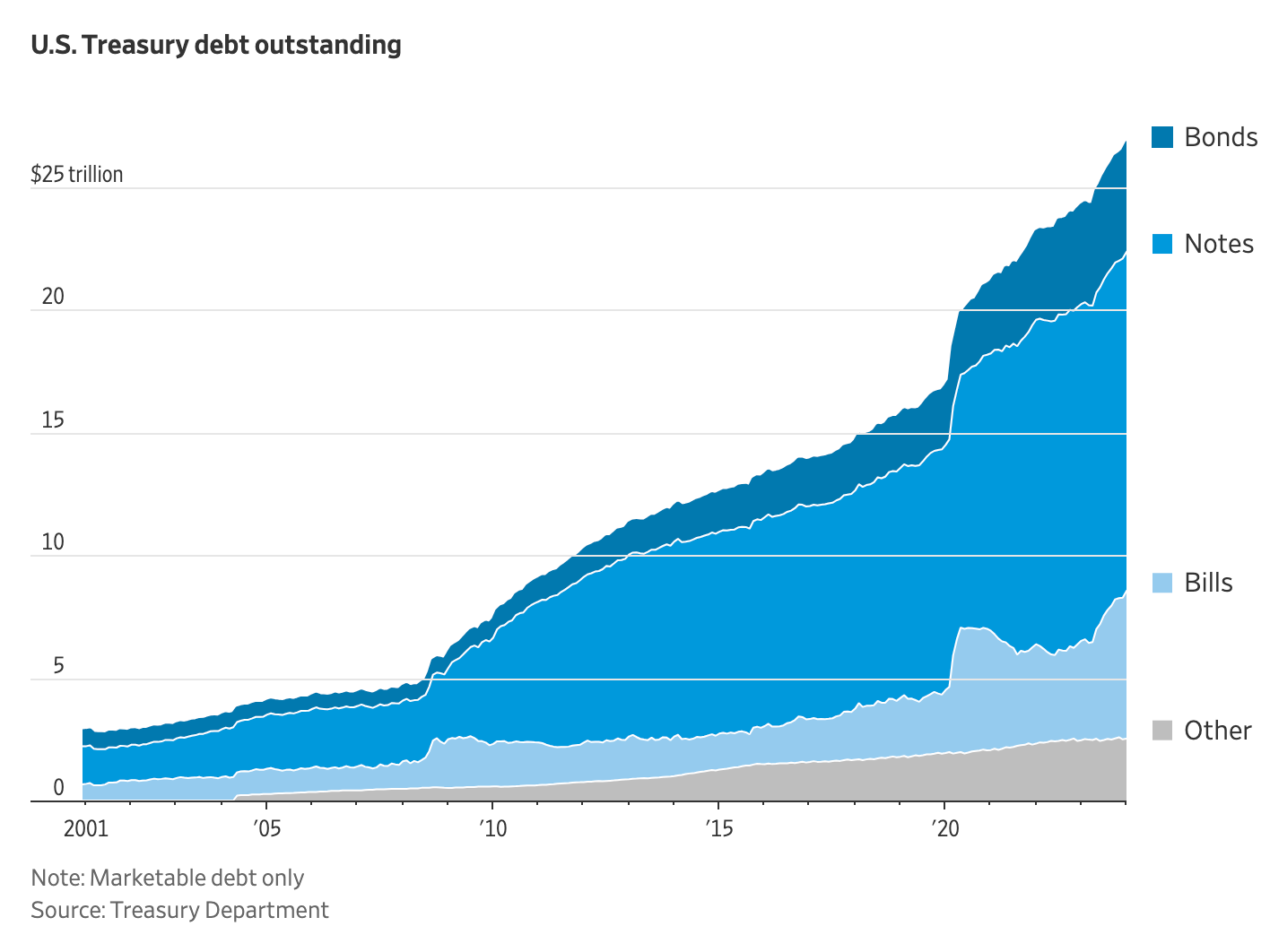

This has bloated the Treasury market to $27 trillion — up 60% since the pandemic. In other words, one-third of Treasuries have fresh ink on them. And it’s up roughly sixfold since the 2008 crisis.

Meaning if we hit another crash, it could be a lot bigger.

At this point, federal debt is rising by $1 trillion every 90 days, and US government spending as a percent of GDP is at World War 2 levels.

Given we’re not in a World War — in theory — nor are we in a pandemic, why so much debt? Easy: it’s buying growth.

Or as Balaji Srinivasan puts it: “The economy isn’t real. It’s propped up by debt. They will fake it till they break it.”

Even the Wall Street Journal, which loves debt, is sounding the alarm, writing that rapid growth in debt often ends badly, and given the enormous size and alleged safety of the Treasury market any “instability” could be catastrophic.

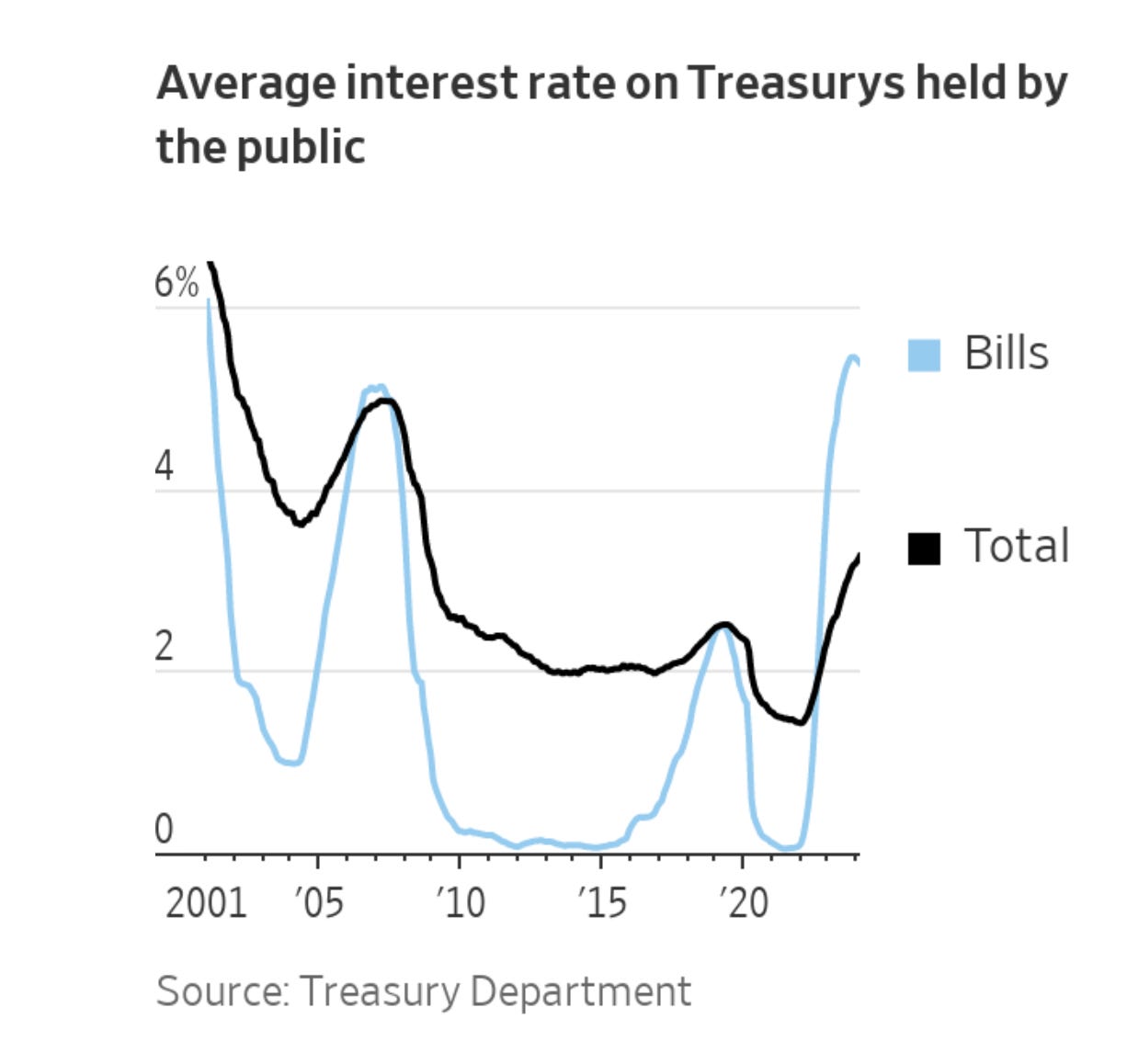

Why catastrophic? Because US treasuries are treated like cash by everything from banks to pension funds to large corporations and individual 401k’s. A treasury is seen as cash that pays interest.

This is false, of course: A Treasury is a promise from Uncle Sam to pay you back someday, perhaps 20 or 30 years in the future.

This means that, unlike cash, any concerns investors might have about Uncle Sam’s ability — or willingness — to pay can crash Treasuries.

If that happens it immediately sends the entire banking system, pension system, and hundreds of corporations into default.

Indeed, it could break the payment plumbing in the entire financial system — you wouldn’t be able to get money.

If that sounds dire, recall that all of these are sustained by the gossamer thin belief that Uncle Sam will pay back every penny with interest.

This is curious given neither voters, who in theory run the government, nor Congress — who actually does run the government — seem to think the debt is real.

You can actually try this at home: tell a voter that student loan bailouts will cost a trillion — meaning $10 grand out of their pocket. Or that another war will cost $30 grand out of pocket. Most don’t care. Because it’s not real.

So the voters don’t think it’s real. Congress doesn’t think it’s real. But literally, everything depends on the illusion that every penny of federal debt will be repaid in full, with interest.

What could go wrong?

Every fiscal trend is in the wrong direction. We’re already at $2 trillion deficit, it will soar by trillions when a recession hits.

And it will keep churning with social security, Medicare, and spending on everything from illegal immigrants to fresh wars.

At this point, there is nothing standing between us and fiscal collapse. The only question is when.

Peter St. Onge writes articles about Economics and Freedom. He’s an economist at the Heritage Foundation, a Fellow at the Mises Institute, and a former professor at Taiwan’s Feng Chia University. His website is www.ProfStOnge.com.