(Mike Maharrey, Money Metals News Service) Powell & Company at the Federal Reserve sees an elevated stagflation threat. In response, they decided to do nothing.

The Fed held interest rates steady between 4.25 and 4.5 percent. Rates have remained at that level since last December.

The official FOMC statement was little changed from the May meeting. The committee emphasized that it is “attentive to the risks to both sides of its dual mandate.”

Powell remains convinced tariffs will boost price inflation. During his post-meeting press conference, he said everybody he knows is forecasting a meaningful increase in inflation due to tariffs.

“It will be someone in that chain that I mentioned, between the manufacturer, the exporter, the importer, the retailer, ultimately somebody putting it into a good of some kind or just the consumer buying it.”

Despite no sign of increasing inflation pressure in the CPI, Powell said it is in the pipeline and we shouldn’t expect it to manifest immediately.

“It takes some time for tariffs to work their way through the chain of distribution to the end consumer. … Ultimately, the cost of the tariff has to be paid. And some of it will fall on the end consumer.”

On the other side of the coin, the FOMC is clearly worried about a slowing economy. It lowered its growth forecast down by 0.3 percent, projecting a tepid 1.4 percent this year with price inflation rising to 3 percent.

And what do we call high inflation coupled with low growth?

Stagflation.

Meaningless Dot Plots

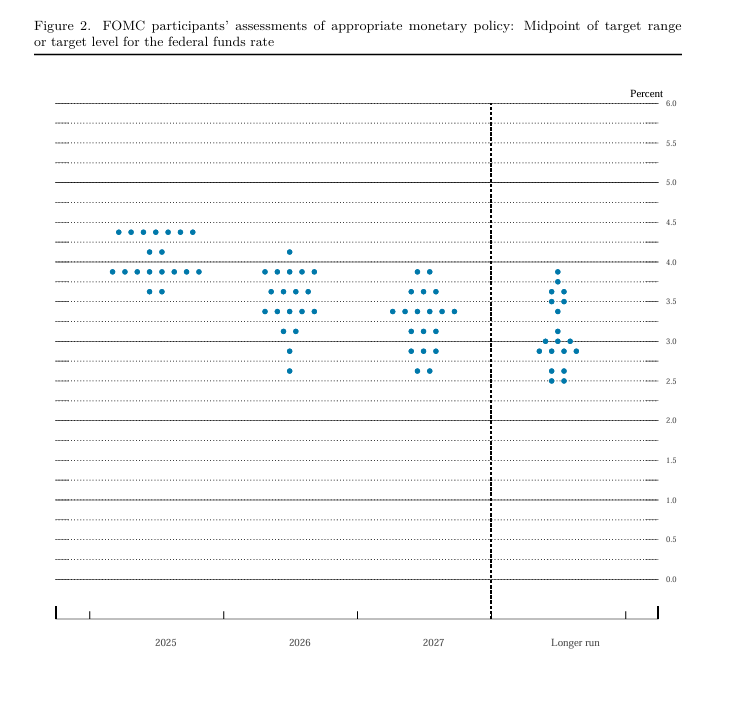

The FOMC also released its revised dot plot showing the projected trajectory of interest rates. It still calls for two rate cuts in 2025, but it eliminated one cut each in 2026 and 2027. If the Fed follows the forecast, there would be four cuts totaling 1 percentage point over the next three years.

Notably, the number of committee members projecting no rate cuts this year rose from four to seven.

While analysts tend to get all excited about these dot-plot forecasts, they are virtually meaningless.

Fed members are notoriously bad a projecting the trajectory of interest rates, even though they’re the ones literally setting the rates.

How bad is their track record?

Fund manager David Hay analyzed past dot plots and found the FOMC only got interest rate projections right 37 percent of the time. And as Hay pointed out, “They control interest rates!”

For instance, in March 2021, the FOMC projected the interest rate would still be zero in 2022. The actual 2022 rate was 1.75 percent. And in 2023, the vast majority of FOMC members thought the rate would still be at zero. The actual rate was over 5 percent.

The FOMC would probably get much better results by flipping coins or throwing darts at the wall.

Powell even indicated we should take their dot plots with a grain of salt.

“I think what you see people doing is looking ahead at a time of very high uncertainty and writing down what they think the most likely case is. No one holds these rate paths with a great deal of conviction, and everyone would agree that they’re all going to be data dependent.”

Is Holding Steady the Right Move?

The ugly reality is that there isn’t a “right move” for the Fed given the dynamics. It’s stuck between a rock and a hard place.

When central bankers are worried about economic growth, they typically ease rates for the stimulative effect. But this move elevates inflation. (Keep in mind that inflation isn’t rising prices. It’s an increase in the money supply. One of the results of this monetary inflation is price inflation.)

When central bankers are worried about inflation pressures, they tend to raise rates (or hold them steady).

What is a central banker to do when worried about both inflation and growth?

Nothing.

That’s exactly the path the Fed has laid out. Powell said the Fed is “well positioned to wait to learn more about the likely course of the economy before considering any adjustments to our policies.”

It appears the plan is to stand pat and then address whichever side of the mandate gets ugly first. If the CPI surges, rates will remain elevated, but if the economy begins to wobble, you can expect fast and aggressive cuts.

President Trump is not pleased with this approach. He wants rate cuts now. He blasted Powell before the meeting, calling him “a stupid person.”

“He probably won’t cut today. Europe had 10 cuts, and we had none. I guess he’s a political guy, I don’t know. He’s a political guy who’s not a smart person. But he’s costing the country a fortune.”

Trump is referring to the rising interest expense for the federal government. He also likely knows that this debt-dependent economy needs to stimulus to keep limping along.

Trump isn’t wrong. But he isn’t right either.

The Fed’s inaction is exactly what you would expect given the Catch-22 it finds itself in. It simultaneously needs to cut rates to prop up the easy money-addicted economy and hold rates steady (or even raise them) to keep inflation at bay.

Keep in mind that despite the cooler CPI readings over the last several months, inflation (as defined by a rise in the money supply) has been increasing for more than a year.

Powell and his fellow central bankers have been walking this tightrope for quite a while. He acknowledged it in April during a speech at the Economic Club of Chicago. As the AP described it, “The Fed would essentially have to choose whether to keep interest rates high to fight inflation or cut them to spur growth and hiring.”

“Our tool only does one of those two things at the same time,” Powell said during a Q&A session.

What is a central banker to do?

Wait and see.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.