(Headline USA) The Federal Reserve raised its key interest rate for the seventh time this year and signaled more hikes to come after a recent report showed that economy-wrecking inflation remained more than three times the normal 2% benchmark for healthy year-over-year growth.

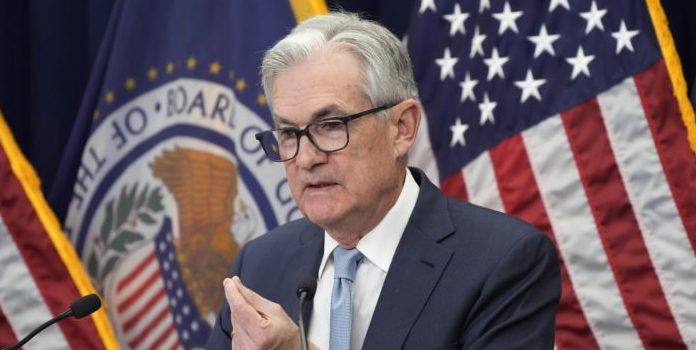

Despite signs of inflationary easing, the Fed made clear, in a statement and a news conference by Chair Jerome Powell, that it thinks sharply higher rates are still needed to fully tame the worst inflation bout to strike the economy in four decades.

The central bank boosted its benchmark rate a half-point to a range of 4.25% to 4.5%, its highest level in 15 years.

Though lower than its previous three-quarter-point hikes, the latest move will further increase the costs of many consumer and business loans and the risk of a recession.

More surprisingly, the policymakers forecast that their key short-term rate will reach a range of 5% to 5.25% by the end of 2023. That suggests that the Fed is poised to raise its rate by an additional three-quarters of a point and leave it there through next year.

Some economists had expected that the Fed would project only an additional half-point increase.

The latest rate hike was announced one day after a report showed a year-over-year increase of 7.1%. Though still high, it was sharply below a recent peak of 9.1% in June.

“The inflation data in October and November show a welcome reduction,” Powell said at his news conference. “But it will take substantially more evidence to give confidence that inflation is on a sustained downward path.”

In its updated forecasts, the Fed’s policymakers predicted slower growth and higher unemployment for next year and 2024. The unemployment rate is envisioned to jump to 4.6% by the end of 2023, from 3.7% today.

That would mark a significant increase in joblessness that typically would reflect a recession, which is defined as two or more quarters of economic contraction.

Consistent with a sharp slowdown, the officials also projected that the economy will barely grow next year, expanding just 0.5%, less than half the forecast it had made in September.

Many economists think the Fed will further downshift to a quarter-point rate hike when it next meets early next year.

Asked about that Wednesday, Powell said he has yet to decide how large he thinks the next hike should be. But having raised rates so fast, he said, “we think the appropriate thing to do now is to move at a slower pace. That will allow us to feel our way.”

Powell downplayed any notion that the Fed might decide to reverse course next year and start cutting rates to support growth, as Wall Street investors are expecting.

“I wouldn’t see the committee cutting rates until we’re confident that inflation is moving down in a sustained way,” he said.

Cumulatively, the Fed’s hikes have led to much costlier borrowing rates for consumers as well as companies, ranging from mortgages to auto and business loans. They have sent home sales plummeting and are starting to weigh down rents on new apartments, a leading source of high inflation.

Fed officials have said they want rates to reach “restrictive” levels that slow growth and hiring and bring inflation down to their target range. Worries have grown that the Fed is raising rates so much in its drive to curb inflation that it will trigger a recession next year.

The policymakers have stressed that more significant than how fast they raise rates is how long they keep them at or near their peak.

“It’s far more important to think what is the ultimate level,” Powell said Wednesday.

Powell’s biggest focus has been on services prices, which he has said are likely to stay persistently high. In part, that’s because sharp increases in wages are becoming a key contributor to inflation. Services companies, like hotels and restaurants, are particularly labor-intensive. And with average wages growing at

With many service-sector employers still desperate for workers, Powell said pay growth may remain above what’s consistent with the Fed’s 2% inflation target.

“We have a long way to go,” the Fed chair said, “to get to price stability.”

Adapted from reporting by the Associated Press