(Mike Maharrey, Money Metals News Service) I have written that the commercial real estate market could be the next thing to pop in this bubble economy and that could lead to the next major financial crisis.

But you don’t need to worry. Federal Reserve Chairman Jerome Powell assured us that everything is fine.

During a 60 Minutes interview aired Sunday, Feb. 4, Powell conceded some smaller and regional banks with “concentrated exposures” in commercial real estate “are challenged.” But he said he wasn’t concerned about these problems spreading into the broader banking system as the subprime crisis did in 2008.

“I don’t think there’s much risk of a repeat of 2008,” he said, adding, “I do think it’s a manageable problem.”

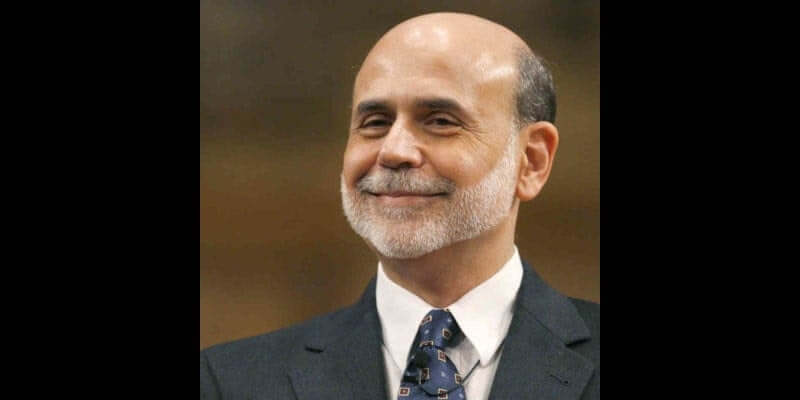

Powell sounds a lot like former Federal Reserve Chairman Ben Bernanke who insisted in 2007 that problems in the subprime mortgage sector were “contained.”

On March 28, 2007, Bernanke told Congress everything was fine.

The ongoing tightening of lending standards, although an appropriate market response, will reduce somewhat the effective demand for housing, and foreclosed properties will add to the inventories of unsold homes,” Bernanke said. “At this juncture, however, the impact on the broader economy and financial markets of the problems in the subprime market seems likely to be contained.

He repeated this mantra on May 17 during a financial conference.

We believe the effect of the troubles in the subprime sector on the broader housing market will be limited and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.

Bernanke’s remarks were reflected in the August 2007 FOMC statement.

Financial markets have been volatile in recent weeks, credit conditions have become tighter for some households and businesses, and the housing correction is ongoing. Nevertheless, the economy seems likely to continue to expand at a moderate pace over the coming quarters, supported by solid growth in employment and incomes and a robust global economy.

Sounds a lot like Powell and Company today, doesn’t it? Of course, we all know what happened in the year after Bernanke’s assurances.

I sure do hope Powell’s promises aren’t equally empty.