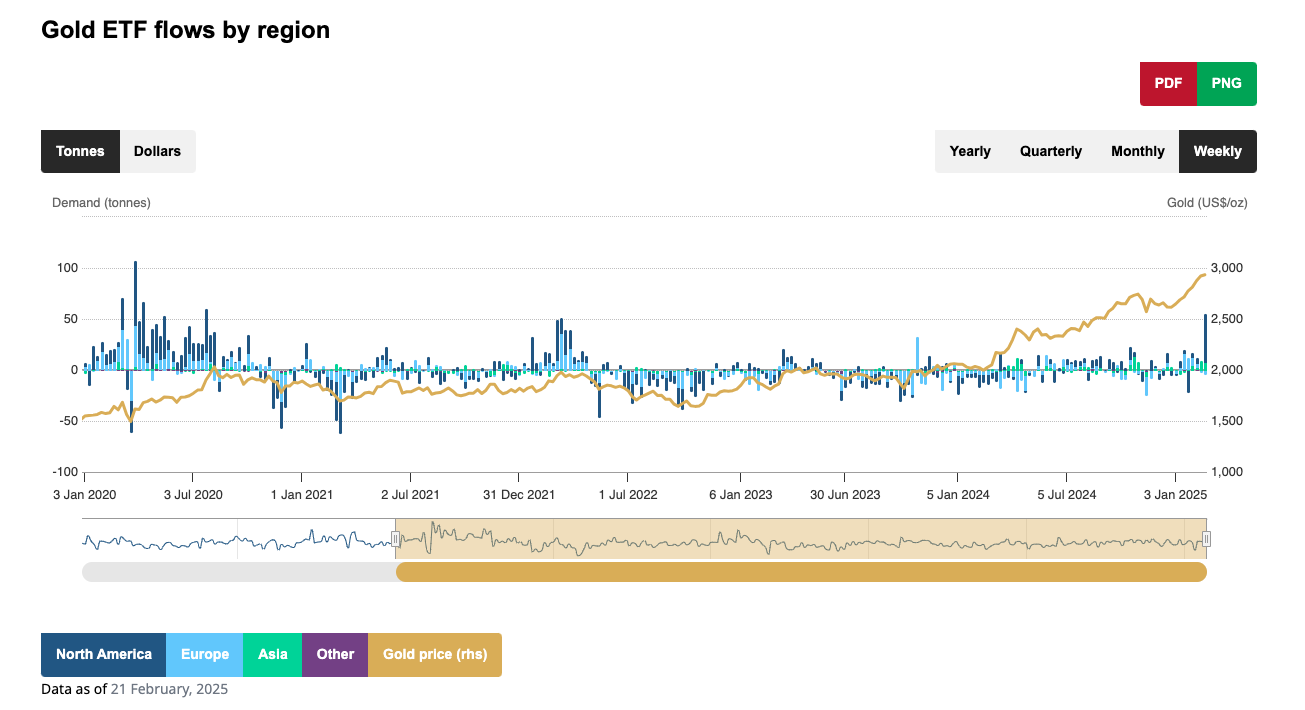

(Mike Maharrey, Money Metals News Service) If gold flows into ETFs are any indication, North American investors are finally hopping on the gold bandwagon.

Last week, 48.8 tonnes of gold flowed into North American-based gold-backed funds. The last time we saw weekly flows at that level was April 2020 as governments were locking down economies during the COVID-19 pandemic.

Bloomberg Intelligence senior commodity analyst Mike McGlone noted that total ETF holdings have recovered to the highest level since the beginning of 2024.

“It’s not surprising to expect a shift to gold ETF inflows in 2025, especially if there’s a bit of a reversion in the rapidly rising U.S. stock market and high interest rates.”

Inflows of gold into ETFs can significantly impact the global gold market by pushing overall demand higher.

A gold ETF is backed by a trust company that holds metal owned and stored by the trust. In most cases, investing in an ETF does not entitle you to any amount of physical gold. You own a share of the ETF, not gold itself.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

The Gold Bulls Are Running

After rising 26.5 percent in 2024 and setting 40 record highs, the gold bull rally continued into 2025. The price has surged to over $2,950, breaking several more records along the way.

It’s interesting to note that there has been a breakdown of traditional market dynamics during this bull run with gold gaining despite higher interest rates. Typically, a higher interest rate environment creates headwinds for the yellow metal because it is a non-yielding asset.

Gold Newsletter publisher Brien Lundin noted earlier this month that gold seems to “want” to go higher.

“A powerful sign of a bull market is when seemingly bearish news or data is instead interpreted bullishly by investors. … That’s just where we are now — at a time when even a strong dollar or rising Treasury yields can’t deter gold’s upward trajectory.”

Demand for gold by central banks and investors in the East has primarily driven the gold bull market. Up until recently, investors in the West – particularly in the U.S. – have largely remained on the sidelines. Many analysts believe that a revival in Western bullishness could spark the next leg of the bull rally and drive gold to over $3,000 per ounce.

Gabelli Gold Fund associate portfolio manager Chris Mancini told Kitco News that Western investors are turning to gold to hedge against possible economic disruption due to tariffs along with worries about persistent price inflation and the growing expectation that the Federal Reserve will have to try to hold interest rates higher for longer.

“Gold is serving as a hedge against the dollar and other currencies losing their purchasing power. Tariffs might accelerate this process as the prices of goods across the world increase. Also, if global central banks (including the Fed) reduce interest rates or print money as a way to combat economic weakness, prices will likely rise, increasing gold’s appeal to investors.”

Some analysts believe that with the rapid ascent, gold is due for a correction. Trade Nation senior market analyst said he thinks gold is overbought based on the daily moving average convergence/divergence (MACD).

However, Mancini said it’s important to focus on the long-term trend.

“$3,000 gold is telling us that investors are realizing that owning a physical asset that you can hold has more value during uncertain geopolitical and economic times. It’s telling us that the state of geopolitics and the world economy is becoming more uncertain.”

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.