State and local governments placed citizens under house arrest and forcefully closed businesses, destroying the livelihoods of many

Now they are demanding that they pay higher taxes, The Daily Wire reported.

Members of the Nashville City Council voted to increase property taxes by 34 percent in order to give more funding to the police department and public schools.

California Gov. Gavin Newsom approved the state legislature’s proposal to scrap tax breaks for some businesses, which increased taxes by $4.4 billion.

The state will have about $54 billion in debt this year.

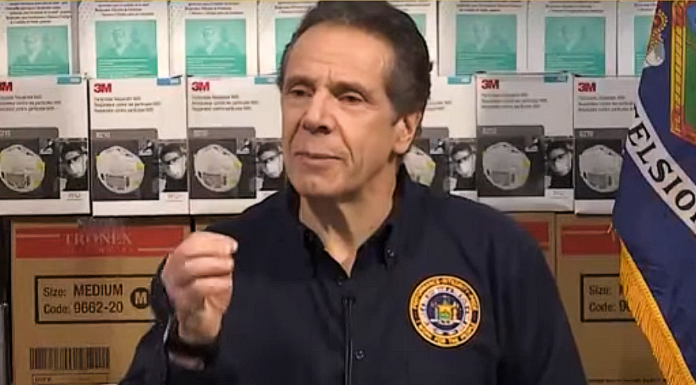

The New York state legislature, which has been hit by the cap on state and local tax (SALT) deductions, is considering tax hikes.

Members of the Seattle City Council voted in favor of new taxes on companies that spend at least $7 million a year to pay for employee’s wages and salaries.

Members of the District of Columbia Council voted to cut tax breaks for businesses and to raise the gasoline tax.

Chicago Mayor Lori Lightfoot said the city has to increase property taxes to fill in for its reckless spending habits that have led to $700 million in debt.

State governments dug themselves into a combined $555 billion hole over the next two years, according to the Center on Budget and Policy Priorities, a left-wing group based in Washington, D.C.

“This figure is for state shortfalls only and does not include the additional shortfalls that local and tribal governments and the U.S. territories face,” the Center said.

The group suggested that Congress and the Federal Reserve continue to print and spend trillions of dollars in order to prop up the economy.

“The projected shortfall for 2021 fiscal year, which began on July 1 for most states, is much deeper than the shortfalls faced in any year of the Great Recession,” the Center said.