(Associated Press) House Democrats unveiled a sweeping proposal Monday for tax hikes on big corporations and the wealthy to fund President Joe Biden‘s $3.5 trillion rebuilding plan, as Congress speeds ahead to shape the far-reaching package that touches almost all aspects of domestic life.

The proposed top tax rate would revert to 39.6% on couples earning more than $450,000, and there would be a 3% tax on wealthier Americans making beyond $5 million a year. For big businesses, the proposal would lift the 21% corporate tax rate to 26.5% on incomes beyond $5 million.

In all, the tax hikes are in line with Biden’s own proposals and would bring about the most substantive changes in the tax code since Republicans with then-President Donald Trump slashed taxes in 2017. Business and anti-tax groups are sure to object. But Democrats are pressing forward.

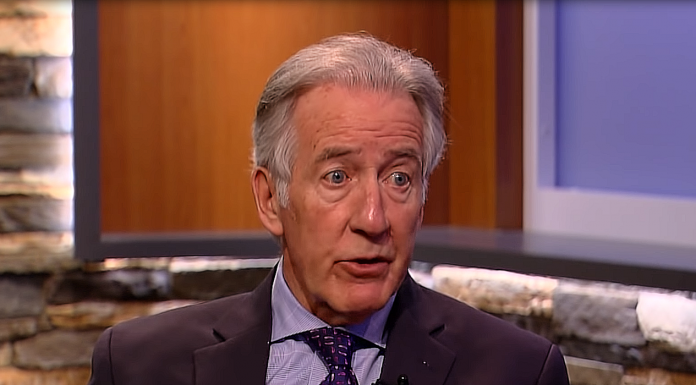

Rep. Richard Neal, D-Mass., the chairman of the tax-writing Ways & Means Committee, said taken together, the proposals would “expand opportunity for the American people and support our efforts to build a healthier, more prosperous future.”

It’s a daunting moment for Biden and his allies in Congress as they assemble the massive package that is destined to become one of the largest singles measures considered in some time, if ever. The president’s “build back” agenda includes spending on child care, health care, education and strategies to confront climate change. It is a sweeping undertaking, on part with the Great Society or New Deal.

One Democratic senator vital to the bill’s fate says the cost will need to be slashed to $1 trillion to $1.5 trillion to win his support.

Sen. Joe Manchin, D-W.Va., also cautioned there was “no way” Congress will meet the late September goal from House Speaker Nancy Pelosi, D-Calif., for passage given his current wide differences with liberal Democrats on how much to spend and how to pay for it.

“I cannot support $3.5 trillion,” Manchin said Sunday, citing in particular his opposition to a proposed increase in the corporate tax rate from 21% to 28% and vast new social spending. “We don’t have the need to rush into this.”

Democrats have no votes to spare if they want to enact Biden’s massive “Build Back Better” agenda, with the Senate split 50-50 and Vice President Kamala Harris the tiebreaker if there is no Republican support. Democratic congressional leaders have set a target of Wednesday for committees to have the bill drafted.

The White House welcomed the preliminary tax plan, which “makes significant progress towards ensuring our economy rewards work and not just wealth,” said deputy press secretary Andrew Bates.

“This meets two core goals the President laid out at the beginning of this process — it does not raise taxes on Americans earning under $400,000 and it repeals the core elements of the Trump tax giveaways for the wealthy and corporations,” he said in a statement.

The proposal was pitched as potentially raising some $2.9 trillion — but that’s a preliminary estimate. That would go a long way toward paying for the $3.5 trillion legislation. The White House is counting on long-term economic growth to be sparked by the legislation to generate an additional $600 billion to make up the difference.

Much of the revenue raised would come from the higher taxes on corporations and the highest earners — more than $450,000 for married couples filing jointly, to 39.6% from the current 37%.

Pressed repeatedly about a price tag he could support, Manchin said, “It’s going to be $1, $1.5 (trillion).” He suggested the range was based on a modest rise in the corporate tax rate to 25%, a figure he believes will keep the U.S. globally competitive.

But Sen. Bernie Sanders, the Vermont independent who chairs the Senate Budget Committee and is helping craft the measure, noted that he and other members of the liberal flank in Congress had initially urged an even more robust package of $6 trillion.

“I don’t think it’s acceptable to the president, to the American people or to the overwhelming majority of the people in the Democratic caucus,” Sanders said. He added: “I believe we’re going to all sit down and work together and come up with a $3.5 trillion reconciliation bill which deals with the enormously unmet needs of working families.”

The current blueprint proposes billions for rebuilding infrastructure, tackling climate change and expanding or introducing a range of services, from free prekindergarten to dental, vision and hearing aid care for older people.

Manchin voted last month to approve a budget resolution that set the figure, though he and Sen. Kyrsten Sinema, D-Ariz., have expressed reservations about the topline amount. All of it would be paid for with taxes on corporations and the wealthy.

Congressional committees have been working hard this month on slices of the 10-year proposal in a bid to meet this week’s timeline from Pelosi and Senate Majority Leader Chuck Schumer, D-N.Y., to have the bill drafted. Pelosi is seeking a House vote by Oct. 1, near the Sept. 27 timeline for voting on a slimmer infrastructure plan favored by moderate lawmakers.

Manchin, who in an op-ed earlier this month urged a “strategic pause” on the legislation to reconsider the cost, described the timing as unrealistic. He has urged Congress to act first on the $1 trillion bipartisan infrastructure bill already passed by the Senate. But liberal Democrats have threatened to withhold their support until the $3.5 trillion spending bill is passed alongside it.

Manchin spoke on CNN’s “State of the Union,” NBC’s “Meet the Press” and ABC’s “This Week.” Sanders was on CNN and ABC.