(Clint Siegner, Money Metals News Service) Americans may start the New Year without certainty as to who will be sworn in as president on Inauguration Day.

President Donald Trump and his supporters can’t find courts willing to consider their evidence of widespread voter fraud. Trump is not likely to concede.

The battle continues in the courts and in the swing state legislatures.

The election isn’t the only issue dividing Americans. The response to the COVID-19 pandemic also has people at odds.

Some argue government health authorities should be dutifully followed – and we must submit to restrictions in order to keep hospitals from being overwhelmed.

Others are more concerned about the loss of personal liberty and see evidence lockdowns carry hideous economic and psychological costs while not meaningfully reducing the spread.

This is the sociopolitical backdrop as markets enter 2021. That doesn’t sound like a “risk on” environment.

Nevertheless, stock markets will start the year with valuations at, or near, all-time highs. That is, unless the wheels come off in the last half of December.

The equity markets appear just as broken as the COMEX when it comes to pricing stocks based on fundamentals.

Bullion investors should keep a close eye on the equity markets. If the bubble pops there, it will drive safe-haven buying for coins, rounds, and bars. The spike in demand earlier this year may have only been a preview.

Another fundamental driver to watch is the explosion in negative yielding debt. Last week, a record $17.5 trillion in bonds yielded less than zero percent in nominal terms. That makes zero yield gold and silver bars relatively more attractive to investors looking for security.

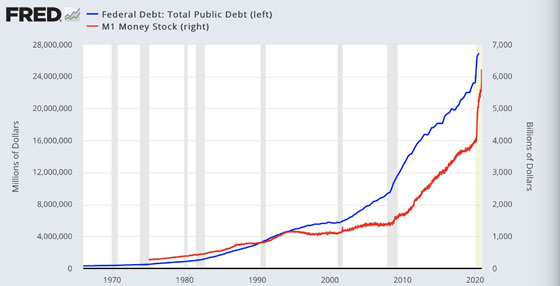

The M1 money supply quadrupled over the past decade. That freshly printed money was gifted to the banks and the Treasury Department to keep stock and bond valuations elevated. If even a fraction of that cash rotates into the precious metals markets, it will be something to behold.

There are also extremes to consider in the gold and silver futures markets. The COMEX delivered more metal in 2020 than in the prior 5 years combined.

This is not sustainable for the bullion banks. We aren’t sure how they managed thus far, to be honest.

One thing is sure. The banks and the COMEX are not to be trusted.

One way to deliver that many bars without creating a massive spike in the price is to deliver paper receipts rather than actual metal. Those who stood for delivery of COMEX bars may be wise to remove their bars from the exchange altogether and place them into segregated storage.

There is no telling if 2021 will finally be the year where powerful fundamental drivers finally break the rigged paper price discovery mechanism in metals. But 2020 brought us a lot closer to that day…Original Source…

Clint Siegner is a Director at Money Metals Exchange, a precious metals dealer recently named “Best in the USA” by an independent global ratings group. A graduate of Linfield College in Oregon, Siegner puts his experience in business management along with his passion for personal liberty, limited government, and honest money into the development of Money Metals’ brand and reach. This includes writing extensively on the bullion markets and their intersection with policy and world affairs.