(Mike Maharrey, Money Metals News Service) It’s getting harder and harder to pretend the inflation problem isn’t a problem.

Last month, the markets and the mainstream media threw a party when the CPI data came in “cooler than expected.” CNBC led with this rosy summary. “U.S. stocks popped on Wednesday for their best day since November, on the back of the cooler-than-expected inflation reading.”

However, the actual CPI data told a different story. It was the same narrative we’d seen for several months – the inflation monster slithering back out from under the bed.

And the January inflation data was even more damning.

January CPI

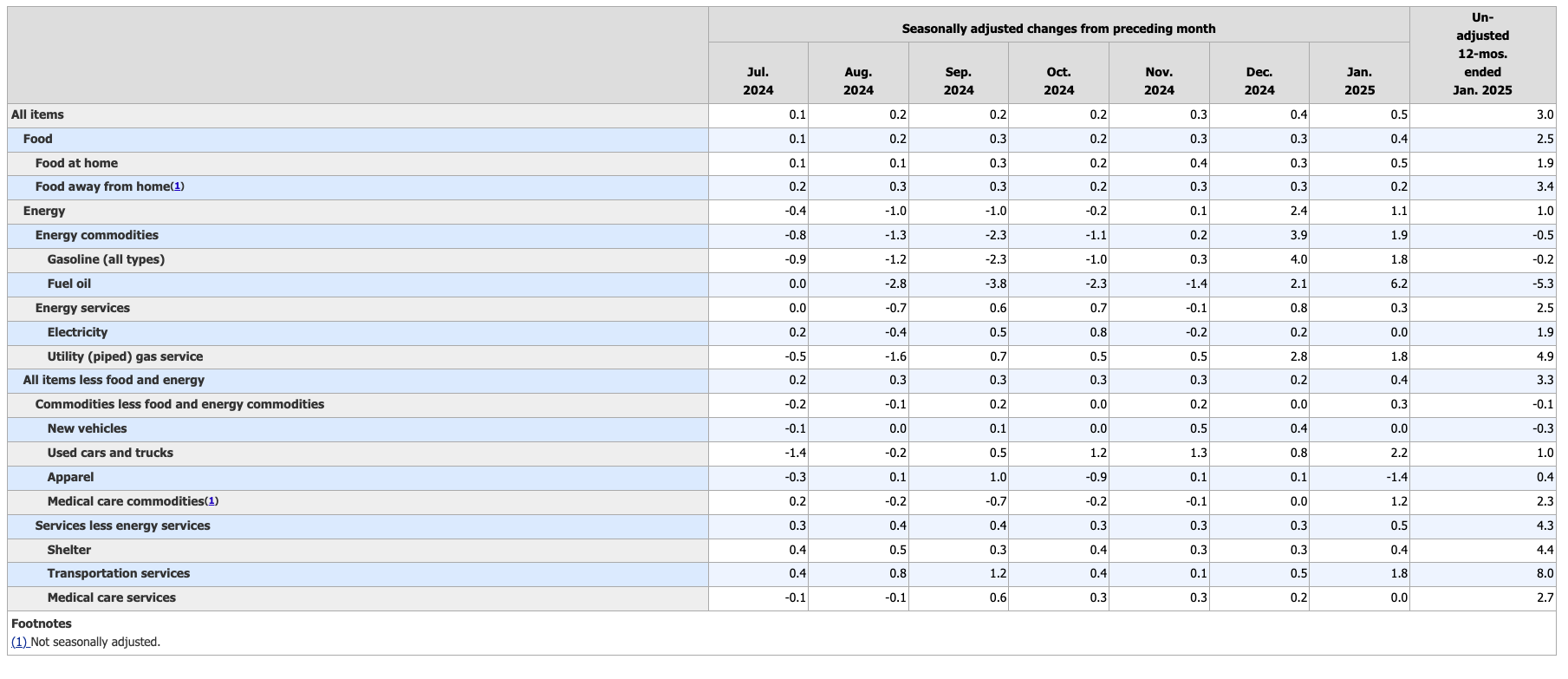

Prices rose 3 percent last month on an annual basis, the fourth straight increase in the headline CPI number. The CPI has crept up from 2.4 percent in September, 2.6 percent in October, 2.7 percent in November, and 2.9 percent in December.

The last time the CPI charted 3 percent was June 2024, and it was 3.1 percent in June 2023.

On a monthly basis, prices spiked by 0.5 percent. That came on the heels of a 0.4 percent increase in December. If you annualize the CPI over the last two months, it comes to 5.4 percent.

The “good news” last month was on the core inflation front.

That was short-lived

Coming off the encouraging 0.2 percent increase in December, core CPI stripping out more volatile food and energy prices surged by 0.4 percent in January. That pushed the annual core CPI to back up 3.3 percent. Core CPI has been mired in this range since last July.

Overall, the CPI data tells the same story it’s been telling for months: price inflation is stubbornly sticky.

And this time, the pundits and politicians can’t even gaslight you by claiming it was a good report because the numbers were “better than expected.” All of the January numbers were higher than forecast.

You don’t have to be an economist to understand that all of these numbers remain far above the Federal Reserve’s mythical 2 percent target.

Keep in mind that the CPI doesn’t tell the entire story of inflation. The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

Looking more closely at the data, we find that you paid more for virtually everything in January. The food index rose 0.5 percent month-on-month. Energy rose by 1.1 percent. Shelter was up 0.4 percent. Service costs spiked by 0.5 percent. The only category that declined was apparel.

Reaction to the January CPI

Reaction to the January CPI

The hotter-than-expected CPI increased angst in the markets, as it further dashed hopes for more Federal Reserve interest rate cuts.

ClearBridge Investments investment strategy analyst Josh Jamner told CNBC he thinks this put “the final nail in the coffin for the rate cut cycle.”

“The ‘wait and see’ Fed is going to be waiting longer than anticipated after a red-hot January CPI inflation report.”

Market pricing pushed the timing of the next rate cut to at least September.

But while he was testifying on Capitol Hill, Federal Reserve Chairman Jerome Powell tried to keep hope alive.

“We don’t get excited about one or two good readings, and we don’t get excited about one or two bad readings.”

Of course, this is the same guy who swore price inflation was “transitory” before finally acknowledging the obvious and raising rates back in 2022.

The reality is the Federal Reserve is in a Catch-22. Given the escalating inflationary pressure, it needs to push rates even higher. After all, it never did do enough to slay the inflation monster. The bottom line is that the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. Given the levels of debt and the amount of malinvestment, the economy can’t function in this higher interest rate environment. It needs its easy money drug.

How Powell & Company will navigate this remains to be seen, but they certainly can’t simultaneously raise and lower interest rates.

And it’s getting harder and harder to simply sweep the inflation problem under the rug.

Mike Maharrey is a journalist and market analyst for MoneyMetals.com with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.