(Mike Maharrey, Money Metals News Service) Could the commercial real estate market be the next thing to pop in this bubble economy? According to a recent working paper published by the National Bureau of Economic Research, the answer is yes.

And that could kick off the next major financial crisis.

Based on the NBER’s research, approximately 300 regional banks are at risk of collapse due to problems in the commercial real estate (CRE) sector.

Remember Silicon Valley Bank?

Kind of like that.

A blog published by the International Monetary Fund (IMF) also warned about stress in the commercial real estate market, saying it is “under intense pressure globally” due to rising interest rates.

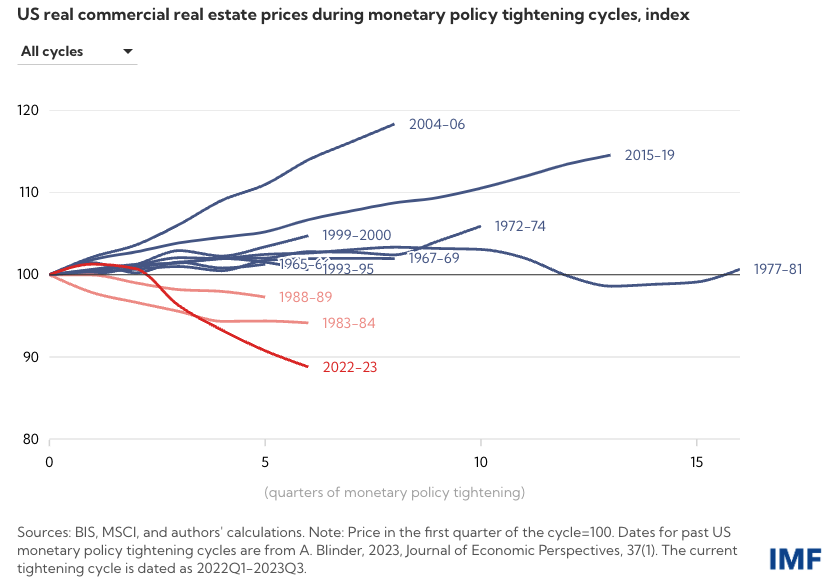

The U.S. has the biggest commercial real estate market in the world. According to the IMF, commercial real estate prices have tumbled by 11 percent since the Fed started hiking rates in 2022. This precipitous drop in commercial real estate value erased the previous two year’s gains.

The IMF points out that commercial real estate prices have plunged far more than during previous monetary tightening prices.

Part of this divergence in price behavior between the recent and past monetary policy tightening cycles may be attributed to the steep pace of monetary policy tightening this time around, a factor that has contributed to the sharp increase in mortgage rates and commercial mortgage-backed securities spreads. It has also notably slowed private equity fundraising—an important source of financing for the sector in recent years, as noted in our recent Global Financial Stability Report.

The CRE sector faces the triple whammy of falling prices, falling demand, and rising interest rates. The post-pandemic rise of telecommuting and work-at-home programs crushed demand for office space. Vacancy rates in commercial buildings have soared.

This has put significant stress on commercial real estate companies. The biggest bankruptcy in 2023 was the failure of the Pennsylvania Real Estate Investment Trust. The company had loaded up with more than $1 billion in liabilities.

The Commercial Real Estate Collapse Is a Big Problem for Banks

The collapse of the commercial real estate market could easily spill over into the financial sector. That’s because a lot of loans are coming due.

According to the Mortgage Bankers Association, around $1.2 trillion of commercial real estate debt in the United States will mature over the next two years.

According to Trepp (a real estate data provider), $2.56 trillion in commercial real estate loans will mature over the next five years, with $1.4 trillion held by banks.

All of that debt will have to be refinanced. That’s a big problem for debtors who face much higher interest rates to borrow money on buildings with much lower values.

Trepp said, “With rates rising and credit conditions tightening, many loans may face an uphill battle as refinancing becomes more costly, especially if banks and other lenders look to reduce their CRE exposure as we saw happen during previous recessionary cycles. This could lead to lower property values and larger losses for lenders.”

As the IMF put it, “Higher financing costs since the beginning of the tightening cycle and tumbling property prices have resulted in rising losses on commercial real estate loans. Stricter lending standards by US banks have further restricted funding availability.”

There is also a growing number of commercial real estate defaults.

For instance, according to Bank of America’s Q3 financial statement, the total value of non-performing loans (at least 90 days past due) increased to nearly $5 billion. That was up from $4.27 billion in Q2. The big increase was largely due to its commercial real estate portfolio.

A Reuters report last fall warned, “Weak demand for offices could trigger a wave of borrowers to default on their loans and put pressure on banks and other lenders, which are hoping to avoid selling loans at significant discounts.”

Small and midsized regional banks hold a significant share of commercial real estate debt. They carry more than 4.4 times the exposure to CRE loans than major “too big to fail” banks. According to an analysis by Citigroup, regional and local banks hold 70 percent of all commercial real estate loans. And according to a report by a Goldman Sachs economist, banks with less than $250 billion in assets hold more than 80 percent of commercial real estate loans.

The IMF summarized the situation.

Financial intermediaries and investors with a significant exposure to commercial real estate face heightened asset quality risks. Smaller and regional U.S. banks are particularly vulnerable as they are almost five times more exposed to the sector than larger banks. … Rising delinquencies and defaults in the sector could restrict lending and trigger a vicious cycle of tighter funding conditions, falling commercial property prices, and losses for financial intermediaries with adverse spillovers to the rest of the economy.

Mainstream economists and Fed officials insist that the banking system is sound. Economists claim the issues in the commercial real estate market don’t pose a systemic risk. Everything will be OK, they claim. But these same people told us the subprime problem in 2007 was “contained,” inflation was “transitory,” and quantitative easing was a “temporary program” that would be unwound.

In other words, they have a pretty awful track record.

Rabobank asked the operative question.

What happens when all of those regional US banks with balance sheets loaded with dubious commercial real estate loans can no longer pledge underwater securities at par?

The Federal Reserve Broke the Commercial Real Estate Market (And A Lot of Other Things)

Most people will blame problems in the commercial real estate sector on the pandemic and the drop in demand for commercial real estate space.

This is certainly part of the equation.

But ultimately, the Federal Reserve created this problem, and it wasn’t the recent interest rate hikes that mainstream analysts tend to focus on.

The central bank sowed the seeds for this problem more than a decade ago when it slashed interest rates to zero and launched the first round of quantitative easing in the aftermath of the 2008 financial crisis. It doubled down on these policies during the pandemic, slashing interest rates to zero again, and injecting trillions of dollars of new money into the economy.

This incentivized excessive borrowing and created all kinds of malinvestments in the economy.

When price inflation forced the Fed to hike rates, it exposed these problems. It was inevitable that things in the bubble economy would go “pop” when the central tried to raise interest rates in order to fight the price inflation it caused with its loose monetary policy.

Easy money is the mother’s milk of the economy and the financial system. The Fed started draining that lifeblood away when it stepped in to fight the price inflation it could no longer write off as transitory. There was no way the central bank wasn’t going to break something.

The first crack in the dam was the failure of Silicon Valley Bank and Signature Bank last March. The Fed managed to paper over problems in the banking system with a bailout. But issues in the commercial real estate market may well lead to an even bigger series of bank failures, similar to the way subprime mortgages crashed the financial system in 2008.

The commercial real estate market serves as just one example of the many distortions Fed monetary policy created in the economy. Similar malinvestments and structural problems lurk under the surface in many economic sectors, from finance to manufacturing, to tech.

Commercial real estate is a good candidate to be the thing that breaks creating a domino effect throughout the economy and setting off the next major crisis. But it could be something else.

The bottom line is that no matter what the pundits and government people tell you, everything in the economy is not “fine.” The foundation is cracked and it’s just a matter of time before things start falling down.