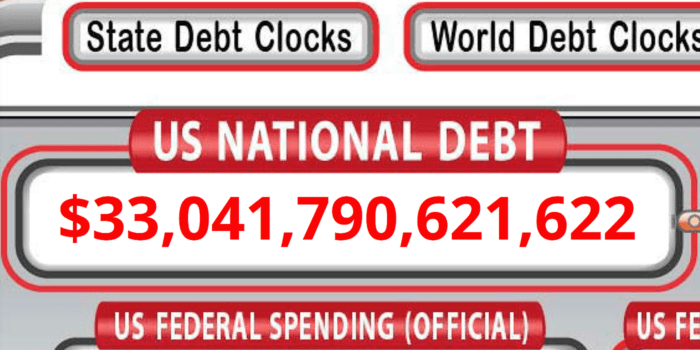

(Ken Silva, Headline USA) It now costs the U.S. government $1 trillion to merely pay for the interest on its skyrocketing national debt, which is nearly $34 trillion.

Bloomberg published an analysis on Tuesday, estimating that annualized interest payments on the U.S. government debt climbed past $1 trillion as of the end of October. That projected amount has doubled in the past 19 months, according to Bloomberg.

Bloomberg explained that the estimated interest expense is calculated by looking at the government’s monthly outstanding debt balances and the average interest it pays.

Interest costs in the fiscal year that ended Sept. 30 were reportedly $879.3 billion, up from $717.6 billion the previous year.

But those costs are expected to skyrocket as low-interest treasury bills mature and the government refinances them at the current, higher interest rate. Interest rates on a 10-year bill are nearly 5%, whereas they were less than 2% a decade ago.

The Federal Reserve has indicated that it will continue to raise interest rates in an attempt to fight inflation. This has the U.S. government in a nasty spiral, whereby it must borrow even more just to finance its interest payments.

“There will be further increases to Treasury coupon auctions and T-bills outstanding going forward,” stated Bloomberg Intelligence strategists Ira Jersey and Will Hoffman.

“Besides deficits of over $2 trillion in the foreseeable future, climbing maturities following the increase of issuance from March 2020 will also need to be refinanced.”

Economist Daniel Lacalle noted that the debt crisis puts otherwise rosy economic data in a grim perspective. Real GDP growth was allegedly nearly 5% in the third quarter, unemployment remains lower than 4% and consumer spending grew at a 4% annualized rate.

“A large part of the growth in GDP came from bloated government spending financed with more debt and inventory revaluation, adding 0.8 and 1.4 percentage points to GDP growth. Many of these temporary effects will revert in the fourth quarter,” Lacalle wrote for the Mises Institute.

The increase in gross domestic product between the third quarter of 2022 and the same period of 2023 was a mere $414.3 billion, according to the Bureau of Economic Analysis, while the increase in public debt was $1.3 trillion,” he added.

“The United States is now in the worst year of growth, excluding public debt accumulation since the thirties.”

Ken Silva is a staff writer at Headline USA. Follow him at twitter.com/jd_cashless.