(Mike Maharrey, Money Metals News Service) The Federal Reserve just got the green light to crank up the inflation machine.

The Consumer Price Index (CPI) moderated in February and turned downright cool in March. Prices fell month-on-month, driven by much lower energy costs.

That cracks the door for the Fed to plausibly cut interest rates again sooner rather than later. And that open door could come in handy for the Fed with markets in chaos and recession worries heating up.

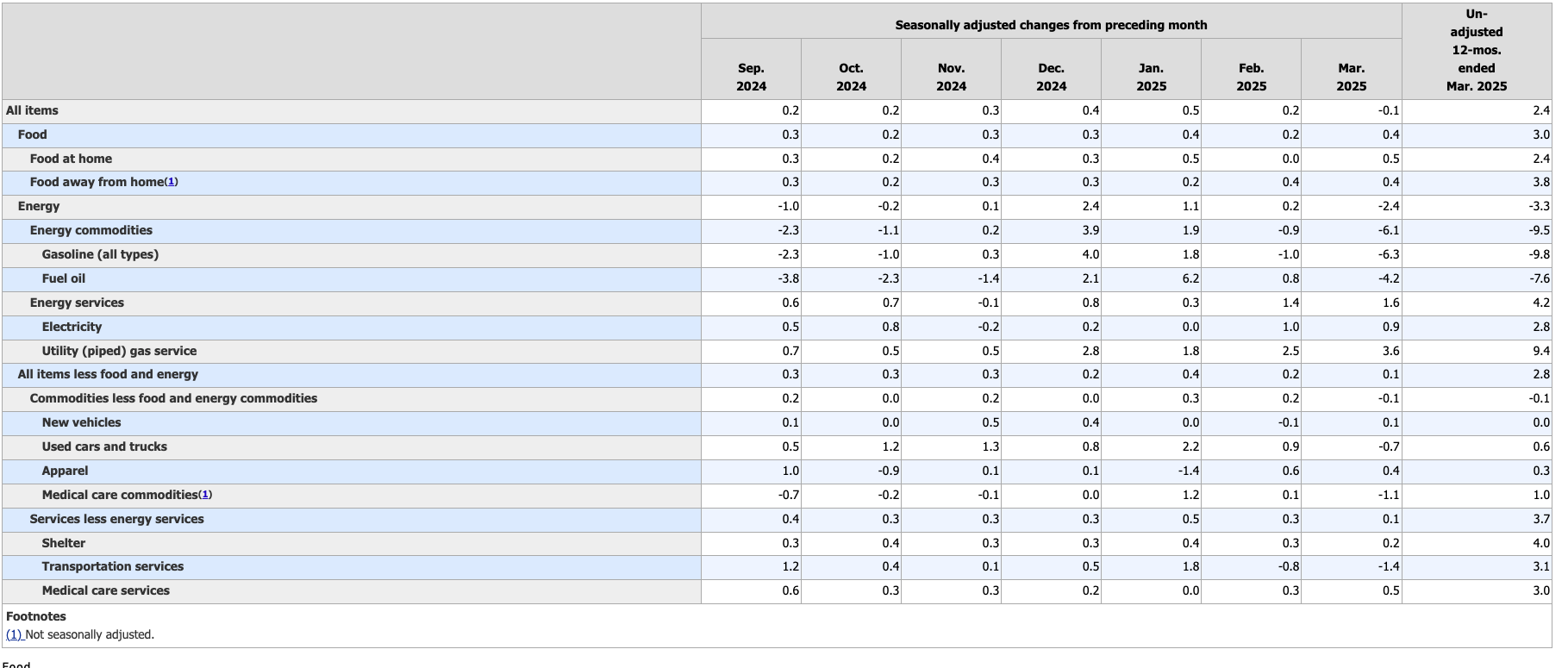

The March CPI Data

On an annual basis, the CPI came in at 2.4 percent, according to data from the BLS. That was down from 2.8 percent in February. The forecast was for a 2.6 percent annual price gain.

Month-on-month, prices contracted by -0.1 percent. We had a couple of months when prices didn’t rise in the spring of 2024, but this is the first drop in prices since 2020.

Stripping out more volatile food and energy prices, core CPI rose by a modest 0.1 percent month-on-month. On an annual basis, core CPI fell to 2.8 percent. This is the first time core CPI has dropped below 3 percent since March 2021. The forecast was for core CPI to come in at 3 percent.

As you parse the data, keep in mind that the CPI doesn’t tell the entire story of inflation. The government revised the CPI formula in the 1990s so that it understated the actual rise in prices. Based on the formula used in the 1970s, CPI is closer to double the official numbers. So, if the BLS was using the old formula, we’re looking at CPI closer to 6 percent. And using an honest formula, it would probably be worse than that.

However, this is the formula the government uses, and it drives decision-making.

Looking deeper into the data, we find that gasoline prices fell -6.1 percent month-on-month, pulling the broader energy index down by -2.4 percent.

Shelter prices also moderated, rising by 0.2 percent.

However, all the news wasn’t good. Food prices climbed 0.4 percent.

Reaction

The mainstream wasn’t in the mood for good news.

Despite the rosy CPI data, stocks sold off sharply on Thursday, and tariff worries continue to dominate.

As CNBC pointed out, “If Thursday’s consumer price index report, which showed prices actually dipping month on month and core inflation dropping to the lowest since 2021, had been released prior to the tariff chaos unleashed by U.S. President Donald Trump, stocks would probably have shot up.”

Most of the commentary on the price inflation data centered around tariffs and worries that falling prices are the calm before the storm. An economist for Navy Federal Credit Union compared this CPI report to a “before and after snapshot.”

“This is before. We may be whistling past the graveyard right now, because we know that costs are going to increase.”

Even as the Trump administration announced a 90-day pause on tariffs for “non-retaliating” countries, China will still feel the weight of tariff policy, and quite frankly, nobody really knows what tomorrow will bring.

“Today’s softer-than-expected CPI release feels backward-looking given the large changes to trade policy seen in recent days,” global co-head of fixed income and liquidity solutions at Goldman Sachs Asset Management Kay Haigh told CNBC. “Going forward, the Fed is likely to face a difficult trade-off as tariff-driven price increases start to feed through to the inflation data and activity remains soft.”

A former Fed economist told Yahoo Finance, “This could easily be the last really good CPI day for a while,” adding that it would take a while for the impact of tariffs to show up in the data.”

A Green Light for the Fed

Regardless, the cooling CPI is good news for Federal Reserve officials who may need the cover of improving inflation to cut interest rates if the economy deteriorates and the stock market continues to tank.

Right now, the Fed is taking a cautious tone – a “wait and see” mentality, as one analyst put it. However, we know that the Fed’s response to a crisis is easy money. If the markets continue to flounder and we begin seeing signs of a recession, it’s almost certain the central banker will ride on a white horse to save the day.

That means more inflation – not less.

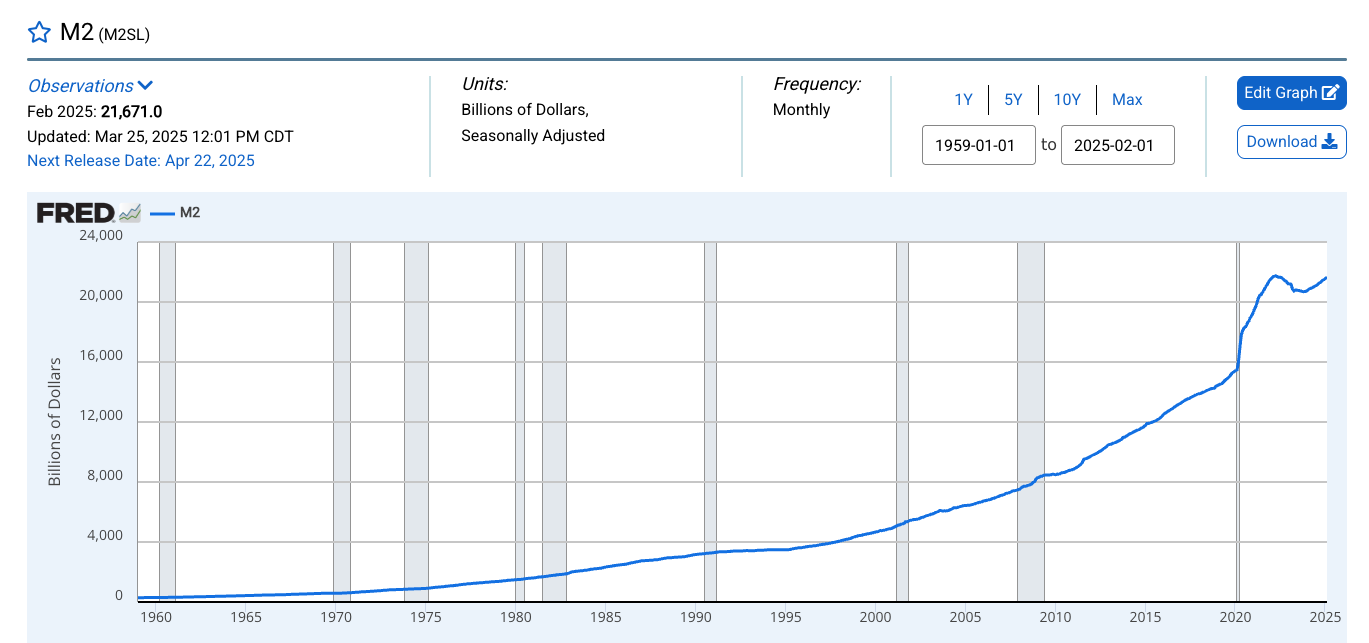

Rate cuts encourage borrowing. In turn, this boosts the money supply. This is, by definition, inflation. One of the symptoms of this monetary inflation is price inflation. In other words, any victory over price inflation opens the door for the Fed to resume the very policy that gave us higher price inflation to begin with.

We’re already seeing this inflationary pressure manifest after the first round of rate cuts and the slowdown of balance sheet reduction.

The M2 money supply bottomed a little over a year ago at $20.60 trillion. Since then, it has crept upward. As of February, it was at $21.67 trillion. That’s the highest level since June 2022 and approaching the all-time high of $21.72 trillion hit in the spring of that year.

The Chicago Fed National Financial Conditions Index also reflects this increasingly inflationary environment. As of the week ending March 7, the NFCI stood at -0.61. A negative number reflects historically loose financial conditions.

And the markets want even more looseness!

The fact is they’ve already gotten it.

Even though the Fed held interest rates steady during the March FOMC meeting, the central bank loosened its monetary policy, announcing a significant slowdown in its balance sheet reduction scheme.

This is a significant loosening of monetary policy. In fact, I would argue it is far more significant than a quarter-percent rate cut. As one analyst told CNBC, “The Fed indirectly cut rates today by taking action to reduce the pace of runoff of its Treasury holdings.” [Emphasis added]

With an even cooler CPI report in March, the Fed can plausibly loosen even more if they need to.

And they’ll probably need to.

It’s not even so much about tariffs. Nearly two decades of loose monetary policy blew the economy into a big, fat, ugly bubble waiting for a pin. Tariffs may be that pin. But even if they’re not, the pin is out there.

This underscores the problem facing the central bankers over at the Fed.

The reality is that the Federal Reserve is in a Catch-22. A couple of good CPI reports notwithstanding, inflation is far from dead. After all, it never did do enough to slay the inflation monster. The bottom line is that the inflation dragon isn’t dead. Sure, the Fed might have knocked it to the mat. But it’s not down for the count.

On the other hand, the central bank needs to cut rates because the economy is addicted to easy money. Given the levels of debt and the amount of malinvestment, the economy can’t function in this higher interest rate environment. It needs its easy money drug.

How Powell & Company will navigate this remains to be seen, but they can now plausibly crank up the inflation machine to try to keep the bubbles inflated.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.