(Mike Maharrey, Money Metals News Service) Chinese investors are pouring money into gold. China accounted for more than half of gold flows into ETFs globally last month, and Q1 Chinese demand for gold bars and coins hit the second-highest quarterly level on record.

As World Gold Council senior market strategist John Rease put it, Chinese investment demand for gold has increased “dramatically.”

China ranks as the world’s biggest gold market.

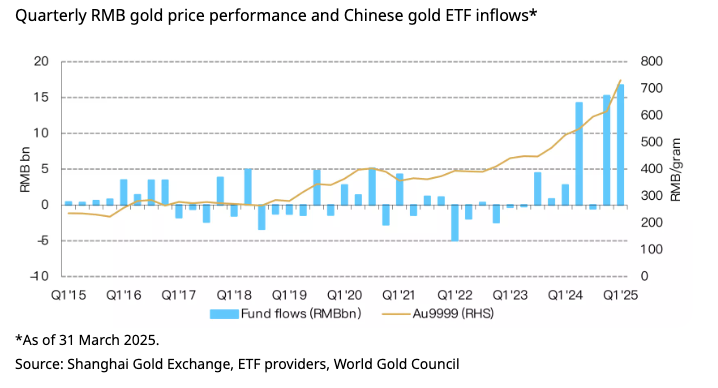

Chinese investors responded as the RMB gold price recorded its strongest Q1 since 2002 when the Shanghai Gold Exchange (SGE) was established.

Total inflows of gold into China-based ETFs were estimated at over 70 tonnes in April, totaling around $7.4 billion. According to the World Gold Council, this more than doubled the previous monthly record.

This was on top of record gold inflows of 23 tonnes totaling ¥16.7 billion ($2.3 billion) in Q1.

ETFs are a convenient way for investors to play the gold market, but owning ETF shares is not the same as holding physical gold.

China’s share of global ETF holdings jumped to 6 percent last month, up from 3 percent at the beginning of the year.

Chinese interest in gold-backed funds is a relatively new phenomenon. Physical gold has historically been the primary means of investment in the country, and even with the surging interest in ETFs, Chinese investors continue to gobble up physical metal. Gold bar and coin sales surged 12 percent to 124 tonnes in the first quarter.

China accounted for 38 percent of global Q1 bar and coin investment.

While physical gold investment surged in China (and Asia more broadly), it declined in the U.S., with gold coin and bar sales falling to the lowest level in five years.

Demand for gold in China has driven price premiums to extreme levels. During the third week of April, they rose as high as $100 per ounce.

Chinese demand for gold was so strong in April that the government allocated additional gold import quotas for commercial banks.

The demand frenzy also prompted the Shanghai Gold Exchange to issue a warning.

“Investors should manage risks and make rational investment decisions in light of recent gold price fluctuations.”

According to the Financial Times, gold has become the most attractive investment option in the midst of a Chinese real estate crisis and a bear market in stocks.

A Shanghai-based client manager told the FT that investors are approaching gold in the same way they typically do stocks.

“It’s just like when stocks rise and mom-and-pop investors rush to open securities accounts. With gold prices soaring, people think buying gold is a sure way to make money.”

According to the World Gold Council, “escalating trade tension between the US and China, alongside expected currency depreciation, also drove safe-haven demand for gold; this was further encouraged by continued announcements of buying by the PBoC.”

Looking ahead, World Gold Council analyst Ray Jia expects gold investment demand to remain strong, primarily driven by the escalating trade war.

“The global gold price strength, boosted by a restructuring of the world trade order and world market volatility, will provide further support.”

A pilot program that allows insurance funds to invest in gold should also support Chinese demand. To date, four insurance companies have joined the SGE. They executed their first trades of gold contracts the very next day.

According to Jia, “Their participation should sustain long-term investment demand for gold in China, especially amid ongoing economic and trade uncertainties.”

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.