(Brien Lundin, Money Metals News Service) After a couple of weeks away from the markets on a much-needed vacation, I spent last week furiously digging into the metals markets to see if I had missed anything.

I didn’t.

In fact, the metals, aside from some periodic excitement in silver, had been performing just as they typically do during the mid-summer doldrums — simply marking time in anticipation of more interest and, hopefully, higher prices.

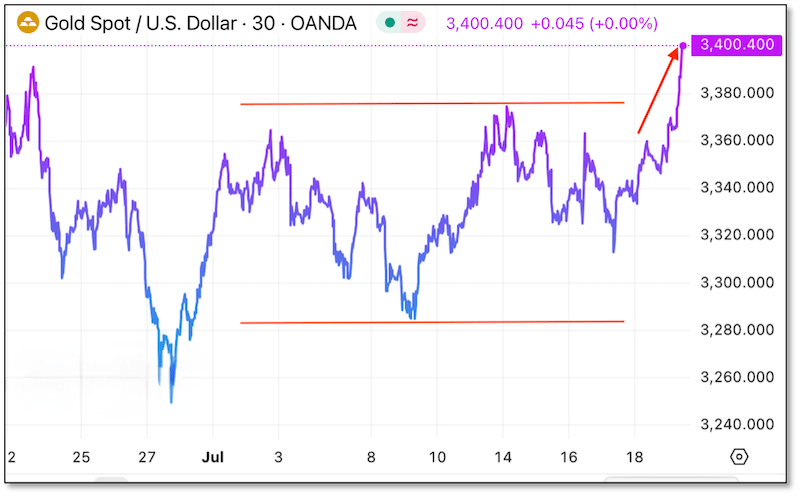

Through last week, gold’s sell-offs this summer had been mild with no follow-through. And it had been the same for the rallies, as they failed to spark any upside momentum.

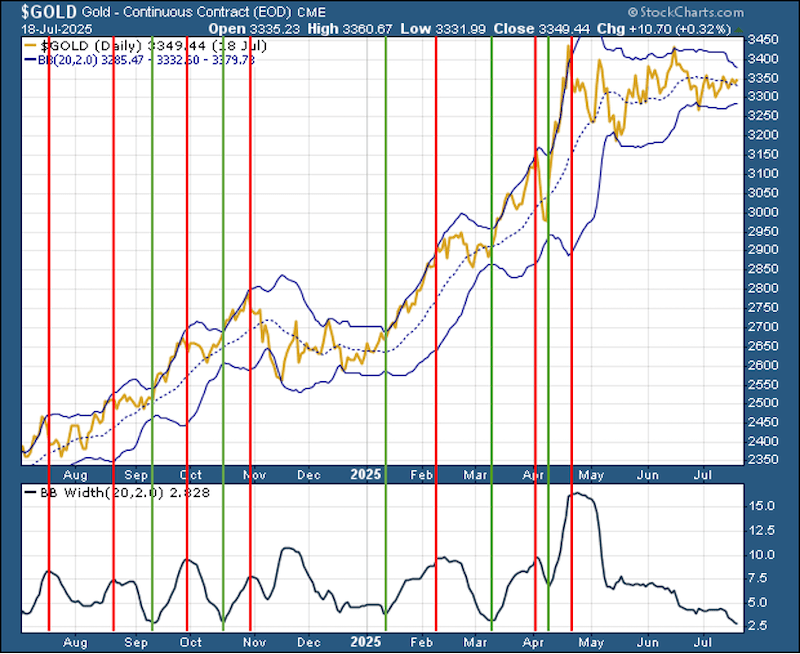

That tight trading range is evident in the one-month chart above. Obviously, this kind of range-trading would entail falling volatility, which prompted me to check in on our chart of gold’s Bollinger bands and their width:

The lower panel tracks the width of the bands and, therefore, the trading volatility. As you can see, the width has collapsed to levels that have previously marked bottoms and imminent rallies.

The timing would be right for another rally as well. In my experience spanning far too many years watching the metals, gold tends to bottom anywhere from mid-July to mid-August.

We’re smack dab in the middle of that time frame at the moment…so I told my subscribers that we would have anywhere from mere hours to a month to take advantage of this summertime lull.

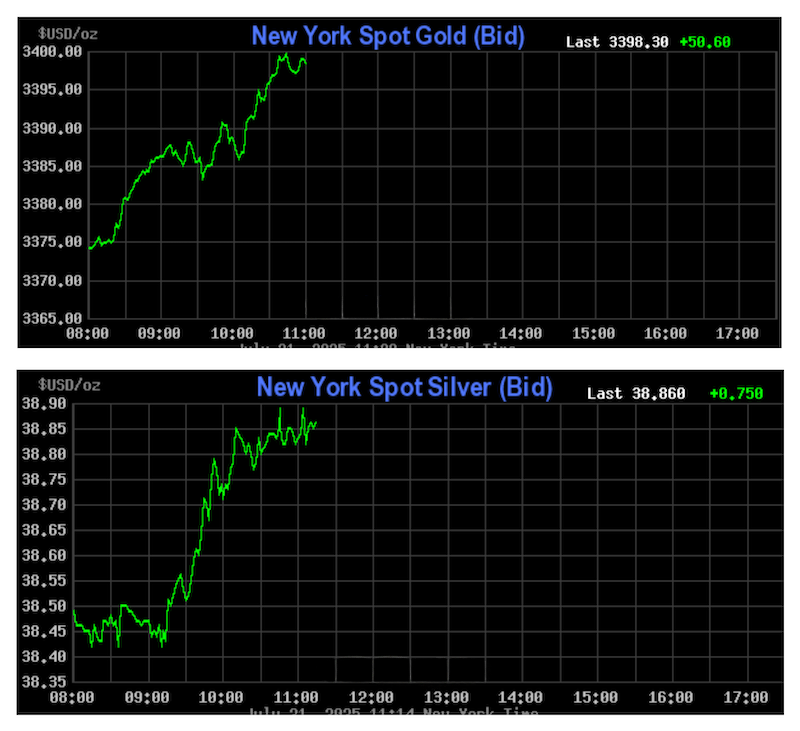

Looks like it may have been just hours for the turn — because gold and silver are rocketing higher today.

Today’s breakout is also clear on that one-month chart above. It’s even more impressive on these daily charts below, showing gold up over $50 and silver jumping $0.75 (apparently on its way to $40 soon).

In response, mining stocks are rocketing higher, with all of the major indices up well over 4% today.

It gets even better for investors in junior mining stocks — and particularly those who subscribe to our service. Many of our picks have more than doubled in value so far this year…and our most recent recommendations are heating up on the launching pad.

If you’re not already a subscriber to our free email newsletter, you can do that by clicking on this link.

I cannot stress it enough: This is the kind of chance we get only rarely in our lives — truly a generational opportunity. Absolute fortunes will be made in the months and years just ahead for those who are positioned for this historic metals and mining bull market.

To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.

Brien Lundin is the publisher and editor of Gold Newsletter, the publication that has been the cornerstone of precious metals advisories since 1971. Mr. Lundin covers not only resource stocks but also the entire world of investing. He also hosts the annual New Orleans Investment Conference. To get Brien Lundin’s ongoing commentary on the markets at no charge, click here to subscribe to his free Golden Opportunities newsletter.