(The Center Square) Millions of Americans say the likely will have to push back their retirement because of rising inflation, newly released financial survey data found.

The BMO Real Financial Progress Index, a quarterly survey from BMO and Ipsos, showed that a quarter of Americans will likely need to delay their retirement because of higher prices.

“Nearly 60% of those surveyed said that inflation has adversely affected their personal finances, of which about one in four said that they have felt a major impact,” the group said.

“As a result of inflation, 36% of Americans have reduced their savings and 21% have reduced their retirement savings. A quarter of Americans will need to delay their retirement,” it added. “Younger Americans are feeling the most impact—over 60% of those aged 18-34 said they had to reduce contributions to their savings.”

This survey of more than 3,400 adults was conducted from March 30 to April 25.

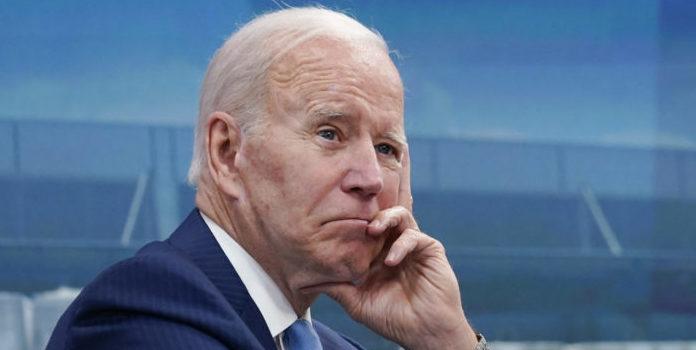

Prices on a range of goods and services have soared since President Joe Biden took office, with energy costs leading the way.

The latest data on the consumer price index, a key marker of inflation produced by the Bureau of Labor Statistics, reported the highest inflation rate in four decades.

“The all items index increased 8.3 percent for the 12 months ending April, a smaller increase than the 8.5-percent figure for the period ending in March,” BLS said. “The all items less food and energy index rose 6.2 percent over the last 12 months. The energy index rose 30.3 percent over the last year, and the food index increased 9.4 percent, the largest 12-month increase since the period ending April 1981.”

Those price increases are forcing many Americans to change their spending habits. According to the BMO survey, ”80% of Americans surveyed plan to change their actions to offset the impact of inflation and rising costs of everyday essentials.”

That includes looking for cheaper groceries, eating out less, driving less, canceling vacations and more.

“Prices across the board – from cars and gasoline to groceries and other everyday essentials—are rising at the fastest pace since the 1980s,” said Paul Dilda, head of consumer strategy for BMO Harris Bank. “Consumers must think differently about their finances in this inflationary environment.”

In fact, the rate of inflation has been at its highest since the first fiscal quarter of 1981—the last one attributable to Democratic President Jimmy Carter, to whom Biden has frequently drawn comparisons.

The survey comes alongside recent polling that shows the majority of surveyed Americans blame Biden for inflation. Convention of States Action, along with the Trafalgar group, released polling this week that found that “59.9 percent of American voters believe that President Biden’s policies and spending are the leading contributor to rising inflation in the U.S.”

Biden has acknowledged rising prices but pointed to the invasion of Ukraine, blaming Russian President Vladimir Putin, though prices began rising well before the invasion.

According to the poll, many voters do blame Putin, but more hold Biden responsible, with only 31.6% saying that “Russia’s war with Ukraine is the leading contributor to rising inflation in the U.S.”