(The Center Square, Casey Harper) A sweeping new federal program that will provide monthly payouts to parents kicks off next month, and the Biden administration indicated there is more to come.

The $1.9 trillion COVID stimulus bill passed earlier this year included a provision for fully refundable, advanceable child tax credit payments. This means that most families with children will begin receiving monthly checks from the federal government beginning July 15.

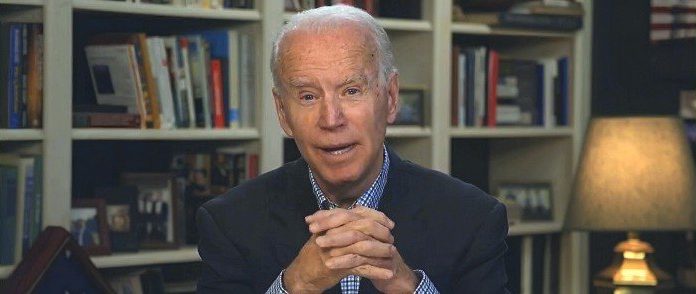

Ahead of the kickoff of the program, though, President Joe Biden made clear that the payments are “just the first step.”

“Folks, this Child Tax Credit is a huge step towards a tax system that works for the middle class. It will lift millions of children out of poverty,” Biden said Monday.

“This is just the first step,” he continued. “My American Families Plan will extend this benefit for years to come. On July 15th, automatic payments from the Child Tax Credit will begin hitting bank accounts and mailboxes. For a working family with two kids: that’s $500 or more on the 15th of every month this year.”

The COVID stimulus bill increased the child tax credit from $2,000 per child to $3,000 per child for all kids 6 years and older. For kids under the age of 6, the tax credit went from $2,000 to $3,600. The cutoff age for the tax credits is also now 17.

Because the program is advanceable, families will begin receiving the funds monthly starting in July instead of waiting for their refund next year.

Since the credits are fully refundable, families will receive them whether they pay income taxes or not.

“All working families will get the full credit if they make up to $150,000 for a couple or $112,500 for a family with a single parent…” the White House said.

Families do not need to apply for the payments, and as long as they qualify, they will begin receiving the funds July 15.

“Most working families will receive automatic payments—no sign ups needed, all you need to do is make sure you’ve filed your taxes,” Biden said. “Folks who don’t make enough to be required to file taxes can get these benefits too.”

The payments come at a unique time in the nation’s economy. Economic indicators show inflation steadily rising, and many states have seen unemployment stay high despite widely available jobs.

Republican governors have blamed additional $300 weekly federal unemployment benefits for higher unemployment, arguing those benefits in addition to state payments have made it more advantageous to stay home than return to the workforce.

“Employers are telling me one of the big reasons they cannot recruit and retain some workers is because those employees are receiving more on unemployment than they would while working,” Idaho’s Republican Gov. Brad Little said last month when he announced his state would no longer accept the federal payments.

Little is one of many Republican governors around the country that have announced they will no longer accept the federal payments right as these child tax credit payments will begin to kick in. How these new payments will affect the unemployment dynamic remains to be seen.

Some have warned that the payments could be abused. The federal government saw significant fraud related to the stimulus checks sent out during the COVID pandemic.

“Refundable tax credits can be better understood as cash payments; that is, they operate as cash from the federal government rather than traditional tax credits that are a return of tax dollars paid or owed to the federal government,” House Ways and Means ranking member Kevin Brady, R-Texas, and Rep. Mike Kelly, R-Penn., wrote in a letter to the White House American Rescue Plan Coordinator Gene Sperling in April.

“As such, Congress has received numerous reports from the Government Accountability Office warning of the ‘high risk’ nature of refundable tax credit programs,” the letter continued. “They risk a high level of erroneous payments, often through fraud but sometimes through taxpayer confusion or error.”

The U.S. Census Bureaus called Monday “Child Tax Credit Awareness Day,” pointing to a coordinated effort to tout the plan’s monthly payments.

“Join government leaders and national and community organizations across the country in raising awareness of the Child Tax Credit today and in the days and weeks ahead,” the bureau said. “The Child Tax Credit is part of the American Rescue Plan and aims to help families raising children make ends meet. Experts estimate the new Child Tax Credit has the potential to cut child poverty in half.“