(Mike Maharrey, Money Metals News Service) I see a lot of people out there in the world of social media claiming that Trump is solving the debt problem. One woman insisted that “Trump is paying down the debt!”

However, despite all the talk about DOGE and spending cuts, despite all the chatter about tariff revenue plugging the budget hole, the national debt keeps getting bigger and bigger.

Last October, U.S. government debt eclipsed $38 trillion. Just four months later, it’s approaching $39 trillion.

Just since the first of the year, the national debt has ballooned by $300 billion. It rose by $145.7 billion in January alone. That’s roughly $50 billion per day!

As of Feb. 17, the outstanding government debt stood at $38,720,327,822,350.87.

Putting the speed of debt growth into perspective, the national debt hit $34 trillion in January 2024 and $35 trillion in November 2024. It took 188 days for the debt to grow from $35 trillion to $36 trillion. It took another 265 days to reach $37 trillion.

Don’t be fooled. The borrowing didn’t slow down between $36 and $37 trillion. It was just that the federal government ran up against the debt ceiling on January 1. As a result, it couldn’t borrow any money until the enactment of the “Big Beautiful Bill,” which raised the debt ceiling by $5 trillion as of July 1.

At that time, the national debt stood at $36.2 trillion. It took less than two months for the federal government to borrow more than $800 billion, pushing the debt over $37 trillion. And here we are today.

Despite record levels of federal revenue thanks to the surge in tariff receipts, spending is driving the debt higher at a staggering rate.

It’s true that tariff revenue has shrunk the monthly budget deficits. But it hasn’t erased them entirely. Through the first four months of fiscal 2026, the Trump administration ran a $697 billion deficit. That compares to a $841.6 billion deficit through the same period in fiscal ’25, a 20 percent reduction.

You can argue the Trump administration is making progress, but the fact that the government continues to spend significantly more than it’s taking in means we’re a long way from any kind of celebration.

The fact of the matter is, the federal government has a spending problem. Through the first four months of fiscal 2026, the federal government has blown through $2.48 trillion, a 2 percent increase. If it weren’t for the influx of tariff revenue, we’d be seeing even bigger deficits.

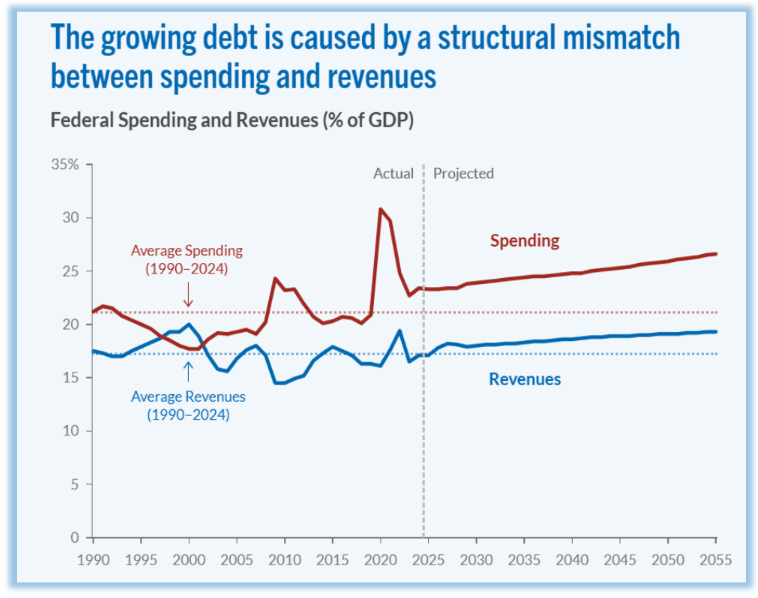

As analyst Greg Weldon put it, there is a structural mismatch between spending and revenues.

CBO Ups Deficit Projection

The CBO doesn’t have any confidence that the current gaggle of politicians in Washington, D.C. is going to address the debt problem. It recently upped its deficit projections by $1.4 trillion over the next 10 years.

The CBO forecasts a $1.9 trillion deficit in fiscal 2026. That would be up slightly from $1.8 trillion in fiscal ’25.

From there, it only gets worse.

By 2036, the CBO projects deficits running $3.1 trillion annually.

Relative to the size of the economy, the deficit will represent around 5.8 percent of GDP. In 10 years, the deficits will grow to an estimated 6.7 percent of GDP. Over the past 50 years, the deficit has averaged 3.8 percent of GDP.

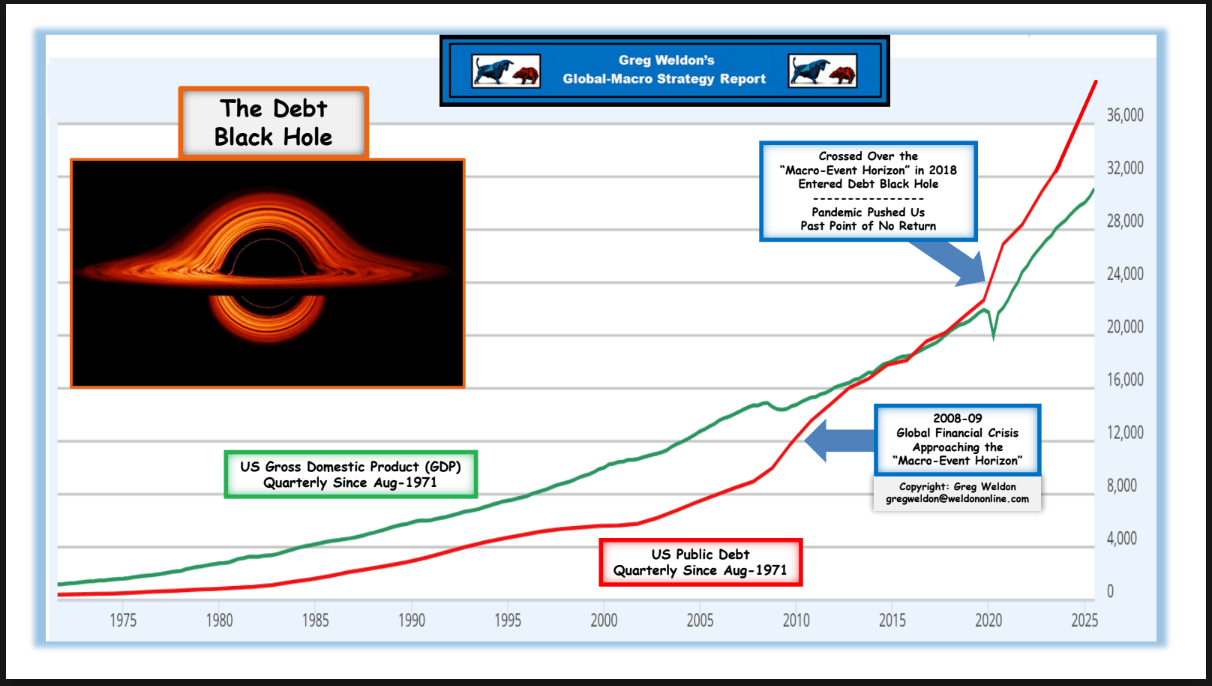

The bottom line is that the Debt Black Hole is getting bigger and more powerful by the day.

Weldon created a chart to help us visualize what is happening. He argues that the pandemic pushed the U.S. past the point of no return.

Why Does It Matter?

In the first place, a large national debt puts a drag on economic growth.

According to the national debt clock, the current debt level represents 124.2 percent of the GDP. Studies have shown that a debt-to-GDP ratio of over 90 percent retards economic growth by about 30 percent.

And then there’s the growing interest expense. Interest on the national debt cost $1.2 trillion in fiscal 2025. That was up 7.3 percent over 2024.

In the last fiscal year, the federal government spent more on interest on the debt than it did on national defense ($917 billion) or Medicare ($997 billion). The only higher spending category is Social Security ($1.58 trillion).

Even more concerning is the fact that at some point, the world will decide it’s no longer interested in financing the U.S. government’s borrowing and spending.

As the Bipartisan Policy Center points out, the growing national debt and the mounting fiscal irresponsibility undermine the dollar.

“Confidence in U.S. creditworthiness may be undermined by a rapidly deteriorating fiscal situation, an increasing concern with federal debt set to grow substantially in the coming years.”

If you’re wondering why the Federal Reserve is talking about easing monetary policy despite persistently high inflation, look no further than the debt. The government needs the central bank to keep its thumb on the bond market. That requires it to hold more Treasuries on its balance sheet, thereby creating demand for bonds. This allows the federal government to borrow at a lower interest rate than it otherwise would. This is exactly why the Fed recently relaunched quantitative easing (QE).

And that means even more inflation.

People seem unconcerned about the growing debt because people have warned about it for decades, and the promised crisis hasn’t occurred – yet.

But the bottom line is that just because the debt hasn’t caused a crisis doesn’t mean it won’t. After all, things happen slowly and then all at once.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.