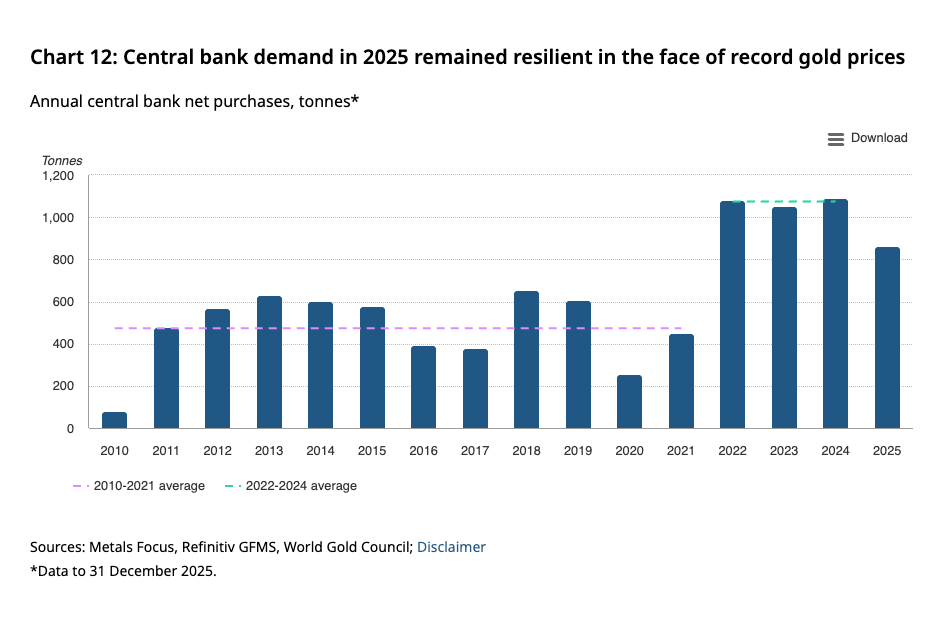

(Mike Maharrey, Money Metals News Service) Central bank gold buying moderated in 2025 but remained far above the recent historical average.

Central banks stepped up purchases in the final quarter, adding 230 tonnes to global gold reserves, a 6 percent quarter-on-quarter increase. That drove the official net full-year buying to 863.3 tonnes, according to data compiled by the World Gold Council.

Central bank gold buying was down 21 percent year-on-year, charting the lowest level since 2021.

While central bank gold purchases declined, they were still well above the 2010-2021 annual average of 473 tonnes.

Last year was the fourth-largest expansion of central bank gold reserves on record. The all-time high was set in 2022 (1,136 tonnes). It was the highest level of net purchases on record, dating back to 1950, including since the suspension of dollar convertibility into gold in 1971.

The surging gold price was likely a factor in slowing central bank gold accumulation. As the World Gold Council put it, the higher price prompted “a more cautious approach.”

“This highlights that central banks are not insensitive to price dynamics, even as their long-term strategic interest in gold remains firmly intact.”

The World Gold Council characterized 2025 central bank gold demand as “impressive,” despite falling short of the 1,000-tonne threshold, adding that it “underscores the metal’s enduring strategic appeal.”

Even with the modest slowdown in gold purchases, the yellow metal surpassed U.S. Treasuries to become the world’s top reserve asset late last year.

Twenty-two central banks reported an increase in gold reserves of at least 1 tonne last year, led by Poland.

The National Bank of Poland added 102 tonnes of gold to its holdings in 2025. The Polish central bank now holds 550 tonnes of the yellow metal, accounting for around 28 percent of its official reserves.

Last month, the National Bank of Poland issued a statement saying it plans to purchase up to 150 more tonnes of gold, raising its holdings to a maximum of 700 tonnes.

NBP Governor Adam Glapiński said the increase in gold reserves would elevate Poland to an “elite” status.

“This will place Poland among the elite 10 countries with the largest gold reserves in the world.”

The Polish central bank already holds more gold than the European Central Bank. To put the country’s gold reserves in context, in 1996, the NBP only held 14 tonnes of gold.

The National Bank of Kazakhstan was the number two gold buyer in 2025 with a 52-tonne increase to its reserves. It was the Kazakh’s highest level of annual buying since 1993.

It is not uncommon for banks that buy from domestic production – such as Uzbekistan and Kazakhstan – to flip-flop between buying and selling. However, National Bank of Kazakhstan Governor Timur Suleimenov said, “We want to stay a net gold buyer,” until global tensions ease.

Brazil waded back into the gold market in the latter half of 2025. The Brazilian central bank added 43 tonnes of gold to its reserves between September and November. That boosted the country’s official gold reserves to 172 tonnes.

The Central Bank of Turkey was a steady buyer throughout 2025, making small purchases for 23 straight months through the end of October. Last year, the Turkish central bank added 27 tonnes of gold to its holdings.

The Czech National Bank has followed a similar strategy – growing its gold reserves at a slow and steady pace. It has bought gold for 34 straight months, adding 20 tonnes to its holdings last year. The Czech Republic now holds 72 tonnes of gold. Czech officials say they plan to increase gold reserves to 100 tonnes by 2028.

China slowed its pace of gold accumulation, at least based on official numbers. The People’s Bank of China reported a 27-tonne increase in gold reserves in 2025. It’s reported that gold reserves now stand at 2,306 tonnes, making up almost 9 percent of total official reserves.

China has reported an increase in its official reserves for 14 straight months, adding another tonne in December. The People’s Bank of China has increased its official holdings by 402 tonnes in that span.

Notice the emphasis on “official.”

China is among the central banks that are likely to hold significantly more gold than they publicly disclose. As Jan Nieuwenhuijs has reported, the People’s Bank of China is secretly buying large amounts of gold off the books. According to data parsed by the renowned Money Metals researcher, the Chinese central bank is currently sitting on more than 5,000 tonnes of monetary gold located in Beijing – more than TWICE what has been publicly admitted.

Mainstream reporting has finally picked up on this.

Other countries reporting an increase in reserves include Iraq, Cambodia, Uzbekistan, Ghana, Indonesia, Guatemala, Kyrgyz Republic, Qatar, Serbia, India, Egypt, the Philippines, Bulgaria, Slovenia, UAE, and Zimbabwe.

Even with soaring prices, there were few notable sellers in 2025.

The Monetary Authority of Singapore reported the largest decrease in reserves at 14 tonnes. Russia sold 6 tonnes of gold, and the Central Bank of Jordan reduced its holdings by 1 tonne. The German Bundesbank also reported a 1-tonne decrease in reserves connected to its coin minting program.

The World Gold Council reported significant unreported buying.

“The gap between Metals Focus’ estimates and officially reported data continues to indicate substantial opaque activity (57 percent of the annual total). This implies that some official institutions are adding to their reserves without immediate disclosure – a consistent trend in recent years.”

This is likely capturing at least some of the unreported Chinese purchases. Other banks are likely adding to their reserves quietly as well.

Despite the modest slowdown in gold accumulation, the World Gold Council remains bullish, saying that “persistent economic and geopolitical uncertainty is likely to sustain demand for gold as a reserve asset.”

“We maintain our view that central banks will continue to add gold to their reserves. Our Central Bank Gold Reserves Survey 2025 shows that respondents overwhelmingly (95 percent) expect global central bank gold reserves to increase over the next 12 months, while 43 percent believe that their own gold reserves will also increase over the same period. Notably, none of the respondents anticipate a decline in their gold reserves.”

You can read more details about that central bank survey HERE.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.