(Mike Maharrey, Money Metals News Service) Federal Reserve Chairman Jerome Powell and his fellow central bankers are stuck between a rock and a hard place – and he knows it.

He admitted as much during a recent speech at the Greater Providence Chamber of Commerce 2025 Economic Outlook Luncheon, held in Warwick, Rhode Island, earlier this week.

Powell confessed that there is “no risk-free path.”

I’ve been writing about the Fed’s Catch-22 for months, but it is unusual for a central banker to acknowledge risk. They want to maintain the illusion that they have everything under control.

They don’t.

Although Powell didn’t use the word, he described a stagflationary setup, with deteriorating economic conditions reflected in the labor market, coupled with “somewhat elevated” inflation.

“Near-term risks to inflation are tilted to the upside and risks to employment to the downside—a challenging situation. Two-sided risks mean that there is no risk-free path.”

Powell & Company is walking a tightrope, and it would only take a little nudge for them to fall to one side or another.

Powell described the risk.

“If we ease too aggressively, we could leave the inflation job unfinished and need to reverse course later to fully restore 2 percent inflation. If we maintain restrictive policy too long, the labor market could soften unnecessarily. When our goals are in tension like this, our framework calls for us to balance both sides of our dual mandate.”

The problem is that the current scenario requires the Fed to pursue two opposite paths. It needs to hold rates higher for longer to keep inflation under control. (By “under control,” we mean not so high that you notice it.) It also needs to cut rates to keep the air in this debt-riddled bubble economy.

It can’t do both.

So, Powell & Company are walking the tightrope with their fingers crossed, hoping they don’t go splat.

Using typical Fed-speak, Powell set the stage for the central bank to plausibly pursue any path moving forward, insisting policy is “not on a preset course.”

“We will continue to determine the appropriate stance based on the incoming data, the evolving outlook, and the balance of risks.”

It’s worth noting that Powell continues to insist that monetary policy is “modestly restrictive.”

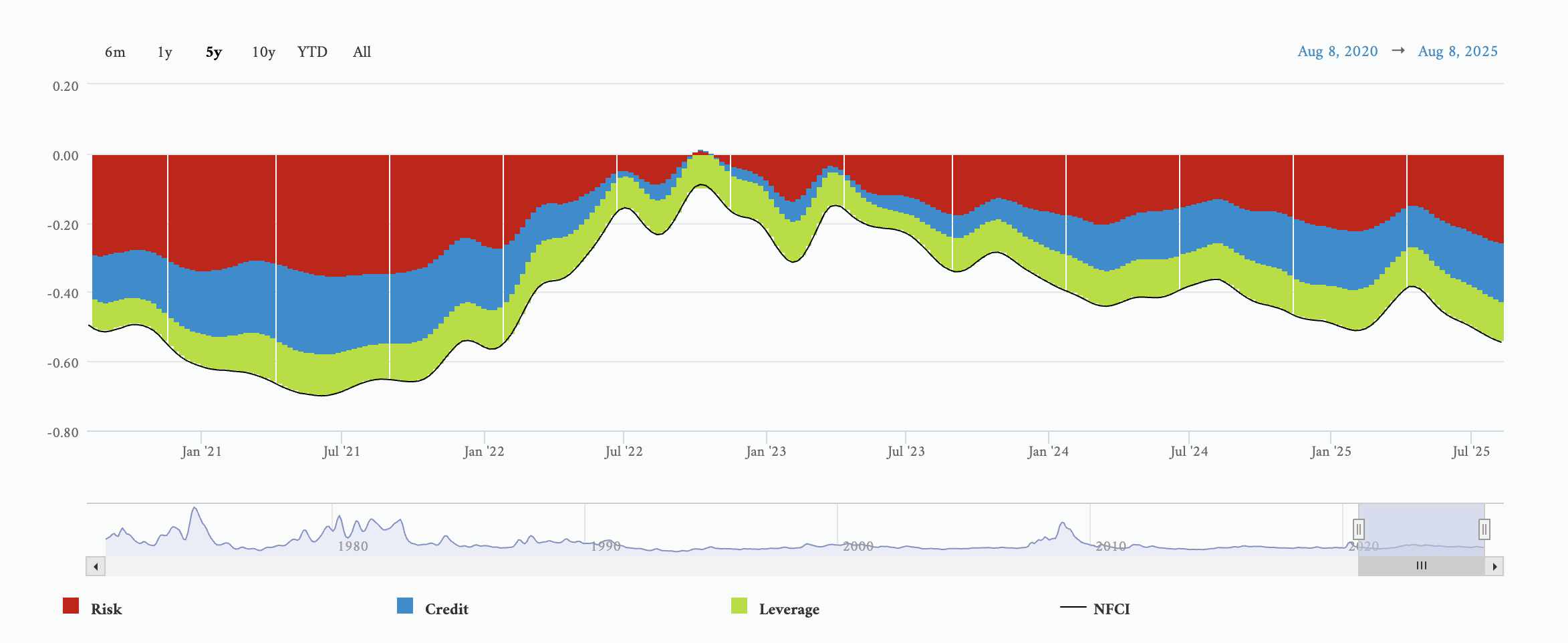

It’s not. At least not from a historical perspective. In fact, based on the Chicago Fed’s National Financial Conditions Index, monetary policy has remained historically loose throughout the entire hiking cycle.

As a result, the money supply only contracted modestly at the height of the hiking cycle, and it has been increasing for well over a year. That is, by definition, inflation.

The bottom line is that Powell and his minions had to make a choice.

They chose inflation.

Powell said he can no longer describe the labor market as “solid.” That necessitated a “more balanced approach.”

“The increased downside risks to employment have shifted the balance of risks to achieving our goals. We therefore judged it appropriate at our last meeting to take another step toward a more neutral policy stance, lowering the target range for the federal funds rate by 25 basis points to 4 to 4-1/4 percent.”

In other words, we cut rates even though inflation is alive and well because the economy can’t keep creeping along without another dose of its easy money drug. The economy is addicted, and the pusher just delivered another dose, hoping to keep the party rolling just a little longer.

Mike Maharrey is a journalist and market analyst for Money Metals with over a decade of experience in precious metals. He holds a BS in accounting from the University of Kentucky and a BA in journalism from the University of South Florida.